Too big to fail (TBTF)

Bank resolution regime rolls out in Hong Kong

HKMA chief outlines how the new bank resolution regime can end the use of taxpayers’ money in case of a bank failure; authority also plans to conduct a public consultation on loss absorbency

Fed would remove Wells Fargo board if ‘appropriate’, says Yellen

Fed chair asked why stricter penalties had not been imposed after bank opened millions of fake accounts; senator Warren says current system has created “bullet proof” executives

Deutsche Bank fined further $41 million by Fed

US central bank finds fault with banking giant’s AML function, months after UK regulators imposed similar fines; Deutsche has two months to submit reform plans

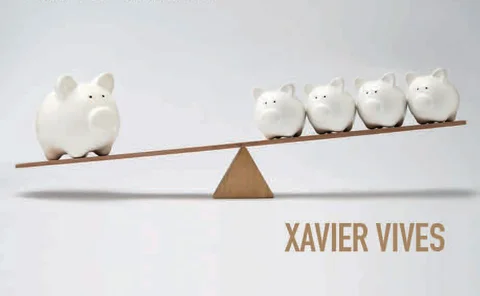

Book notes: Competition and Stability in Banking, by Xavier Vives

Xavier Vives has written a fascinating book that highlights many important issues in banking regulation. But there are some flaws in his argument

Lars Rohde on negative rates, pegs, productivity and resolution

The National Bank of Denmark governor speaks to Christopher Jeffery about the productivity paradox, defending currency pegs, unexpected limits for negative rates and addressing too-big-to-fail

European Commissioner cautions US on TLAC rules

Dombrovskis says foreign banks should not be mistreated by Fed internal TLAC proposal

FSB fleshes out guidance on resolution

Reports add detail on emergency funding needs for global banks and maintaining the continuity of critical services during resolution; most standard-setting work expected to be finished in 2017

European banks suffer as regulators ban Monte dei Paschi short-selling

Banks hit by further shockwaves from UK’s vote to leave EU, while European authorities scramble to shore up crumbling Italian bank Monte dei Paschi di Siena

Swiss regulator forms resolution division

Regulator hopes to focus its efforts by uniting disparate teams in a new division, with current enforcement chief David Wyss becoming head of resolution

Cunliffe warns of tough transition to new resolution regime

Going back to world of small, less complex banks is not how to solve ‘too big to fail’ problem, BoE deputy suggests, instead favouring a ‘multi-pronged’ regulatory approach

Minneapolis Fed to explore resolution alternatives in TBTF initiative

Neel Kashkari adds alternative resolution mechanisms to the agenda as Minneapolis Fed looks for solutions to the too-big-to-fail problem; discusses outcomes from this month’s symposium

CCPs: too interconnected to fail?

The likely responses by national authorities to the possible failure of CCPs in stressed conditions aren't generally assured. But they may be reluctant to allow them to fail, writes Richard Heckinger

UK’s Treasury Committee raises concerns over FPC accountability

MPs question whether Financial Policy Committee discussions are adequately represented by meeting records; wide-ranging discussion takes in liquidity issues, 'too big to fail' and stress testing

Zhu Guangyao on global financial governance, divergent monetary policy and IMF reform

China's vice-minister of finance Zhu Guangyao speaks about the state of the global economy, deflation, and China's role in finance reform and the international monetary system

ICBC chairman on the overseas expansion of China’s banking industry

ICBC chairman and president of IFF, Jiang Jianqing, details the challenges Chinese financial institutions need avoid as they continue to expand their global operations

BoE paper identifies issues in measuring ‘too big to fail’

Research assesses different approaches to measuring the scale of the ‘too big to fail’ problem, and finds none is without issues, but different approaches still identify effects

ECB's Angeloni defines 'level playing field' for banks

If risk borne by taxpayers is higher than elsewhere, banks receive an implicit public subsidy that distorts the competitive playing field, says Ignazio Angeloni

FSB unveils loss-absorbency standards

Minimum standard for total loss-absorbing capacity aims to end ‘too-big-to-fail’ and should reduce the funding advantage of globally systemic banks, FSB says, in consultation document

Carney hails ‘major achievement’ on resolution stays

Isda protocol signed by 18 major banks aims to solve cross-border legal issues, preventing a ‘cascade of termination events’ that could undermine an orderly resolution

US senator calls for hearings into NY Fed supervision

Elizabeth Warren says ‘disturbing issues' raised by former employee's secret recordings of colleagues; New York Fed ‘categorically rejects allegations'

Carney hints at coming shift in FSB focus

Mark Carney says Financial Stability Board will need to shift its focus towards ‘evolving’ threats such as shadow banking; ending too-big-to-fail high on the agenda for Brisbane G-20 summit

World's biggest banks $60bn closer to Basel III target

Internationally active banks $20bn short of Basel III target, compared with $80bn six months earlier, according to Basel Committee review

Macro-prudential policies could ‘become part of the problem’, says BIS’ Borio

Weight of expectation on macro-prudential policies to address financial system stresses may be too great, says BIS economics head Claudio Borio; stress tests ‘woefully deficient’ in predicting crises

Fed blasts big banks over ‘unrealistic' living wills

Eleven firms, including Goldman Sachs and JP Morgan, must take ‘immediate action to improve their resolvability', US central bank says