Supervision

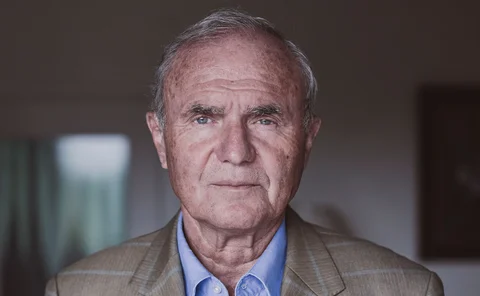

Otmar Issing on the art of central bank communications

EMU architect speaks about Draghi’s “whatever it takes” intervention, forward guidance failures, the Fed’s average inflation target ‘miscommunication’, and why the ECB may be overreaching in its strategy review

Centralisation key to digitising central banks – ECB conference

Bank of Italy studies use of machine learning to boost supervisory capabilities

Is the RBI doomed to fail its ‘quest for financial stability’?

Covid-19 has set back progress on hard-won reforms. As the economy struggles to recover, the RBI and government must walk a treacherous path back to safety

ECB sets new climate risk requirements for banks

Survey of eurozone banks shows most do not disclose basic climate-related data, ECB says

Canada launches climate risk scenario pilot

Project will test volunteer institutions for their exposure to climate change risk

BoE warns banks: start preparing for a higher carbon price

Risk Live: stress tests should assume rising carbon price, regardless of government policy, says Breeden

EBA wants Basel to revisit prudential rules on software

Banking regulator set to soften capital impact of IT assets, but proposals are still out of line with US

MAS encourages digital reporting through new grant

Firms can claim up to S$250,000 to implement new technology but only from pre-approved firms

MAS secures more financial crime convictions

Nine individuals convicted as a result of MAS investigations over 18-month period

Egyptian central bank fires head of largest commercial lender

Governor holds emergency meeting with lender’s board but nature of problems is unclear

Paper offers method for evaluating machine learning models

Bank of Spain paper looks at cost and benefits of ML models for predicting credit defaults

Regulators need common crypto asset standards – policy-makers

“Too many” crypto assets created to avoid regulation, official tells Central Banking summit

Bundesbank paper looks at consequences of weak supervision

Supervisors seen as less likely to intervene give banks incentive to stay undercapitalised - researchers

Regulators fine Goldman $2.9 billion over 1MDB

DoJ says bribes were largest it had discovered, as UK regulators fine US bank $126 million

Georgia’s Gvenetadze on implementing an aggressive reform agenda

The National Bank of Georgia governor speaks about efforts to improve monetary policy, financial infrastructure, financial literacy, transparency and ESG

Banks and regulators call for global climate risk standards

Carney and Winters warn private sector cannot move much further without lawmakers

Banking sector resilience ‘likely to be tested’ – IMF’s Adrian

Fund’s stability report says vulnerabilities are high and rising, creating difficult policy choices

FSB unveils ‘comprehensive plan’ to reform global payments

“Roadmap” for cross-border payments to be considered by G20 leaders this week

FSB weighs impact of growing big tech dominance

Big tech offers benefits but is also using its clout to gain significant market power, FSB says

Fed and OCC act against Citigroup

US lender fined $400 million by OCC as regulators cite poor risk management

Beyond climate: addressing the ‘E’ in ESG

Environmental degradation raises fundamental questions about how central banks think about risk; efforts to expand focus beyond climate risks now under way

Fed will calibrate NSFR to avoid hurting repo

Fed’s supervision head says final liquidity rule will be fast-tracked without fresh consultation

Action needed to avert Latin American banking crisis – report

Emergency measures may mask growing solvency problems, institutions warn

ECB changes largest eurozone banks’ leverage ratios

Latest emergency response to Covid-19 should raise banks’ leverage ratios by about 0.3%, ECB says