Sterling

Sovereign green bonds: the reserve portfolio’s panacea?

German, Swedish, Danish and UK debt managers speak to Victor Mendez-Barreira about ‘twin bonds’ and other efforts to solve green bond liquidity concerns

IMF boosts dollar and renminbi weights in new SDR valuation

Euro records largest drop, while yen and sterling decline slightly

Book notes: Robert Triffin, by Ivo Maes with Ilaria Pasotti

Triffin’s story is well told by Maes, whose extensive personal and academic research shines through on page after page

The IMF’s $650bn SDR allocation and a future ‘digital SDR’

Focus is needed on widening SDR use in payments and the creation of a ‘digital SDR’, to support a large allocation of ‘official’ IMF SDRs, writes Warren Coats

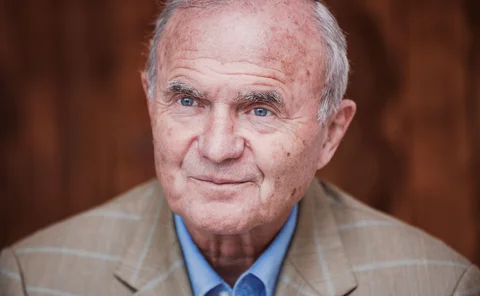

Charles Goodhart on inflation targets, financial stability and the role of money

The LSE professor says inflation targets should have been 0%, the Fed’s move to AIT is a mistake, independence is under threat from inflation, big balance sheets support liquidity, AI can help supervisors and climate stress tests are unconvincing

BIS to operate sterling liquidity facility backed by BoE

Move echoes 20th century arrangements when BIS acted as intermediary in swaps network

Lifetime achievement: Charles Goodhart

The LSE and BoE veteran economist has his own ‘law’, and played a key role in the establishment of monetary policy in the UK, Hong Kong’s peg and the ‘New Zealand model’, which influenced a generation of central bankers

Book notes: The political economy of the special relationship, by Jeremy Green

Unsatisfactory story about the decline and resurgence of the UK’s importance in the global financial system

New Isda ‘fallbacks’ critical to making Libor transition a ‘non-event’

New protocol and supplement offer a transition away from Libor rates in 2021, despite CFTC saying 2,400 companies still exposed and Fed extending some US libor contracts until mid-2023

An end to the loveless marriage with the US dollar?

Covid-19 represents an unexpected shock that could cause further US dollar decoupling, which could show up in next week’s Cofer data release, writes Gary Smith

Sterling swap traders brace for new Sonia switch deadline

Covid delays force regulators to set new date for interdealer swap market to price off RFR

BoE’s Hauser: Covid-19 forced “largest and fastest” actions ever

Executive director gives blow-by-blow account of how the BoE tackled the Covid-19 crisis in the markets

Libra’s Disparte on big tech’s move into digital currency

Libra Association vice-chair Dante Disparte speaks about the decision to abandon a multi-currency reserve, stress-testing a global payment network and how the Facebook-backed body still has 3 billion customers in its sights

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Custody initiative: Euroclear

The securities depository has debuted instant dollar settlement in central bank money outside the US – a service that has virtually eliminated settlement risk

Governor of the year: Mark Carney

Carney has played a vital role in managing Brexit risks while driving efforts towards climate, payments and dollar funding reform

Sterling’s fall boosted UK inflation - San Fran Fed paper

Prices of tradeable goods rose significantly more than non-tradable goods, researchers find

BoE’s Ramsden calls time on Libor use

Deputy governor says progress on transition to Sonia benchmark needs to accelerate

How Singapore manages its reserves

MAS managing director Ravi Menon explains Singapore’s total approach to reserve management, which includes the use of customised fixed income benchmarks and tapping into external investment expertise

Central banks disagree over cash regulation

The BoE has issued legislation demanding banks supply certain denominations, but other regulators remain on the fence about how they should manage the future of cash

Canadian deputy governor explains reserves regime

Floating exchange rate, asset-liability matching and liquidity focus do not demand bigger portfolio

Central bank of the year: Monetary Authority of Singapore

Singapore’s central bank stands out for its pioneering fintech efforts combined with its consistency of performance in monetary policy, financial stability and supervision

Brexit unlikely to affect sterling’s reserve currency status

No-deal scenario could put major downward pressure on the currency

Key Brexit vote complicates outlook for UK economy

Vote this evening leaves UK’s political and economic future uncertain; analysts optimistic on outlook for sterling