Spreads

Central bank of the year: The Federal Reserve System

Overwhelming Fed interventions in March 2020 forestalled a damaging global financial crisis, as policy overhaul prompts introspection in Europe and Japan

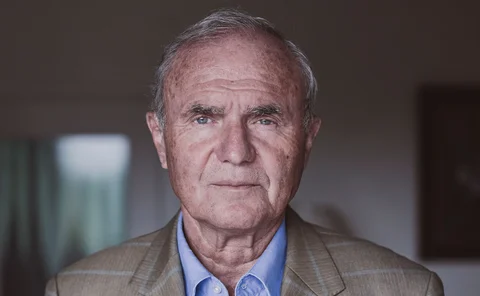

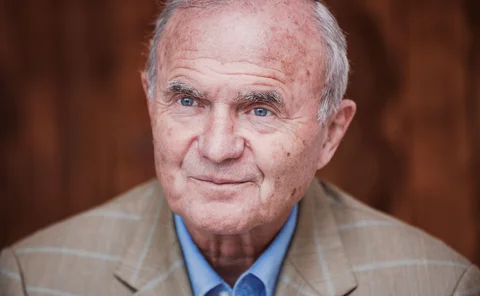

Otmar Issing on the art of central bank communications

EMU architect speaks about Draghi’s “whatever it takes” intervention, forward guidance failures, the Fed’s average inflation target ‘miscommunication’, and why the ECB may be overreaching in its strategy review

How vulnerable are EMEs to renewed Covid-19 turbulence?

Emerging markets face twin pressures from the health crisis and global financial forces, says Steve Kamin

The evolving role of central bank money in payments

The line between commercial and central bank money continues to blur, but the multiple-issuer/one-currency paradigm underpinning the current monetary system is set to remain in a CBDC world, write Ulrich Bindseil and Ignacio Terol

BIS suspends dividend to prepare for further Covid-19 strains

BIS will not pay dividend for first time since 1950, as senior managers see further turbulence ahead

Central banking enters a new era

Central banks face a delicate balancing act to preserve their reputations as they evolve into ‘buyers of last resort’ and some of their actions appear functionally equivalent to ‘monetary financing’

Stress levels rising: investment funds and the Covid-19 shock

Extreme market stresses due to Covid-19 are underscoring the central role non-banks play in crisis contagion, as in 2008. Were regulators better prepared this time?

The ECB, the lockdown and the monetary financing lock

The eurozone’s central bank may need to break its prohibition on monetary financing to fight the pandemic

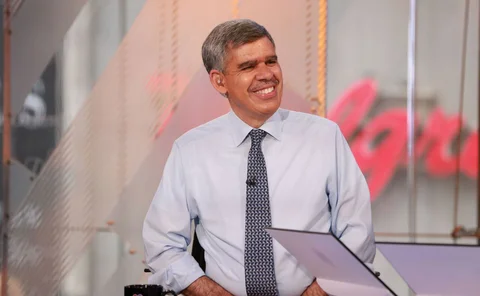

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

Fed moves to ease commercial paper strains

Commercial paper market under “considerable strain” due to coronavirus-related uncertainty, Fed says

Central banks grapple with dollar funding crunch

Indicators of stress hit highest levels since global crisis; dollar backstops may soon be tested

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Eurozone bail-in regime has not widened bond spreads – ECB paper

Wider financial and economic environment play key role in determining bond spreads – researcher

Central Banking’s ‘Leaders’ for custody, banking and gold

Central banks want integrated custody platforms and real-time data from custodians as the low-yield environment drives demand for banking services and increases the relative attractiveness of gold

Insights from network analytics in suptech

With regulators leveraging technological innovations to move towards informed, data‑driven decision‑making and automation, supervisory technology is attracting enhanced interest. Kimmo Soramäki and Phillip Straley examine how regulators are gaining…

Italy’s trial

Francesco Papadia argues Italy is likely to suffer financial and economic damage under its new political leadership, but will still not leave the euro

BoJ’s bond purchases impact credit spreads – paper

The BoJ’s corporate bond holdings have reached $29 billion, or about 0.6% of GDP

Sovereign debt crises hit non-tradable sectors harder

A 1% increase in bond spreads is associated with an average decline of 3% in growth of zero-traded industries

Credit spreads’ limited use as short-term predictors – paper

Researcher examines the accuracy of three sets of credit spreads

Inclusion of 'spatial effects' help explain Colombian money market spreads, central bank paper argues

Traditional factors like 'size and leverage' insufficient to explain borrowing spreads, argues paper, which is 'first attempt' to model Colombian money market within a spatial econometrics framework

Croatia among EU members whose spreads are most affected by fundamentals

While spillovers from external shocks remain the dominant factor in spreads EU-wide, Croatia is among those where fundamentals are playing an increasingly influential role