Risk

More trouble likely after ‘bumps’ in past quarter, says BIS’s Borio

Corporate debt markets are looking overstretched and could trigger problems; term spread may not be best indicator of recession, special feature finds

Five central banks and supervisors join environmental group

Network for Greening the Financial System aims to help meet Paris agreement goals

EME central banks can counter the next downturn

Philip Turner urges central banks to consider a broad range of actions to tackle volatility stemming from currency mismatches

Brainard reboots calls for countercyclical buffers

“Countercyclical capital requirements build resilience, unlike monetary policy,” Brainard says

IMF tells Jamaica to bring in risk-based supervision

IMF sets year deadline for new framework implementation and urges improved co-ordination among regulators

Fintech poses “serious” challenge to governance, says former PBoC deputy

Li Dongrong warns of fintech spillover risks, regulatory arbitrage and digital divide; dismisses PBoC use of ‘untested’ blockchain

Italian crisis and trade tensions are raising eurozone risk – ECB

Emerging market stress and fears of protectionism may drag down global growth, ECB says

UK banks’ holdings of leveraged loans ‘very small’, BoE says

Global leveraged loan market growing rapidly but lending standards falling, says Bank of England

FSB calls for action as regulatory deadlines pass

Mark Carney urges G20 to stay disciplined as global growth begins to fade

Interview: Clair Mills on the meaning of fintech

The Bank of England’s head of change and data management discusses why fintech is so important for a financial sector going into uncharted territory

Podcast: Crisis lessons

Central banks may have learned the lessons of the crisis, but are they fully on top of the risks?

Carney calls for financial sector to face up to climate risks

Outlook is “concerning” as losses from extreme weather hit record levels, BoE governor says

Standard notions of time fail to fully explain financial cycles – BIS paper

Distinguishing “calendar time” and “financial cycle time” could help explain booms and busts

FSB unveils latest G-Sib list

One bank joins and two drop off the 2018 tally

Brainard: Fed keeping open mind on AI regulation

Some rules already apply to AI tools, but Fed “still learning” about AI’s impact

The EU tries to rethink its faltering AML regime

The European Union plans to centralise its anti-money laundering efforts following a series of scandals this year. Dan Hardie looks at the options available and the multitude of challenges that remain

Podcast: Are women better risk managers?

Rachael King speaks with senior portfolio manager Vaithegi Naidu to find out why women are attracted to reserve management

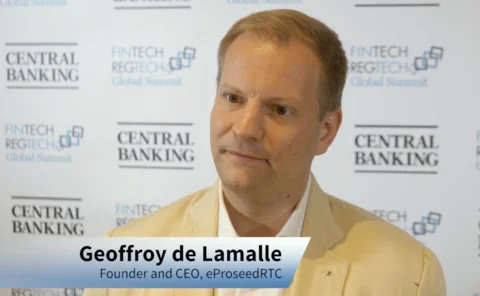

Video Q&A: Geoffroy de Lamalle, eProseedRTC

Central Banking spoke to Geoffroy de Lamalle, founder and chief executive at eProseedRTC, at the FinTech and RegTech Global Summit in Singapore

Financial regulation reform must not stop, Olli Rehn tells IMF

Foreign-denominated lending may threaten emerging markets, Finnish governor warns

Mexico’s Guzmán worried about protectionism

Difficult to understand why given the experience during the Great Depression, the governor said

BoE to demand senior financiers tackle climate risks

Proposals from PRA would hold senior managers accountable for climate change risks, and capital surcharges may follow

Central Bank of Ireland details updated financial buffers framework

Central bank incorporates risk simulation over five-year horizon

Asia outlook positive despite growing risks, IMF reports

Sound policymaking should protect Asia’s prospects for staying at the forefront of global growth, IMF says