Quantitative easing

Lagarde misstep overshadows ‘bold’ measures, analysts say

ECB president seemed to have hampered governments’ debt financing at a critical juncture

Lagarde seems to stumble as ECB announces coronavirus response

ECB announces more QE, expanded financing and loosening of banks’ capital and liquidity buffers

ECB likely to shy away from rate cut, analysts say

Central bank expected to unveil targeted measures to support banks and SMEs

RBNZ prepares unconventional policy tools

Central bank is not planning to use them yet, governor stresses

Riksbank to focus on liquidity against Covid-19

Governor Ingves says a rate cut is not the most important measure now

IMF’s Gopinath advises central banks on cocktail of measures to fight virus

IMF chief economist says central banks should stand ready to provide liquidity

Coronavirus could require expanded QE powers – Rosengren

Congress should grant Fed ability to buy wider set of assets under severe scenario, Rosengren says

What can the ECB do now?

Central bank is facing coronavirus shock with limited room for further policy measures

ECB’s asset purchases had global spillovers – IMF research

Eurozone investors significantly rebalanced into foreign advanced-economy securities, researchers find

Inflation targets back in the spotlight

Monetary policy can do little to offset the impact of Covid-19

Do low rates spur investment?

Many believe low interest rates spur investment, but there appears to be little hard evidence to support such claims, writes former IMF head Jacques de Larosière

Economist joins Bank of Japan’s rate-setters

BoJ board member in favour of continued QE but has expressed doubts on negative rates

ECB’s TLTRO2 eased Italian credit conditions – BoI paper

QE measure lowered loan interest rates while increasing credit quantities, researchers find

Interview: Luiz Awazu Pereira da Silva

BIS deputy general manager talks about the obstacles central banks face with regard to climate change and why the status quo needs to evolve

BIS’s Pereira says green QE could distort market

Central banks should focus on financial stability mandate not green QE, says deputy general manager

Yield curve models overstate chances of US recession – ECB research

Models need to account for effects of QE asset purchases on bond premia, authors say

ECB monetary policy was weakened by regulation – Bundesbank paper

Tighter regulation reduced lending by weakly-capitalised banks from 2008 to 2018 – researchers

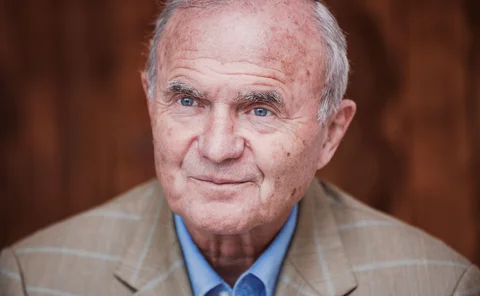

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Governor of the year: Mark Carney

Carney has played a vital role in managing Brexit risks while driving efforts towards climate, payments and dollar funding reform

ECB reallocates subscribed capital after Brexit

Eurozone central banks will increase their total paid-up capital by €1.2 billion over the next two years

Riksbank’s Skingsley calls for other policy areas to support monetary stimulus

First deputy governor says Swedish central bank has tools to react to future recessions

ECB’s Mersch warns of negative side-effects of ultra-loose policies

Policies may be contributing to risk-taking, high asset-price inflation and inequality, board member says

Lagarde promises wide-ranging review as ECB holds rates

ECB’s monetary policy review will look at green finance and engagement with citizens – Lagarde

ECB willing to provide further stimulus – minutes

Governing council stresses inflation remains below its medium-term goal