Interest rate benchmarks

Majority of central banks have analysed effects of tariffs

Spike in levies seen as having varying degrees of impact on financial stability

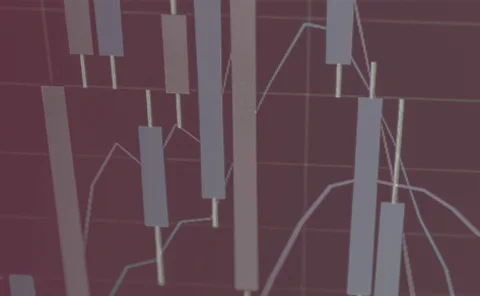

Philippines launches new interest rate swap market

Central bank says platform could boost trading and liquidity in domestic bonds

South Korean regulators push for benchmark rate reform

Authorities encourage wider adoption of repo-based RFR for financial transactions

Most central banks disclose governors’ salaries

Governors’ salaries show moderate correlation with countries’ per capita GDP

Market and personnel become key rising risks for central banks

Over 47% of institutions highlight one of these two factors as the fastest-growing risk

Cyber security remains most pressing risk for central banks

For second consecutive year it is singled out as the risk rising the most

The case for trade surveillance in FX and fixed-income markets

This whitepaper explores the essential need for central banks to monitor activity for signs of market abuse, which has a negative impact on the economy and society

UK regulators fix end date for Libor

Most Libor settings will cease at the end of 2021 as Bailey tells firms to finish their transitions

US banks cede to SOFR lending as credit hopes fade

Critics of risk-free rate say dynamic spread will be too late for transition

MAS ‘front-loads’ interest rate benchmark reform effort

Central bank says not transitioning to new Sora rate will expose banking sector to increased risk

HKMA sets new Libor transition milestones for banks

Nearly all banks have transition plans but risks from benchmark reform continue to build up in the banking system, HKMA warns

FSB and BCBS survey finds ‘major’ challenges remain in Libor transition

Report highlights data gaps, issues with developing new products, and problem of “tough legacy” contracts

FCA to gain new powers to tackle ‘tough legacy’ issues in Libor transition

Untangling complex legacy issues is looking increasingly difficult as delays mount due to Covid-19

BoE to impose Libor-linked collateral penalties

Andrew Hauser says regulators will employ carrots and sticks as deadline for transition looms

Bank of Canada to take over calculation of reference rate

New methodology will make Corra more “robust, reliable and representative”, central bank says

RBNZ supports plan for ‘fallback’ benchmark rate

New Zealand’s benchmark rate-setting body selects the central bank’s policy rate as fallback option

New York Fed launches longer-term liquidity fix

Markets desk tells overseas central banks that foreign repo pool rate will be revised

New CBSL governor targets transmission mechanism

Priorities for 2020 include tackling bottlenecks, boosting transparency and improving analytics

ECB says new eurozone benchmark successfully introduced

Data shows September rate cut fully passed through to new €STR benchmark, ECB says

New York Fed proposes three SOFR averages

Move is “important next step” in encouraging transition from Libor, official says

IMF: loose monetary policy is fostering greater risk-taking

A crisis half as strong as in 2008 could send “corporate debt at risk” to $19 trillion, says the fund