Inflation

Chilean MPC speeds up tightening, citing higher inflation risks

Central bank board surprises markets, increasing interest rates by 125 basis points to 2.75%

US CPI inflation rises to 5.4%

Prices continue upward climb, but policy-makers still see pressures as temporary

Clarida: ‘Stagflation is not my baseline case’

Fed vice-chair says inflation situation not akin to 1970s

IMF: growth prospects dim as pandemic lingers

Fund revises down growth forecasts, warning of inflation, disruption and divergence

Covid-19, crypto and climate weigh on global economy – GFSR

Central banks face difficult “intertemporal trade-offs”; poorer nations unlikely to regain pre-Covid growth levels for “many, many years”, says IMF’s financial counsellor Tobias Adrian

ECB’s Lane: one-off wage increases do not equal sustained inflation

Inflation is forecast to have reached 3.4% year on year in September, well above the ECB’s 2% goal

Summers fears for Fed’s ability to remove ‘punchbowl’

Central banks may not be able to counter inflation threat amid possible return to 1960s economics, says former US Treasury secretary

Peru central bank raises rates for third time in two months

BCRP forecasts inflation will return to target, but expresses concern over expectations

Some ECB rate-setters concerned over inflation

Minutes show certain governing council members called for sharper cut in asset purchases

Bank of Israel again holds rate steady

But MPC signals it is ready to end QE programme if economic recovery continues

Uruguayan central bank makes second rate increase in a row

Central bank aims to end “expansive” monetary policy and guide inflation to target range

Romania orders first rate increase in more than three years

Central bank adds 25 basis points as energy prices bite, while Moldova continues tightening

Iceland tightens policy to tame inflation

Inflation rose to 4.4% in September, above the central bank’s 2.5% target

Iran appoints third governor this year

Ali Salehabadi joins central bank three months after predecessor took office

RBNZ begins monetary tightening with 25bp hike

Central bank is confident inflation will return to target, but says growth will be “volatile”

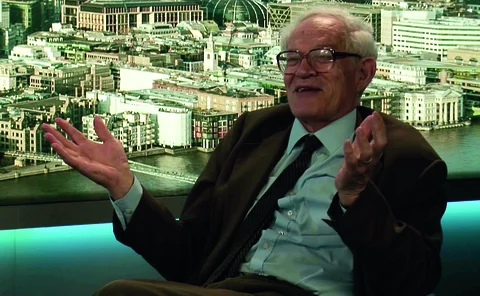

Larry Summers on stagflation risks, lessons from Delphi and never-ending ‘punch’

The former US Treasury secretary speaks about fiscal ‘overexpansion’, Fed/Treasury debt discord, the pitfalls of ‘unknown unknowns’ and central bankers ‘unable’ to remove the ‘punchbowl’

US PCE inflation rises to 4.3%

Fed’s preferred rate reaches new high in August, but “trimmed” measure steady at 2%

Colombia raises policy rate for first time since 2016

Board forecasts inflation will be above target band for the rest of this year

Jamaican central bank makes first rate rise since 2019

Central bank forecasts inflation will be above target for two years as it hikes rate by 100bp

Bank of Mexico makes third consecutive rate raise

Board says inflation risks are tilted to upside and raises fourth-quarter inflation forecast

Czech central bank raises rates despite government pressure

Board votes to increase repo rate 75bp as inflation rises above 4% for first time since 2008

Goodhart, Gopinath and Lippi disagree on inflation

Central banks lack tools to deal with inflation, Goodhart warns, but IMF chief economist disagrees

Elizabeth Warren publicly rejects Powell reappointment

Senator calls Jerome Powell “a dangerous man to head up the Fed”

Bailey puzzles over UK labour market signals

A lot of people are still out of the labour market, but unemployment remains low