Financial inclusion

Markus Brunnermeier on the need for CBDCs

The Princeton academic co-authored a paper for the European Parliament exploring the potential pitfalls of CBDCs. But they are still needed, he says

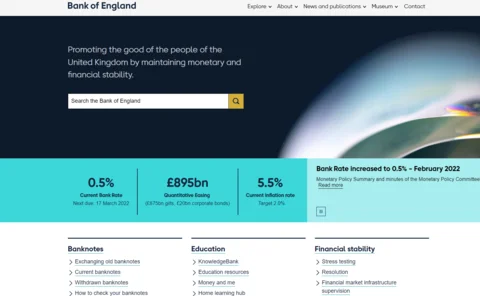

BoE aims to boost comms with new ‘visual identity’

Design overhaul aims to help central bank reach a wider audience, BoE says

How supervisors can step up the AML fight

Marcus Pleyer, president of the Financial Action Task Force, says digital tools, stronger co‑operation and risk-based methods can give supervisors an edge. But threats are still proliferating

Payments efficiency is driving force behind many CBDCs

Inclusion, financial stability and monetary policy are also leading factors

World Bank urges Georgia to make ‘further efforts’ on financial stability

Report praises “significant progress” but says work is needed on supervision, AML and inclusion

Currency Benchmarks 2021 – presentation

Central Banking’s currency subject matter specialist Rachael King speaks with Chris Jeffery about circulation, impact of Covid-19, forecasting, costs and resourcing, security and design, sustainability, and more

BIS paper calls for action on big tech dominance

“Digital platforms” can boost inclusion but may undermine other central bank objectives, authors say

RBI launches offline digital payments

Indian central bank hopes scheme will promote digital payments in remote areas

Mexican government announces CBDC for 2024

Bank of Mexico has yet to comment publicly on the initiative

BoE to publish ‘pop-economics’ book

‘Can’t we just print more money?’ is latest step in educational push by central bank

Podcast: an update on the e-naira project

Bitt’s Imran Khan explains how its project in Nigeria is different to CBDC projects launched before

RBNZ begins wide-ranging review of cash

New Zealand’s central bank warns of potential harm caused by “retreat from cash”

Central banks’ diversity policies can only go so far – RBA’s Debelle

Policies can only go so far in reducing the inequality gap, Debelle says, while providing update on “reconciliation” plan

ESG for central banking focus report 2021

The report flags challenges for central banks themselves – as guardians of the financial system, they have a duty to lead by example. But the lack of liquidity within ESG-compliant assets is proving a problem for many

A future-proof RTGS blueprint

Operating hours, access and data standards should all be considered by central banks contemplating an RTGS overhaul

CBDC issuance should not be rushed, say central bank experts

Officials at Singapore Fintech Festival warn central banks must be alert to risks of CBDCs

Banknote forecasting with big data tools on the rise

Three-quarters of central bank currency departments yet to use big data

Emerging economies more likely to employ access-to-cash policies

Central banks split on access-to-cash policies

Mobile money was ‘crucial’ for low-income countries during the pandemic – IMF

Data shows mobile and internet banking transactions grew for all income levels

Microfinance still key to inclusion despite flaws – RBI deputy

Excessive debt and “coercive recovery practices” demand reform, says Rajeshwar Rao

Nigeria launches ‘digital naira’ pilot

Central bank issues $1.2 million in retail CBDC after clampdown on private crypto

Fed board member says US community banks under threat

Michelle Bowman says smaller community institutions play vital role for ethnic minorities

Fed’s Quarles says there is no case for a US CBDC

Central banks should not waste resource or risk “significant disruption” to the banking system