Coronavirus

Brazil close to limit of monetary easing – minutes

Rate-setters stress new interest rate cuts could imperil financial stability

FCA to gain new powers to tackle ‘tough legacy’ issues in Libor transition

Untangling complex legacy issues is looking increasingly difficult as delays mount due to Covid-19

Weidmann to testify quarterly in parliament to explain ECB policy

Measure follows constitutional court ruling requiring ECB to demonstrate proportionality of government bond purchases

Bank of Canada exploring alternative inflation measures – governor

Canadians feeling prices rising despite CPI being negative for two months, deputy governor says

Brazilian central bank cuts rates to record low

MPC says “remaining space for monetary policy stimulus is uncertain”

Covid-19 hampers inflation measurement – Riksbank’s Ohlsson

Too soon to say whether consumption changes during pandemic will become permanent, official says

Chilean government wants to give central bank QE powers

Draft law would allow Central Bank of Chile to buy government debt in “exceptional circumstances”

PBoC will not engage in monetary financing, Guo says

Senior central bank official says China will not monetise deficits or use negative interest rates

BoE expands asset purchases by £100 billion

Haldane casts sole vote against expansion as ex-MPC member Sentance warns of “autopilot”

Namibia’s central bank cuts rates to record low

Central bank acts to preserve link to South African currency as it reintroduces lockdown measures

Bank Indonesia cuts rate for the third time this year

Governor hints that further cuts may come while analysts warn economy may shrink further

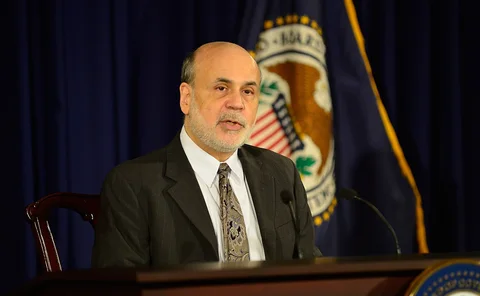

Bernanke and Yellen join call for new fiscal stimulus in US

Former Fed chairs among 148 economists warning of “disastrous” effects if Congress fails to act

Bosnia and Herzegovina central bank staff donate salary to fight Covid-19

Over $20,000 will be donated to charities including the Red Cross

Trends in reserve management: 2020 survey results

Covid-19 expected to dent the risk appetite of central bank portfolio managers; socially responsible investing gains ground

Israeli governor reflects on response to Covid-19

Bank of Israel started government bond purchases and dollar-shekel swaps to boost liquidity

Reserve managers ‘unprepared’ for home trading

Covid-19 presented reserve managers with unprecedented business continuity challenges at a time of acute market and economic distress

Iran’s race towards monetary policy reform faces high hurdle reality

The Majlis Research Center’s Tohid Atashbar says positive outcomes from the Iranian central bank’s fast-tracking of monetary policy reform – made in response to Covid-19 and US sanctions – may prove difficult to deliver

Chicago Fed breaks ties with economist over Black Lives Matter criticism

Controversial comments by senior professor ignite debate over racism in economics, and the Fed’s role in tackling inequality

Ukraine’s central bank cuts rates to record low

Central bank says move was made possible by IMF aid and pledges further boost to reserves

Fears rise over breakdown in Basel and IFRS standards

Bretton Woods institutions worried about growing divergence in capital and accounting standards as credit impairment tsunami looms; US and many emerging economies skirting the rules

CBDC development pushed into ‘top gear’ by Covid – policy-makers

The pandemic will have a lasting impact on consumer payment behaviour, panellists say

UK GDP growth plunges to -20% in April

Figure is worst on record, but may be somewhat better than earlier official estimates

Bank of Israel investigates carbon pricing

NGFS says global economy needs “green recovery” from pandemic

Mauritian central bank to use $2 billion of reserves to fund firms

Central bank will also issue debt instruments to give government $1.5 billion in new funding