Banks

IMF research examines ‘borrower effects’ during crisis

Working paper constructs index to assess the contribution of risky borrower portfolios in tightened overall credit conditions during a financial crisis

EBA-Esma report slams Euribor administrator

Study uncovers ‘weaknesses and insufficiencies’ in benchmark rate-setting process and says prompt action must be taken to address shortcomings

MAS sets out FMI supervisory framework

Monograph gives details of Monetary Authority’s approach to regulating financial market infrastructures in line with CPSS-Iosco principles

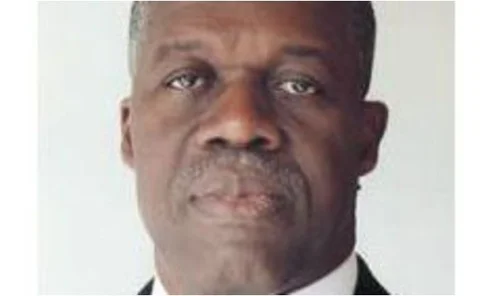

Mauritian deputy governor outlines tighter corporate governance plans

Yandraduth Googoolye sets out recent efforts by the Bank of Mauritius to tackle corporate governance failures that emerged during the financial crisis

RBI seeks to draw retail investors into government securities

Deputy governor Harun Khan says tailoring government securities to retail investors will help cushion volatility created by institutional and international investors

Pakistan’s Anwar presents plan for financial system growth

Governor of the State Bank of Pakistan gives 10-point plan for growth in the financial system to boost the economy and improve the ‘potency’ of monetary policy

Bank of Spain executives hit back at negligence claims

Executive commission rebuts claims made in a leaked internal report that the central bank’s supervisory department tended to ‘look the other way’ when there were signs of criminal activity

Bank of Korea warns of forthcoming credit tightening

Bank lending survey finds a recent trend of credit easing is likely to be reversed in the first quarter of 2013; credit risk expected to run at ‘high levels’

Netherlands Bank report urges restructuring of mortgage finance

First meeting of the Netherlands Bank’s Financial Stability Committee endorses action to address risks surrounding high mortgage indebtedness

Minneapolis Fed research challenges banks’ reliance on short-term debt

Policy paper calls short-term funding as a foundation for efficient payments an ‘artefact of a bygone era’, and suggests reforms to banks’ funding models

Belgian bank survey reports gloomier outlook

National Bank of Belgium survey finds improved financial market conditions are not feeding into the real economy, as respondents again revise down 2013 growth forecasts

PMA gains new authority over payments systems

Decree law gives Palestine Monetary Authority green light to promote ‘modern e-banking services’; Jihad Alwazir says new systems will increase efficiency while reducing risks

IMF fears Ireland could still lose access to markets

Eighth review of extended fund facility says Ireland’s newly regained market access is ‘fragile’ and could be lost if European commitments to ESM funding and OMTs are not followed through

Fed’s Stein highlights transatlantic risks

Jeremy Stein discusses situations that may lead to a spike in dollar funding costs for European banks operating in the US; says renewed swap lines and new regulation will help

BBA delays phase-out of some Libor rates after complaints

Less-used rates will be produced until May 2013

HKMA’s Yue on consumer education and protection

Market players, regulator and consumers all have roles to play to ensure that trust remains in financial services, says Hong Kong deputy chief executive

Banque de France paper tests policy interactions

Researchers examine optimal configurations of monetary and macro-prudential policy under different conditions; find monetary policy cannot affect financial stability in some cases

Ghana annual report details payments upgrades

Bank of Ghana notes projects implemented in 2011 to improve financial market infrastructure

Book notes: The Great Recession: Market Failure or Policy Failure?

This is a hugely important book that should be read by all central bankers, bank supervisors, politicians and newspaper editors

Sri Lankan governor issues 21-point plan for bankers

Ajith Nivard Cabraal gives guidance on how banking operations should be monitored and upgraded throughout 2013

Paper finds flimsy productivity base for banks in Spain

A Bank of Spain working paper says two-thirds of pre-crisis banking productivity growth was attributable to the expansion of mortgage lending, a reliance on short-term finance and leverage

Central Bank of Ireland to toughen penalties for financial crime

Irish central bank looks to harden sanctions for financial crime, including doubling maximum fines and the possibility of criminal prosecution for top managers

BoE and FDIC co-operate on bail-in plans

US deposit insurer and UK central bank release plans for resolution of global systemically important banks, focusing on a ‘top-down’ approach to maintain viability long enough for restructuring

BoJ paper finds noisy reference rate can create volatility

Working paper studies effect of reference rates on stabilising or destabilising interbank markets; finds noise in rates reported by large banks can feed volatility and impair monetary policy