Balance sheet

Q&A: New York Fed’s Stiroh on climate change and Covid

Co-chair of Basel task force discusses possible supervisory approaches to climate risk

Banks will be tested in next phase of pandemic – FSB chair

Reforms are needed to improve resolution planning and non-bank resilience, Randal Quarles says

Peter Praet on Europe’s Covid-19 responses

The former ECB chief economist talks about threats to financial stability, negative rates, common debt issuance and steps to improve the EMU

BIS suspends dividend to prepare for further Covid-19 strains

BIS will not pay dividend for first time since 1950, as senior managers see further turbulence ahead

The Fed must be careful to avoid bank deposit crowding out

Rising US government debt will have a major effect on bank funding, write Wenhao Li, Yiming Ma and Yang Zhao

UK debt office narrowly avoided disorderly market in March

DMO chief says BoE intervention triggered rapid recovery; debt issuance now running at record levels

Fed promises to keep buying assets at current rate

Fed will hold accommodation in place for “however long it takes”, chair Jerome Powell says; FOMC releases first projections this year

Balance sheets could grow by 23% of GDP in largest advanced economies – BIS

Economists forecast balance sheets will remain large for the foreseeable future

Central banking enters a new era

Central banks face a delicate balancing act to preserve their reputations as they evolve into ‘buyers of last resort’ and some of their actions appear functionally equivalent to ‘monetary financing’

ECB’s Enria unsure banks will dip into capital buffers

Anxiety over investor and rating agency reaction may limit banks’ use of Covid relief measures

Book notes: Central banking before 1800, by Ulrich Bindseil

A new standard reference point for the history of central banking

Economists debate monetary financing of China’s government debt

PBoC adviser dismisses idea of monetising government bonds despite calls from Ministry of Finance think-tank

Fed predicts ‘unprecedented’ economic shock

Policy on hold as Q2 may see data “worse than any data we have seen”, Powell warns

Fed’s balance sheet increases by 50% since March

Total assets now just shy of $6.4 trillion, a new record high

BoE and ECB weigh calls to follow US lead on capital relief

European regulators face pressure to exempt sovereign exposures from the leverage ratio

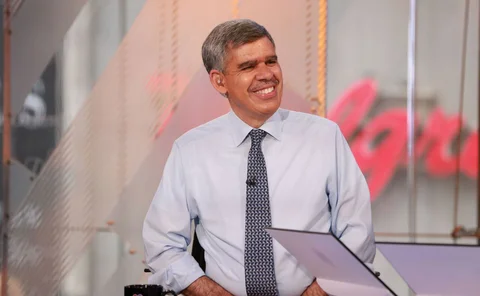

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

Beware of capital: much ado about nothing?

Capital increases can be offset by asset valuation, provision and income recognition forbearance

Bank of England to lend directly to government

Central bank agrees temporary expansion of “Ways and Means” facility

Central banks may have to become ‘dealers of last resort’ – BIS economists

EMEs have not overcome “original sin” by deepening local currency bond markets, authors warn

Should the Fed be next to implement yield curve control?

The Reserve Bank of Australia is now the second G20 central bank trying to control longer-term interest rates. Could the Fed be next?

Accounting for losses during a pandemic

US banks get green light from senators to use loan loss accounting methods widely criticised following 2008 crisis

Fed’s balance sheet could see massive further growth

Response to coronavirus has already pushed Fed’s holdings up to record levels

Banks rush to tap new dollar liquidity facilities

IIF warns of major capital flight from emerging markets as demand for Fed-backed repos surges

Fed unveils new capital regime to criticism from Brainard

Federal Reserve says new rules will maintain capital levels, but senior official calls them “imprudent”