Regulation

CNB's Tuma calls for cross-border supervision

Zdenek Tuma discusses the future of financial regulation and the prospects for joining the euro

Thailand's Bandid stresses importance of Pillar II

Work by the Bank of Thailand on the implementation of Pillar II of Basel II is continuing, said Bandid Nijathaworn, the deputy governor of the central bank.

Bernanke defines macroprudential approach

Ben Bernanke, the chairman of the Federal Reserve, on Thursday detailed how a macroprudential approach to regulation would look.

SNB's Hildebrand wants global bankruptcy code

Philipp Hildebrand, a member of the Swiss National Bank's governing board who will take the helm next year, has called for global insolvency standards as a means to handle the too-big-to-fail and too-big-to-save problems.

Guyana set to take on insurance role

The Bank of Guyana's regulatory ambit may expand to include the state's insurance industry if legislation tabled by the government on Thursday is passed.

Israel at odds with major bank over CEO role

The Bank of Israel has criticised the state's second-largest bank for the lender's hasty appointment of a new chief executive.

Malaysia steps up liberalisation agenda

Bank Negara Malaysia on Monday announced a raft of measures to further liberalise the country's financial markets.

EU devises new rules for rating agencies

The European Parliament on Thursday approved a batch of rules aimed at enhancing the transparency and performance of credit rating agencies, under fire for their role in the crisis.

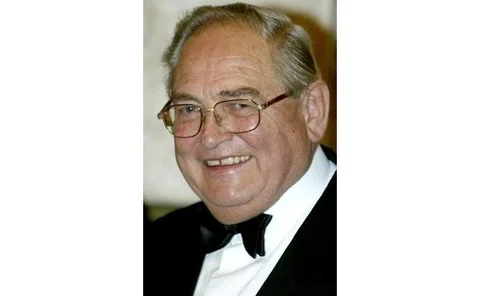

Eddie George on independence and supervision

In 2000, Sir Eddie George, the former governor of the Bank of England who died at the weekend, spoke on the Bank's then new-found independence and the loss of its supervisory function

Bernanke stresses benefits of innovation

Ben Bernanke, the chairman of the Federal Reserve, has urged lawmakers to beware of regulating to prevent financial innovation, though he acknowledged that new products had to be transparent and understandable.

Portuguese-speaking states team up: Macao's Teng

Closer cooperation between financial regulators can enhance the positive impact of financial industry on the economy of Portuguese-speaking countries, said Anselmo Teng, the chairman of the Monetary Authority of Macao.

British regulator denies whistleblower claims

The Financial Services Authority (FSA), the United Kingdom's financial regulator, has parried allegations made by a former employee that it had allowed building societies to become involved in areas of finance that they knew little about.

Czechs criticise De Larosiere report

The De Larosiere report fails to take account of the need for one regulator to cover supervision of all sectors of the financial market, says a position statement from the Czech National Bank.

Buba's Weber against new European authorities

The Bundesbank is strongly against the De Larosiere report's proposition to create new European authorities out of the three Lamfalussy committees, said Axel Weber, the president of the central bank.

G20 group: more supervisory colleges needed

Regulators should collaborate to establish supervisory colleges for all major cross-border financial institutions, says a report from a working group prepared for the G20 London summit.

Uniform banking rules crucial: Norway's Gjedrem

All global supervisory authorities must take a uniform approach to regulating banks, said Svein Gjedrem, the governor of the Norges Bank.

FSF details reform proposals

A leverage ratio, less risky pay deals and closer work on cross-border contingency planning are among the measures for a new global regulatory code outlined by the Financial Stability Forum on Wednesday.

Banks reforming pay deals, says industry group

The Institute of International Finance (IIF), a global organisation for the banking industry, has said that financial firms are overhauling their compensation practices to reflect a longer-term outlook.

Wellink: long-term fix will abate near-term fears

A clear outline of the post-crisis regulatory landscape would help allay short-term fears, Nout Wellink, the president of the Netherlands Bank and the chairman of the Basel Committee on Banking Supervision, has said. Wellink also indicated that the…

Geithner outlines regulatory overhaul

Tim Geithner, the US Treasury secretary, sounded the knell of light-touch regulation on Thursday, outlining a reform agenda that if passed will see a single systemic-risk supervisor clamp down on all financial firms deemed either too big, or too…

Basel Committee's Praet on the future of regulation

Peter Praet, an executive director at the National Bank of Belgium and a member of the Basel Committee on Banking Supervision, offers some pointers on how global leaders should formulate their regulatory response to the crisis.

Wellink eyes caps on bonuses and hedge funds

Nout Wellink, the chairman of the Basel Committee on Banking Supervision and president of the Netherlands Bank, has called for international principles for bonuses and financial sector pay.

ECB's Papademos calls for macroprudential schema

The establishment of a framework for macroprudential supervision is urgently needed, said Lucas Papademos, the vice president of the European Central Bank.

Calls for Bank to retake control of regulation

The leader of Britain's main opposition party wants the Bank of England to regain its role in regulating the overall level of debt in the banking system.