Singapore

Ageing population is deflationary – HKMA paper

Deflationary pressures “should not be ignored”, economist says

MAS to gain powers over wider set of payment services

Central bank will also enforce new limits for coin payments

Singapore central bank probes possible misconduct at large trading group

Noble Group shares suspended as MAS, police and accounting regulators examine allegations

Singapore’s financial system resilient amid increased global risks – MAS

Despite headwinds the financial system can withstand ‘severe shocks’, the central bank says

Video Q&A: Maciej Piechocki, BearingPoint

Central Banking met with BearingPoint’s Maciej Piechocki at the Central Banking FinTech RegTech Global Summit in Singapore to discuss financial and regulatory technology – known as fintech and regtech respectively – solutions, how technology can help in…

Singapore central bank to put $5 billion into venture capital sector

Move will complement “curated deal-making programme” for Asean investment, says senior official

MAS chief laments ‘data localisation’

Misguided notions of data security threaten digital growth, says Menon; central bank further strengthens fintech support

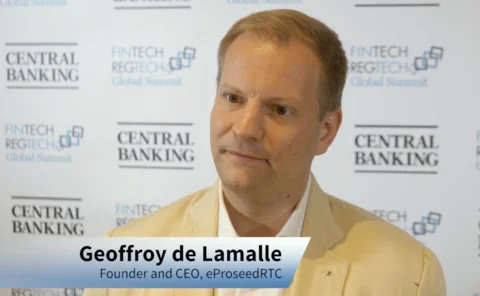

Video Q&A: Geoffroy de Lamalle, eProseedRTC

Central Banking spoke to Geoffroy de Lamalle, founder and chief executive at eProseedRTC, at the FinTech and RegTech Global Summit in Singapore

MAS adjusts exchange rate policy

Monetary authority only changes the slope of the policy band infrequently

MAS fintech officer tells regulators to upgrade to cloud

Data centres are no longer equipped to handle the “uncontrollable” growth of data, Mohanty says

Singapore aims to become e-FX hub for Asia, says MAS’s Loh

Jacqueline Loh says Singapore wants more price discovery to take place in the country

People: China names new vice-governor

China appoints Liu Guoqiang as vice-governor; MAS establishes governance council, Ireland’s central bank gets new director for supervision; and more

A real-time payments revolution in Asia

Asian central banks have encouraged the development of instant payment systems to defend monetary policy transmission and counter cryptocurrency usage

MAS strengthens use of data to combat financial crimes

Singapore central bank will roll out revised reporting forms and reporting platform in August

Singapore moves to curb private housing boom

Buyers have to pay higher taxes and face tougher loan-to-value limits

Singapore central bank aims to eliminate cheques but not go cashless

MAS board member reveals new details of scheme to allow payments by QR codes

Singapore and India launch fintech co-operation scheme

The countries plan to establish real-time payments links

BNM may reopen probe into alleged massive fraud at 1MDB

Malaysian central bank may face questions over its role in investigating alleged crimes

HKMA rolls out new initiatives to lure bond issuance

The three-year pilot promises to fund half of eligible bond issuance expense, up to a maximum of HK$2.5 million

People: BoE appoints chief cashier in senior reshuffle

BoE makes promotion following departure of Chris Salmon; Malaysia picks new assistant governors; MAS makes changes to senior management

Claims on offshore centres at record high – BIS data

Overall cross-border claims “gained momentum” in Q4 2017

SNB rejects idea of retail central bank digital currency

Governing board member Andrea Maechler says central bank digital currency would bring “incalculable risks”, and denies that crypto tokens are “comparable with” money

Crypto tokens not yet a ‘significant risk’ – MAS’s Menon

The MAS is monitoring the crypto world using “unconventional” data-gathering methods

MAS prepares new approach to data collection

MAS says it is moving towards “zero duplication” of data requests and machine-readable regulation