Swiss National Bank (SNB)

Switzerland weighs bold monetary experiment

On June 10, Switzerland will vote on whether to revolutionise its monetary system and hand the central bank a monopoly on money creation

Cash usage in Switzerland below eurozone average – SNB survey

SNB’s first payments study finds 70% of transactions processed in cash in 2017

Adrian and Rey: macro-prudential tools needed to resist ‘bad booms’

Economists say monetary policy cannot fully control local conditions; Hélène Rey calls for improved early warning models

SNB governor condemns 'sovereign money initiative'

Thomas Jordan calls on voters to reject proposal for new credit system

SNB loses $6.9 billion in Q1

Higher interest rates reduced the value of sovereign bonds

Book notes: The paradox of vulnerability, by John Campbell and John Hall

Quality of national institutions vital to handling financial crises, say authors

SNB rejects idea of retail central bank digital currency

Governing board member Andrea Maechler says central bank digital currency would bring “incalculable risks”, and denies that crypto tokens are “comparable with” money

Language shapes monetary policy preferences in Switzerland – research

Culture partly outweighs shared institutions and economic history in setting priorities

SNB achieved record profits in 2017

Acquisitions of euros and dollars via foreign exchange interventions yielded 91% of the gains; SNB reshapes portfolio with greater share of equities and riskier bonds

SNB struggles to end ultra-loose policy regime

The Swiss central bank’s hopes of normalising policy are being held back by weak expectations, a strong currency and policy actions abroad

People: South Korea’s Juyeol Lee nominated for new term

South Korean president nominates Lee for fresh four-year term; SNB’s Wiedmer steps down; State Bank of Vietnam appoints new banking supervisors

Banknote and currency services provider of the year: Landqart

The leading hybrid substrate provider offers the durability and increased security of polymer combined with the security features and customer familiarity of paper

SNB expects record profits for 2017

Swiss central bank benefits from high asset prices and a weaker franc

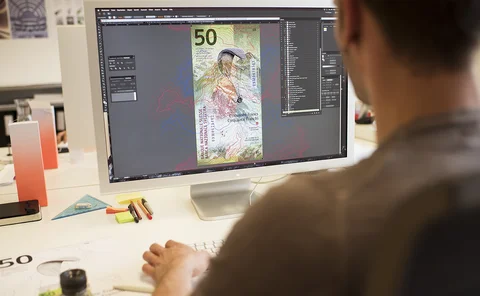

SNB buys banknote company ‘to ensure its survival’

Company that provides substrate for Swiss banknotes came into liquidity difficulties following the cancellation of a tender from an international client

SNB keeps accommodative policy unchanged

Central bank acknowledges Swiss franc’s depreciation, but still considers the development “fragile”

Distorted Swiss surplus not good base for policy – Jordan

Multinationals’ operations, higher nominal rates abroad and Swiss franc appreciation increase the surplus

Public satisfaction with BoE rises with policy understanding

The research recommends targeting young people with low incomes, as well as women

Swiss bond market contracts despite negative rates – SNB’s Maechler

Shift driven by lower issuance by Swiss government and reduced financing needs of banks

SNB’s Jordan defends central bank independence

In contrast to monetary policy, macro-prudential should also be shaped by government

SNB profits hit record high

Swiss franc’s depreciation and high stock prices fuel the rise in revenues in the first three quarters

Firms with greater liquidity needs benefit more from higher public debt – research

The positive effect of government debt on industry stems from domestic debt, not external debt, author finds

More communication may hamper monetary policy, paper says

Independence and bigger MPCs may convey confusing messages and provoke forecast errors

SNB’s Jordan praises John Taylor legacy

The governor values how the Taylor rule has provided policy guidance, becoming an important benchmark

Falling Swiss franc boosts inflation but SNB policy is unchanged

SNB revises down GDP growth forecasts and warns franc “remains highly valued”