Central Banking Awards 2018

The winners of the 2018 Central Banking Awards

The Central Banking Awards 2018 recognise excellence in a community dealing with an ever-evolving landscape, where price and financial stability must be maintained and communicated against a backdrop of continuing innovation in financial services, reserves and currency management.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com

The winners of the 2018 Central Banking Awards

Bank of Canada wins Central Bank of the Year, Lesetja Kganyago picks up Governor of the Year and Perng Fai-nan receives Lifetime Achievement Award; 16 more awards unveiled

Central bank of the year: Bank of Canada

The Canadian central bank has stood out for its ever-improving levels of transparency, forward-looking management and best-practice review of its policy mandate

Governor of the year: Lesetja Kganyago

Kganyago has defended and enhanced the Sarb’s reputation as an independent and well-governed institution against all threats – despite a turbulent political and economic backdrop

Lifetime achievement award: Perng Fai-nan

Pre-emptive financial reforms combined with flexible monetary and forex policies have enabled Taiwan’s veteran governor to provide economic stability, even during turbulent times

Transparency: Central Bank of Ireland

The Irish central bank has made great progress in communicating in a candid and open manner with the people it serves

Reserve manager of the year: Bank of Korea

The South Korean central bank has revamped its reserve operations, and adopted a proactive approach to managing risks and returns that is matched by few of its peers

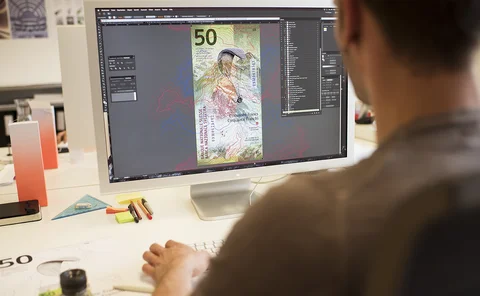

Banknote and currency manager of the year: Norges Bank

The Nordic central bank has redefined how its banknotes are designed, incorporating top-notch security and an innovative awareness campaign

Initiative of the year: Bank of England’s FinTech Accelerator

The UK central bank has embraced fintech service providers in a controlled manner to bolster its cyber-security and payments capabilities

Website of the year: Bank of Lithuania

Bank of Lithuania has built a website around the principle of making the most relevant information as accessible as possible for all of its audience

Economics in central banking: Alberto Cavallo and Roberto Rigobon – Billion Prices Project/PriceStats

Through a vast and ongoing data-collecting exercise, PriceStats has helped central banks overcome many of the drawbacks inherent in traditional inflation series

Asset manager of the year: BlackRock

BlackRock delivered some innovative new products and a highly regarded training scheme to build on its already strong foundation in reserve management services

Innovation in reserve management: HSBC

The global bank stepped in during Egypt’s economic crisis, arranging a private funding package that proved instrumental in turning around the country’s fortunes

Global custodian of the year: BNY Mellon

The US asset specialist has made strong progress in its effort to offer a seamless overlay of its disparate legacy systems, while also providing improved training to official institutions

Securities lending services provider of the year: Northern Trust

Official institutions praise the Chicago-based firm’s excellent coverage, operational smoothness and good returns

Banknote and currency services provider of the year: Landqart

The leading hybrid substrate provider offers the durability and increased security of polymer combined with the security features and customer familiarity of paper

Technology consultant of the year: Vizor Software

The Dublin-based company continued to grow its client base in 2017, proving its mettle in emerging markets, with the addition of Brunei’s central bank and the Zambian pensions and insurance regulator

Risk management services provider of the year: Openlink

Openlink’s central bank and state agency client base continues to grow, with the addition of a number of new clients, including Queensland Treasury Corporation

Consultancy and advisory provider of the year (data and regulatory management): BearingPoint

BearingPoint’s expertise in data and reporting has informed a number of high-level bodies over the past year, including the Basel Committee and the IMF, following groundbreaking work in Austria

Consultancy and advisory provider of the year (currency management): De La Rue

The UK-based company is helping central banks monitor the lifespan of banknotes in a bid to improve stock management and cost-effectiveness of currency operations

Payments and market infrastructure provider of the year: Perago

The software company is helping central banks around the world implement reliable and highly adaptable RTGS and retail payments systems