Website of the year: Bank of Lithuania

For making most relevant information as accessible as possible for all its audience

Central banks have plenty of communication tools at their disposal. But their websites remain the first port of call for many stakeholders, and are an ideal place to build familiarity and trust – two vital components that help them to fulfil their mandates.

The Bank of Lithuania has taken this to heart during the past year, overhauling its website to make it more accessible and relevant to its audience.

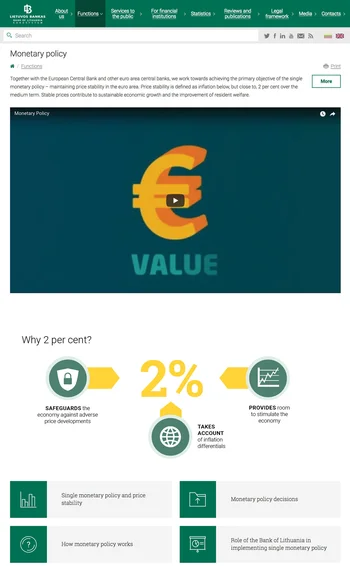

A key feature of the new website is how each of the central bank’s functions (eg, monetary policy, payments, reserve management) is explained to the user. Large blocks of text peppered with technical terms have been replaced with short introductory paragraphs, videos, infographics and links to further information.

The videos are particularly eye-catching. Produced in Lithuanian and English, and with a running time of around two minutes, each video aims to provide a brief and easily understandable description of each function. The animation is smooth and works well with the content, drawing on a range of metaphors. Inflation is a rising and falling tide, macro-prudential measures an umbrella, and capital a bell jar that insulates banks from roving thunderbolts. The videos succeed in making the content resonate with its entire audience.

While other central banks have also used video, the consistent application across a website is rare, as is the quality. The Bank of Lithuania worked with outside video design and animation agencies in a process that took the best part of six months.

“We have got very positive feedback from various target audiences on the final result,” says Giedrius Simonavičius, the head of the central bank’s communications department. “Visualisation is core, especially in this digital era.”

We collaborated with one of the best video design and animation agencies in Lithuania. The process of creating the videos took nearly six months

Audronė Kalvaitytė, Bank of Lithuania

Most videos are accompanied by an infographic, illustrating a relevant nugget of information or key statistic. The central bank’s return on investment is illustrated in a simple graph on one page, while a table neatly summarises its latest projections for inflation, wages, unemployment and GDP on another. These infographics help direct the user from the Bank of Lithuania’s responsibilities to how it is fulfilling them, and are followed by links to more detailed webpages or the latest news and publications relating to each of its functions.

It is also now much easier to move between different areas of the website. “Information is organised to cater for user needs, rather than to reflect the bank’s former organisational structure,” says Audronė Kalvaitytė, chief specialist of the central bank’s public relations division. A team of seven central bank employees utilised analytics and user feedback to build a website that provided users with instant access to what they were looking for. “We surveyed the main target groups – the general public, journalists, financial market participants, numismatists, lecturers and students, internal staff – seeking their opinion on the old website and asking them to specify which information is easy to find and which is not, and what information is missing,” she says.

The result is a prominent section dedicated to the Bank of Lithuania’s public services, including a facility for comparing fees charged by financial institutions, as well as dedicated sections for the institutions themselves and the media. A ‘mega-menu’ allows users to navigate three tiers of content at once, enabling them to more quickly access more detailed information. For example, a user could hover over ‘functions’, locate ‘financial assets’ and select ‘gold reserves’ while still on the home page. This could help explain why, since the new website was launched, users are visiting more of it. The bounce rate – the proportion of users leaving the website after viewing the home page – has fallen by 42%. The number of page views has also ticked up to 553,000 a month.

Increased user-friendliness

The website is more user-friendly in other ways, too. Whereas the old home page was cluttered and text-heavy, content is now restricted to a video, a few news items and popular topics, current exchange and interest rates, a calendar and some contact information. This is in keeping with the trend towards more minimalistic central bank websites. The Bank of Lithuania has also embraced responsive design with content that is adapted to phone, tablet and desktop users – increasingly, the hallmark of a modern website.

Clicking on the interest rates on the Bank of Lithuania home page redirects the user to the European Central Bank website for more information. Every national central bank in the Eurosystem faces the challenge of deciding how much information to convey on eurozone monetary policy, and how frequently to refer to the European Central Bank’s own (award-winning) website. The Bank of Lithuania achieves a good balance by keeping its own content succinct and linking to the European Central Bank for more detail. This is again achieved through effective infographics – one illustrates how monetary policy works, another how decisions are made – while there is a webpage dedicated to explaining the Lithuanian central bank’s role in devising and executing policy.

While the Bank of Lithuania has made excellent progress, its website continues to evolve. More videos will follow, says Kalvaitytė, related to financial education, while infographics will be made more interactive. In addition, the central bank aims to improve its data output. As part of last year’s overhaul, statistics are now split according to their intended audience. There are separate webpages for the public, more advanced users and for analysts and researchers – each more expansive than the last. The next step is to create personalised areas of the website for its data users.

If users can’t find what they are looking for on the website, the bank will do its best to help. As part of its ‘frequently asked questions’ section, the central bank invites users to ask their own – although with the rewritten content, clean design and intuitive navigation of its revamped website, it may receive fewer questions than it has in the past.

The Central Banking Awards were written by Christopher Jeffery, Daniel Hinge, Dan Hardie, Rachael King, Victor Mendez-Barreira, Iris Yeung, Joel Clark and Tristan Carlyle

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com