Central Banks

Canadian deputy says shadow banking could push up household debt

Timothy Lane raises concerns over the securitisation of government-guaranteed mortgages through shadow banks; says the low-cost funding could increase lending for mortgages

RBNZ deputy threatens use of loan-to-value restrictions to curb housing demand

Grant Spencer says interest rate hike would not be an 'appropriate response' to strong housing demand while macro-prudential intervention could be effective

EU finance ministers strike deal on bail-ins

Rules seek to impose losses from bank failures on creditors; national authorities told to create resolution funds to absorb losses in ‘exceptional cases’

Fischer says Frenkel will face ‘completely different' world

In his departing press conference at the Bank of Israel, Stanley Fischer highlights many changes that Jacob Frenkel will find when he returns; Frenkel still faces investigation over improper payments

People: Bank of Russia deputy joins government; Bank of Lithuania appoints deputy chair

Bank of Russia's first deputy chairman appointed as economic development minister; former Lithuanian finance minister moves to central bank as Darius Petrauskas departs; Kevin Feldman joins WGC

Basel Committee updates advice on anti-money laundering practices

Consultative document addresses ways for banks and supervisors to cut risk through diligent use of anti-money laundering efforts, including how to co-ordinate across borders

Monetary policy links to financial stability ‘are not straightforward', says Fed paper

Research paper from Fed's Finance and Economics Discussion Series finds monetary policy and financial stability concerns can be complementary - but the connections are complex

Fed presidents in conflict over 'too-big-to-fail'

Lacker, Fisher, Hoenig and Bair called before US Congressional committee to voice their opinions on Dodd-Frank Act's Orderly Liquidation Authority

Draghi calls for closer eurozone union ‘in all fields of economic policy'

Eurozone members need to sort out external imbalances and unemployment as well as acting together to secure banking union

RBNZ unveils 2013-2016 ‘statement of intent'

New Zealand central bank intends to make better use of a wider range of communication tools, as well as beefing up its macro-prudential toolkit

BoE MPC member says QE has worked, and exit need not cause turbulence

David Miles says opponents of QE are overly pessimistic, and research he has been conducting suggests it ‘might well be part of an optimal monetary policy strategy'

Fed proposals seek to shine light into money markets

Proposals for daily data reporting by a panel of 155 banks aim to improve the Federal Reserve's ability to supervise shadowy money markets

Basel Committee reveals leverage ratio formula

Proposals detail leverage ratio calculation framework and disclosure requirements that will enter force in 2015; committee keeps options open for a higher leverage ratio than originally planned

Chinese financiers hit out at 'blind' PBoC

China central bank accused of being blind to potential capital market reaction in its attempts to clamp down on the shadow banking sector

Swedish paper finds benefit in increasing lag-length in VARs

Working paper says it is possible to estimate structural vector autoregressions with long lags and still obtain precise structural predictions

Bank of England concerned by ‘vulnerability’ to interest rate increases

Financial Stability Report calls for assessment of financial institutions' exposure to increases in global interest rates; recommends banks are allowed to reduce their liquid asset holdings

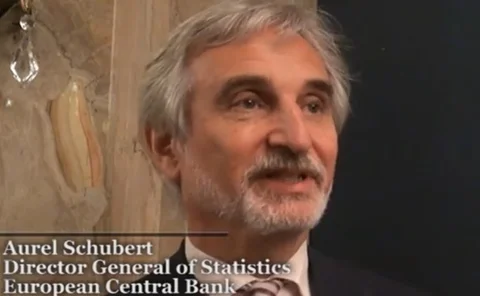

Central bank statistics departments facing multiple strains, says ECB’s Schubert

Meeting new monetary, micro-prudential and macro-prudential data requirements is a major burden for central bank statistics departments, says ECB statistics head Aurel Schubert

Cœuré says ECB will not tighten ‘in near future’

ECB executive board member Benoît Cœuré says the prospect of tighter monetary policy in the eurozone remains distant; calls recent bout of market volatility ‘excessive’

King defends Bernanke over communication of Fed policy

Bank of England's Mervyn King says Fed chairman Ben Bernanke could ‘hardly have been clearer’ over future of monetary policy; vents his frustration at slow pace of economic reforms