Reserves

One in ten central banks opened new liquidity swap lines

Benchmarking participants expanded lines in dollars, euro and renminbi

Securities lending prevalent in European central banks

Monetary policy, market maturity and currency variation may limit adoption in other regions

National income not only determinant of reserve management staff numbers

Salaries ranged between $11,968–$138,768 among benchmark participants

Most central banks invest in derivatives

External managers facilitate wider use of these instruments

External asset manager use on the rise

Central banks in upper-middle income countries allocated a higher share of reserves to external managers

Brazil central bank spends $1bn to support real

Local currency has declined more than 10% against the dollar since June

Emerging nations turned to FX interventions during pandemic

Central banks in emerging nations were twice as likely to implement FX interventions than their peers in advanced economies

Reserve managers prioritise liquidity tranches during pandemic

Central banks increased this part of their portfolios in the wake of US Treasury disruptions

Social bonds gain importance as a reserve asset

More than two-fifths of benchmark respondents invest in social bonds

Climate risk becomes more relevant to reserve managers

More central banks invest in green bonds and include climate risks in their benchmarks

Podcast: Diversifying portfolios post-Covid

BNP’s Johanna Lasker talks about why central banks should consider equities and Tips

Turkey raises banks’ gold and FX reserve levels

Central bank announces work with state-owned organisations on prototype CBDC

Bank of Finland targets 2050 carbon neutrality for investments

Greening FX reserves will only be possible if countries meet their Paris climate goal, central bank says

Central banks can improve reserves handling – World Bank

Direct board involvement, trading office setups and finance ministries all matter, report finds

BIS and HKMA start work on green bond infrastructure project

Digital platform based on blockchain aims to improve green bond market’s transparency

US and IMF block Taliban access to Afghanistan assets

IMF will not allow Taliban to receive SDRs, while US freezes central bank reserves

Mexican president demands IMF assets from central bank

Governor rejects proposal and former presidential ally says it would be legally impossible

Less chance of “taper tantrum” in emerging markets – Dallas Fed paper

Emerging markets have larger dollar reserves to meet financing disruptions

The renminbi’s rise to prominence: focus report 2021

Central Banking explores the impact the addition of the renminbi to the SDR basket has had on internationalising the Chinese currency; central bank reserve managers share their views on including the renminbi in their portfolios; and we take a look at…

IMF governing board signs off on ‘historic’ SDR allocation

Decision paves way for $650 billion worldwide infusion of liquidity later this month; mechanism for rich countries to pass on their share still unclear

The IMF’s $650bn SDR allocation and a future ‘digital SDR’

Focus is needed on widening SDR use in payments and the creation of a ‘digital SDR’, to support a large allocation of ‘official’ IMF SDRs, writes Warren Coats

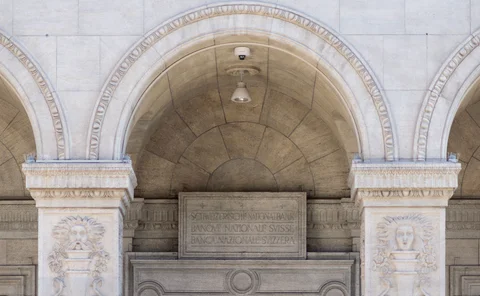

SNB reserves hit Sfr1 trillion

Equity holdings now account for 23% of the portfolio

Could higher US inflation boost euro’s international role?

Divergent rates of inflation on both sides of the Atlantic may compel investors to look for alternatives to the dollar, panellists say