Operating framework

Sri Lanka considers move to single policy rate

CBSL plans overhaul of monetary operations and improved liquidity forecasting

Former NY Fed chief calls for overhaul of discount window

Dudley’s proposed changes include prepositioning collateral, cutting costs of secondary credit facility

Argentina adopts new policy rate

BCRA will use overnight reverse repo rate after halting auctions of Leliq bonds

Cambodia’s Serey calls for greater use of local currency

Governor says demand for the riel has improved over the years

Corridor, floor, other: are operating frameworks fit for the future?

Central banks are becoming uncomfortably aware that monetary operations have ramifications well beyond setting short-term rates

BoE’s Hauser makes case against ultra-lean balance sheets

Even with central bank backstops, markets are not reliable liquidity managers, official says

SNB cuts interest payments amid losses

Swiss central bank lost over Sfr12 billion in Q3

RBA’s Bullock rules out setting an employment target

Governor says full employment cannot be reduced to a single measurement

Riksbank to offer counterparties new liquidity and deposit facilities

Measure aims to prevent volatility in overnight market rates as central bank reduces liquidity

Hungary continues loosening as inflation falls towards 10%

MNB cuts base rate by 75 basis points

Buy side reflects on BoE’s gilt liquidity lifeline

Lending facility could prevent repeat of last year’s LDI crisis if properly designed, pension and insurance experts say

Bangladesh Bank reforms MPC

Move is part of IMF-promoted reforms as Bangladesh adopts interest-rate targeting

UK researchers propose 3% inflation target and negative rates

Inflation stalls at 6.7% in September, the same figure as in August

Opponents of dual mandate win New Zealand elections

National Party promises to abolish RBNZ commitment to ‘maximum sustainable employment’

PEPP to become ECB’s weapon of choice

Facing high but falling inflation, the governing council is expected to hold rates

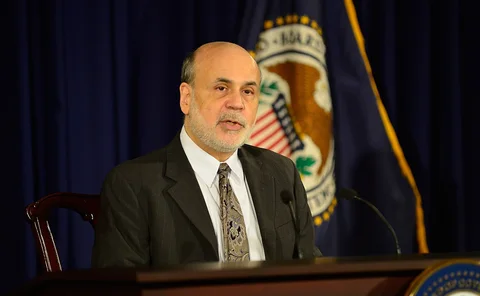

BoE publishes terms of reference for Bernanke review

Former Fed chair to provide insights into how to forecast in “significant uncertainty”

Momentum builds to end RBNZ dual mandate

Think-tank calls for abolishing deposit insurance and creating new prudential regulator

IMF paper offers ‘complete set of tools’ to model reserves demand

Authors say theirs is the first complete modelling framework for reserves demand

Jackson Hole in the wake of policy rules

Symposium heralds a shift to relying on incoming data and judgement, rather than rules or even formal models, to hit inflation targets, writes Barry Eichengreen

ECB: from a supply to a demand-driven floor?

Eurozone’s central bank expected formally to abandon corridor in forthcoming operational framework review

Kenya revives interest rate corridor

Controversial 2016 law capping rates undermined earlier attempt at corridor

Bundesbank cuts remuneration of government deposits to 0%

Measure could further reduce availability of high-quality collateral in the eurozone

Book notes: Inflation targeting and central banks, by Joanna Niedźwiedzińska

A useful and rich reference source, especially for central banks moving to adopt inflation targeting

New Zealand rejects RBNZ’s call for single price-stability goal

Updated central bank remit retains twin goals of price stability and maximum sustainable employment