Financial Stability

French governor sees outlines of possible Basel III deal

Internal models will still regulate some portfolios, governor predicts; output floors still a matter for “debate”

Bank of Japan to launch new website in time for 2017

New responsive design will include information from the old site displayed in new format; central bank has set second launch date in case of “delays”

Cambodia to increase number of financially educated, says director general

Around 29% of Cambodia’s adult population remain financially excluded from services; central bank to coordinate financial inclusion approach with various government ministries

Mixed views on Dodd-Frank rollback

No need to dump central clearing and electronic trading mandates, market participants say

Basel III challenging to implement in Islamic countries – Kuwait’s Al-Hashel

Central bank governor says discretion for Islamic systems, “though well-intended”, could create divergence and opportunities for regulatory arbitrage

IMF paper offers more granular stress testing framework

IMF applies new stress testing framework to Ecuador’s banking sector; framework offers more efficient surveillance, authors argue

Denmark’s economy set for a boom, says Rohde

Latest release of reports show Danish economy is resilient and set to grow in the next two years; governor Rohde still concerned about house prices

Nabiullina warns of low growth in Russian economy

Bank of Russia governor advocates three-year budget rule and structural reforms to counteract economic weaknesses

SAMA governor outlines challenges facing Islamic banking sector

Unified accounting standards would “comfort” regulators and improve transparency for the industry, Alkholifey says; issues need to be addressed in order to foster growth in Islamic banking

BoE’s Salmon seeks to fix deadline for delayed Libor replacement

Chris Salmon sets three-month target to finalise transition plan and reach decision on design for risk-free rate

UK’s PSR announces shake-up in provision of payment services

UK’s payment system regulator to open door to competition in national payment infrastructure; regulator sees benefits to Mastercard’s planned takeover of Vocalink

BIS paper identifies spillovers from targeted macro-prudential policies

Applying tools narrowly to a sector may nevertheless affect other sections of the financial system, authors find

BoE’s Hauser praises plan for integrated retail payments scheme

Faster Payments, Bacs and Cheque Clearing to be integrated into one system, Hauser says; ISO20022 to make interbank payments “much easier” for the UK

Federal Reserve conducts in-depth study into distributed ledger technology

Central bank publishes first paper discussing the benefits of distributed ledger technology in the realm of payments, and clearing and settlement; use of DLT could address “financial frictions”

Route ahead unclear for Italian banks

At least one bank faces major loan book problems; European law may present difficulties with recapitalisation and “bad banks”

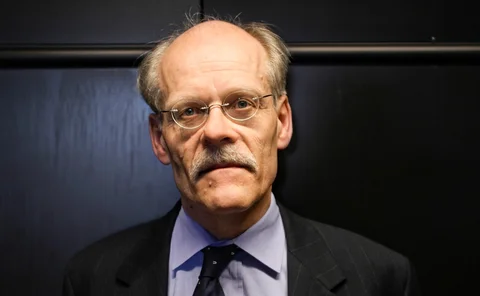

Ingves: internal modelling may create too much complexity

Basel Committee chair says complexity created by internal modelling has a range of adverse effects, though more research is needed

Tajik central bank launches consumer protection push

Plan could create stability and growth if it is successful, but resource constraints are a challenge, National Bank of Tajikistan says

Should banks hold cocos or other kinds of buffers?

Richard Heckinger examines the merits of contingent convertible bonds vs other instruments for meeting regulatory requirements

Malawi governor announces plans for central depository system

New system will provide security for transactions taking place in the market, Chuka says; governor hopes project will increase market liquidity in the long run

Singapore fines two foreign banks for 1MDB-related breaches

Investigations continuing into Goldman Sachs’ role, the regulator says

French paper presents macro-prudential early warning system

Authors advocate aggregating results of larger number of models

Netherlands paper explores people’s trust in pension funds

Most workers opt for flat-rate annuity arrangements but there are some deviations, authors find; expectations on expenses and trust appear to have an effect

Bank Negara Malaysia’s new site draws on award-winning designs

Responsive new site launched after in-house team conducts benchmarking exercise on award-winning central bank sites; head of electronic communications explains the evolutionary process

EU could impose negative rate shocks via IRRBB rules

EBA guidance on shocks is “outdated”, says ECB official