Monetary Policy

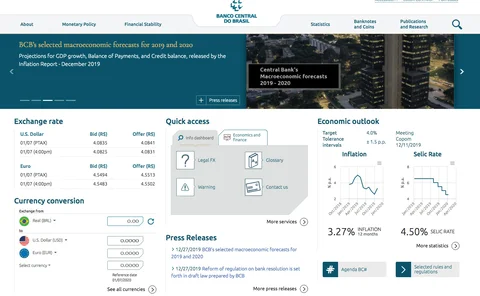

Communications in focus: Central Bank of Brazil

The head of communications at the Central Bank of Brazil speaks about the use of websites during a pandemic and how central bank communications will need to evolve

BoE’s Bailey explores future of balance sheet policy

Question of whether QE is “state contingent” could impact how it is deployed through the cycle

Bank of Japan launches policy review as deflation worsens

BoJ considers further monetary easing and extends special loan programmes

Paper tracks changing rhetoric of Bank of Italy governors

Governors have changed the focus of their concluding remarks over time, as well as the length of their speeches

Central Bank of Iraq devalues currency by 23%

Oil-dependent economy has been hit hard by coronavirus shock

What does 2021 hold for the ECB?

Former officials reflect on AIT, how the strategy review may affect normalisation, QE options and the need for new tools

BoE’s inflation target may hamper response to no-deal Brexit – IMF

Report urges BoE to bolster market communication in the event no deal is reached

SNB still ready to depreciate franc despite US condemnation

Swiss central bank stands firm after US Treasury labelled Switzerland a currency manipulator

Bank of Mexico holds rates as board splits

Change to rate-setting board’s make-up may herald change in policy stance, say observers

Fed’s dollar swap lines and ‘Fima’ facility to run nine more months

FOMC keeps main policy tools on hold, but shifts guidance on asset purchases

BoE’s MPC says UK outlook is ‘unusually uncertain’

Outcome of Brexit talks and evolution of pandemic leave future cloudy, BoE says

Fed faces longer-term challenges under new policy strategy

Steve Kamin warns central bank may not have paid enough attention to why r* has fallen

US brands Switzerland a ‘currency manipulator’

Treasury also accuses Vietnam of manipulating exchange rate to gain “unfair competitive advantage”

IMF’s Adrian weighs balance between stimulus and stability

Central banks need to incorporate macro-financial stability in decision-making processes, he says

Whither the age of ‘magic money’?

EME central banks are more exposed to changes in geopolitics, climate, demography, technology and inflation at a time when monetary theory is running well behind central bank practice

Bank of Israel to offer repos to non-bank credit providers

Measure is a bid to foster competition, and lower households and firms' financing costs

Monetary unions in the making in Africa

EAC, Ecowas and SADC can adopt practical steps learned from EMU to prepare for their own currency unions

ECB adds crucial tweak that could limit PEPP purchases

Hawkish governors secured wording that bond-buying allocation “need not be used in full”

ECB announces major boost to pandemic programmes

New TLTRO programme will offer banks financing at negative rates to maintain consumer lending

ECB set to boost QE purchases and extend duration of stimulus

Eurozone central bank is widely expected to increase emergency asset purchases by around €500 billion on December 10

Ingves: Riksbank must have flexibility to develop new policy tools

Governor warns inquiry into central bank “clings” to an outdated view of economics

ECB is caught in a ‘communications trap’ – Issing

Monetary policy architect says ‘close to’ 2% inflation target was never part of original plan; urges ECB to reject Fed-like average inflation targeting