Christopher Jeffery

Editor-in-chief, Central Banking Publications

Christopher Jeffery is Editor-in-chief of Central Banking Publications, which includes the Central Banking Journal, CentralBanking.com and Central Banking On Air. He has a global role and is responsible for all of Central Banking's editorial content and teams. He has more than 20 years of journalistic experience covering asset management, banking, central banking, derivatives, economics, finance, fintech, public policy and risk management. Now based in London, Chris has previously lived in both the Americas and Asia. Recent interviews include those with Ahmed Alkholifey, Agustín Carstens, Mark Carney, Stanley Fisher, Stefan Ingves, Stephen Poloz, Raghuram Rajan, Robert Schiller, Christopher Sims, Ignazio Visco and Zhou Xiaochuan. Chris is Co-founder of the Central Banking Benchmarking Service and Founder of the Central Banking Awards. Chris was previously Editor of Asia Risk and Deputy Editor of Risk.net.

Follow Christopher

Articles by Christopher Jeffery

Raghuram Rajan on the dangers of asset prices, policy spillovers and finance in India

Raghuram Rajan, governor of the Reserve Bank of India, speaks about the challenges facing emerging market central banks, spillovers and getting to know India’s new prime minister Narendra Modi.

Open economy helps Chile brush aside Fed taper, says CBC's Vial

Sound macro-economic principles, an independent central bank and fiscal discipline rules help Chile to ride effects of Fed taper; China slowdown is a bigger risk

Sanusi: untainted by oil

Sanusi Lamido Sanusi’s aggressive reform agenda and efforts to defy powerful vested interests in Nigeria have secured a positive legacy despite bringing politics to the central bank.

Amando Tetangco on central bank policy, fund flows and financial inclusion

Central Bank of the Philippines governor tells Christopher Jeffery the country is well prepared for policy changes at major central banks and calls for more research on role of financial inclusion

Banque de France's Christian Noyer on bank runs, the euro crisis and a Fed-like ECB

Christian Noyer explains how he has restructured the Banque de France to enable it to become the Eurosystem’s ‘New York Fed’, while facing down a bank run and tackling the euro crisis

Central Bank of Oman's Hamood Sangour Al Zadjali on the dollar, financial stability and Islamic finance

The Central Bank of Oman remains committed to the dollar as it moves to improve governance, liquidity management and Islamic finance in the sultanate, its executive president tells Chris Jeffery

African central banks need to brace for Fed tapering, says Ghana's Opata

African central banks should consider raising FX reserves to cover potential reserves losses and stress in domestic fixed income markets from Fed tapering, says Bank of Ghana official

Sarb official warns about use of Aussie investments as a proxy for China

Australian and Chinese markets are 'vastly different', so investing in Australia as a proxy for China could be risky, South African Reserve Bank risk manager warns delegates at Nalm Africa 2013

Deploying ‘leapfrog' tech in Africa is no easy task, finds CBP Forum

Delegates and speakers debate technology outsourcing, data, staffing, project management and international co-operation at inaugural Central Banking Technology Forum

Central bankers face tough monetary policy dilemmas

Central bankers around the world need to rethink their approaches to monetary policy

OECD’s William White fears global economic system is still highly unstable

William White tells Christopher Jeffery he is wary of placing too much reliance on the ‘science’ of monetary or regulatory policy. He also believes the world economic system is still out of balance

GCC states need to jettison ‘destabilising' US-dollar pegs, says Qatar's Al Khater

Oil-rich Gulf states should peg currencies to crawling trade-weighted baskets as US demand becomes less of a factor in driving oil prices, says Qatari central banker

Central Bank of UAE set to bolster ‘under-developed' local bond market

UAE has looked to economies with strong trade balances as role-models to help develop a domestic bond market; may issue government debt in the coming years

Carney defends Bank of England’s forward guidance

Bank of England governor defends use of state-contingent forward guidance despite bond market reaction; concern rises about mixed policy message

Central Bank of Peru’s Julio Velarde on the impact of Fed tapering

Peru is more insulated against shocks to its financial system than in the past but managing uncertainty has never been tougher, Central Bank of Peru governor Julio Velarde, tells Christopher Jeffery

Nalm Asia 2013: Central banks should to look to ‘complexity science' to model economic systems

Central banks need to rethink their approaches to modelling financial markets if they want to deploy better predictive models in the future, according to speakers at Nalm Asia 2013

Nalm Asia 2013: Asia ‘not shaken' by QE exit talk, says the Philippines' Tuano-Amador

A combination of macroeconomic and macro-prudential tools should enable policy-makers in Asia to deal with large fund flows linked to an end of quantitative easing, says Philippines assistant governor

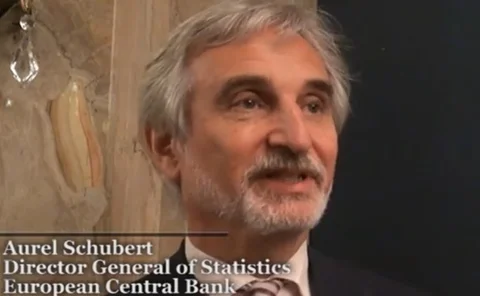

Central bank statistics departments facing multiple strains, says ECB’s Schubert

Meeting new monetary, micro-prudential and macro-prudential data requirements is a major burden for central bank statistics departments, says ECB statistics head Aurel Schubert

Chinese banks may face shadow finance credit crisis, say rating agencies

Strong links between the regulated and unregulated credit sectors in China due to the use of wealth management products and lending to shadow banks pose a systemic threat to Chinese banks

Carney's Bank of England should seek closer ties with ECB, says MEP Bowles

Sharon Bowles will raise issue of European co-operation at her first meeting with Mark Carney - saying it is even more of a priority now Paul Tucker is leaving

Bowles: Give ECB its ‘smoke and mirrors'

ECB's chief inquisitor says central banks must retain 'a certain amount of mystery' to keep fiat monetary systems going; interaction between ECB's monetary and supervisory arms will be 'difficult'

Fischer gives high marks to Bernanke and Draghi

Outgoing Bank of Israel governor Stanley Fischer believes the world owes a great debt to Fed chairman Ben Bernanke and praises ECB president Mario Draghi; says Israel can live with side effects of QE

Bank of Israel’s outgoing chief, Stanley Fischer, on the challenges of central banking

Stanley Fischer believes his work as governor of the Bank of Israel is done. He tells Chris Jeffery about the reform process in Israel as well as the challenges facing the world economy and the IMF