Central Banking staff

Follow Central Banking

Articles by Central Banking staff

The Central Banking Awards 2020 virtual ceremony

View the trophy presentations and acceptance comments from all the winners recognised in the seventh annual Central Banking Awards

European central banks remain leaders for gold

Average gold holdings on the continent stand at 10.6 million ounces

Advanced economy central banks use more custodians

Reserve managers in advanced economies work on average with 5.6 custodians

One third of reserves staff work in front-office roles

Average reserve management team size is less than 30 employees

Advanced economies take the lead in securities lending

Nearly 60% of reserve managers lend out assets that are in high demand

Boards are the main authority for benchmark approvals

Risk management teams tend to lead effort to propose new benchmarks

Lower-income countries generate highest reserves growth

Most reserves portfolios appear to have weathered the Covid-19 crisis well

Few central banks consider climate risk within benchmarks

Despite central banks supporting mandatory climate risk disclosures, very few account for it in their benchmarks

Asia tops rankings for reserves coverage ratios

Asia leads across three main metrics, but the region may be moderating its holdings

Europe leads on reserve manager salaries

Central banks pay a wide range of salaries to their reserve managers

Many Paris Agreement signatories do not use ESG screens

Most reserve managers fail to take environmental factors into account for FX portfolios

Emerging markets act as standard bearers for tranching

Nearly two-thirds of reserve managers tranche; largest allocations made to investment tranche

Lower-income nations invest more with external managers

Third-party institutions offer staff training and new asset class investments

Collateral posting spreads among swaps users

Following the Bank of England’s example, most derivatives users now have two-way CSAs

Some large reserve managers eschew liquidity stress tests

Majority of central banks test for thin trading, but three in 10 larger managers do not

Sarb to buy government bonds

South African central bank also broadens refinancing operations to boost liquidity

Major economies already engaging in ‘currency wars’ – former IMF chief

De Larosière floats new commodity-based exchange rate regime; says “trust” is key to avoiding “beggar-thy-neighbour” policies

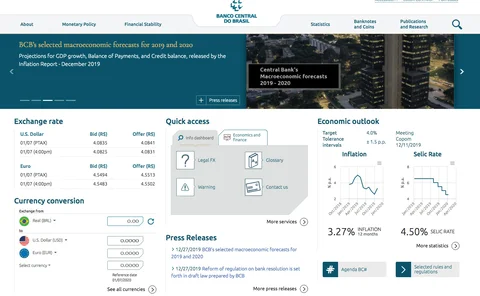

Website of the year: Central Bank of Brazil

The new bilingual site offers enhanced communications to the full range of stakeholders

Global markets award: HSBC

The UK-headquartered bank is a leader in green finance and helped its clients navigate the low-rate environment over the past year

Collateral management services: National Bank of Georgia/Montran

The duo developed Georgia’s fully automated new collateral framework

Communications initiative: Bank of Jamaica

The Bank of Jamaica broke the mould with its reggae-inspired communications strategy, but observers suggest it has done more than just lift the economic literacy of its society

Transparency: Reserve Bank of New Zealand

Publication of new MPC handbook and minutes increases RBNZ’s openness

Specialised lending initiative: BNP Paribas

A new ‘global’ setup helped secure US dollar-denominated assets from a Eurosystem central bank

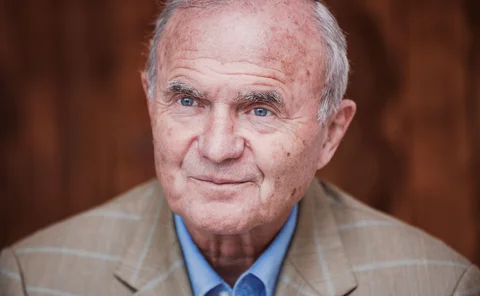

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy