Risk

FSB unveils latest G-Sib list

One bank joins and two drop off the 2018 tally

Brainard: Fed keeping open mind on AI regulation

Some rules already apply to AI tools, but Fed “still learning” about AI’s impact

The EU tries to rethink its faltering AML regime

The European Union plans to centralise its anti-money laundering efforts following a series of scandals this year. Dan Hardie looks at the options available and the multitude of challenges that remain

Podcast: Are women better risk managers?

Rachael King speaks with senior portfolio manager Vaithegi Naidu to find out why women are attracted to reserve management

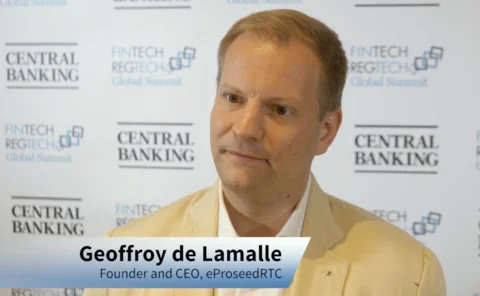

Video Q&A: Geoffroy de Lamalle, eProseedRTC

Central Banking spoke to Geoffroy de Lamalle, founder and chief executive at eProseedRTC, at the FinTech and RegTech Global Summit in Singapore

Financial regulation reform must not stop, Olli Rehn tells IMF

Foreign-denominated lending may threaten emerging markets, Finnish governor warns

Mexico’s Guzmán worried about protectionism

Difficult to understand why given the experience during the Great Depression, the governor said

BoE to demand senior financiers tackle climate risks

Proposals from PRA would hold senior managers accountable for climate change risks, and capital surcharges may follow

Central Bank of Ireland details updated financial buffers framework

Central bank incorporates risk simulation over five-year horizon

Asia outlook positive despite growing risks, IMF reports

Sound policymaking should protect Asia’s prospects for staying at the forefront of global growth, IMF says

Volatility in equities may soon influence Fed policy, says Moody’s economist

US equity sell-off may be due to Fed policy, says John Lonski

ECB board weighs external risks in policy meeting

Risks in growth outlook “broadly balanced”, ECB reports

Macro-prudential forex rules may shift vulnerability – BoE paper

Study of forex rules finds they may succeed in their primary goal, but shift risks elsewhere

IMF reports growing global financial risks

Supervisors must remain vigilant on risks developing in new areas, IMF says

Fed aims for real-time interbank settlement of faster payments

Brainard points to “growing gap” in US transaction capabilities

Political instability main risk for Brazilian banks – central bank

Financial system has expanded credit without increasing risk, Central Bank of Brazil says

Supervisory lessons: fault lines in prudential regulation

Former Bank of Spain head of supervision Aristóbulo de Juan highlights the lessons he has learnt about weaknesses in prudential regulation, in the second of a four-part series on supervision

‘Momentum building’ behind financial response to climate change

FSB welcomes progress on disclosures; BoE report finds many UK banks are facing up to the risks

Sub-Saharan Africa increasingly exposed to debt risks

Public sector borrowing and tighter financial conditions a challenge for regional reserve managers

RBNZ looking to make balance sheet ‘more resilient’ – Perry

RBNZ prepares for Libor transition with liquidity concerns on the horizon

Market power can explain financial market anomalies – BIS paper

Market power of intermediaries can explain behaviour of risk premiums, authors find

Market power, intangibles and risk premia behind low risk-free rates – paper

Brookings paper questions savings glut and technological slowdown hypotheses

Riksbank focused on falling krona, weak inflation and instability – minutes

Executive board said it intends to increase rates by 25 basis points in December or February

IMF warns low-income countries about higher debt risks

Increased exposure to non-traditional lenders could increase rates and shorten maturities