Euro

Danish central bank conducts $670 million FX intervention

Danish central bank conducts largest intervention in FX market since June 2016; analysts say demand for krone will continue, but interest rate hike is unlikely

Cash is here to stay – SNB’s Zurbrügg

SNB official says reports of cash’s “death” are “exaggerated”; central bank has no plans to stop printing banknotes as its popularity remains

Bank of Italy paper looks at impact of monetary policy shocks

The impacts of eurozone and US shocks have diverged since the onset of the financial crisis, the working paper says

ECB reports 20.7% drop in number of counterfeits

Number of counterfeits ticked up in the second half of 2016, but annual figures are down; €50 note still dominates in terms of counterfeit volume, with new note to be released in April

New data sheds light on policy spillover channels – BIS paper

Expanded data published by the BIS show how US dollar, euro and yen affect cross-border lending flows

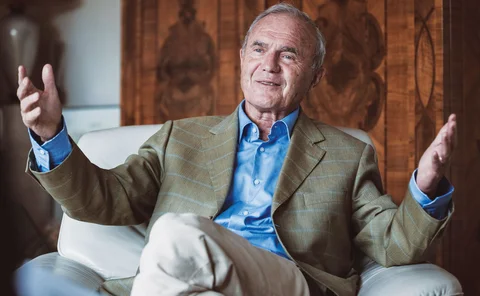

Hans Tietmeyer and his ‘mission’ for euro stability

Otmar Issing on how the former Bundesbank president helped to drive Germany’s social market economy and was instrumental in the stable introduction of the euro

Hans Tietmeyer, 1931-2016

Former Bundesbank president played key roles in German reunification, European single currency and reform of international financial regulation

African central banks have cut euro exposures, says Uganda’s Kavuma

Combination of negative interest rates and falling reserves hit euro holdings but most central banks still avoid investments within Africa

Czech Republic closer to euro adoption but still not ready – CNB

Economy is converging with Europe but costly accession to single supervisory mechanism means country is not ready to begin formal process, CNB says

Researcher uses dynamic factor model for ‘nowcasting’

Research makes three additions to widely-used model

Spanish paper looks at eurozone inflation expectations

Pan-eurozone factors are more important than country-specific forces, paper says

Eurozone reform projects are not delivering, French governor says

“Investment crunch” is biggest problem, not savings glut, Villeroy de Galhau says

Ignazio Visco on Italian banks and why the ECB should not be made a ‘scapegoat’ for EMU fatigue

The Bank of Italy governor speaks to Chris Jeffery about resolving Italy’s NPLs, Europe’s bail-in framework, the importance of QE and why the ECB needs to stop being made a ‘scapegoat’ for EMU fatigue

Serbian central bank report indicates slow progress on reversing ‘euroisation’

Most loans and deposits in the country are still denominated in foreign currency, National Bank of Serbia report shows

No ‘insidious’ German plan for EMU competitive advantage, says Issing

Otmar Issing says Germany didn't even have 'the economic intelligence' to design such a plan; country suffered years of high unemployment as others such as Italy failed to capitalise on price stability

Euro architect says ECB has ‘destroyed’ market discipline in Europe

Otmar Issing, the man who designed the operational framework for the euro, says failures by European politicians and the ECB mean “all the elements” are in place to bring “disaster” to the monetary union

Mervyn King on Brexit, crisis supervision, economic rebalancing and reforming the IMF

The former Bank of England governor discusses Brexit, radical regulatory reform, the difficulties rebalancing the European and global economies and an overhaul of the International Monetary Fund

Book notes: The euro and the battle of ideas, by Markus K Brunnermeier, Harold James and Jean-Pierre Landau

The authors have produced a fascinating and informative book that offers suggestions on how differences in beliefs can be overcome

Money market interactions can explain behaviour of interest rate spreads, researchers argue

Paper analyses the interplay of unsecured and collateralised money markets; information obtained “can explain behaviour of interest rate spreads”, authors say

Co-operation: The competitive edge against counterfeiting

A collaborative approach to banknote projects with trustworthy partners frees up time and resources, pools and mitigates risk, and helps to fulfil the most demanding expectations from stakeholders and the public. Most importantly, it decisively stiffens…

ECB data reveals changes in eurozone wage rigidity

ECB publishes its third survey of wage dynamics in the eurozone; it argues data is “crucial” to designing monetary and other macroeconomic policies

IMF changes method for calculating SDR currency amounts

IMF will switch to new SDR basket in October, including renminbi for the first time; calculation will use new rounding methodology aimed at minimising deviation from weightings

ECB publishes guide to its macroeconomic projections

European Central Bank publishes guide to how its staff research and publish their regular projections for the eurozone economy; gives details of models and tools used

Dombret warns clearing and securities depository business may leave London

Bundesbank’s Andreas Dombret said London’s pull as a venue for euro trading would “shrivel” if the UK voted to leave the EU; warned EBA would need to find “new home”