Basel Committee on Banking Supervision

Book notes: The Right Balance for Banks, by William Cline

An interesting analysis of optimal capital requirements for G-Sibs, examining whether Basel III requirements will be enough to stem another financial crisis

Basel Committee in ‘last few metres’ of post-crisis marathon

Secretary-general says it would be unwise to quit with the finish line so close, but adds the committee won’t be running another marathon for a while

Capital rules may be too risk-sensitive, Basel fears

Complexity is slowing the roll-out of standards, says Basel Committee deputy

Q&A: Asia’s caught in the Basel crossfire – Andrew Sheng

Veteran regulator says international standards may be the wrong medicine for emerging markets

Basel Committee offers guide to fintech revolution

Document offers guidelines to supervisors grappling with rapid innovation, and imagines some of the repercussions of a world without traditional banks

EBA study quantifies impact of IFRS 9

Report finds smaller banks are likely to see a heavier capital impact from new accounting rules; Basel Committee paper says a mix of forward- and backward-looking rules may work best

BCBS and Iosco publish draft securitisation criteria

Document focuses on “simple, transparent and comparable” asset-backed commercial paper securitisations

Basel Committee flags shortfalls in implementation

European Union is yet to fully comply with the liquidity coverage ratio, while many jurisdictions are lagging behind in other areas

Yellen urges caution on regulatory adjustments

Janet Yellen and Mark Carney say the US could adjust its banking regulations without undermining global standards; Basel’s Coen stresses need for co-operation

BIS’s Coen warns of danger in delays as output floors remain stuck

Long phase-in periods increase risk of “dilution or backtracking”, says BCBS secretary-general; remains vague on timetable for Basel III completion

Research finds ways to tame FRTB’s biases in forex charges

New paper shows ways to reduce influence of reporting currency

Basel Committee outlines enhanced disclosure framework

Revised Pillar 3 standard adds “dashboard” of banks’ key prudential metrics and consolidates all existing Basel Committee disclosure requirements

Basel Committee to retain provisioning treatment as IFRS 9 launches

Committee admits differences across countries are likely to remain in the interim, while it works to design a new approach to the regulatory treatment of expected credit losses

Basel action needed before ‘regulatory cycle’ turns

Failure to reach a deal raises the risk of more entrenched protectionist positions

Basel capital surcharges are too low – Fed paper

Authors argue current Basel standards are not enough to guard against the failure of a global bank, particularly those reliant on short-term funding

Basel III has aided system stability, interbank models suggest

Model predicts future crashes will not be total wipeout

Basel capital floors are necessary – Riksbank’s af Jochnick

Internal models have led to doubts over true capital adequacy, Riksbank deputy says, so floors have an important role to play

Basel set to decide on capital relief for accounting changes

Phase-in to IFRS 9 and Cecl needed to avert "a dramatic overnight drop in regulatory capital", say auditors

Basel III completion date pushed back

Governors and heads of supervision to delay meeting that would have given final approval to Basel III, as disagreement continues on output floors

French governor sees outlines of possible Basel III deal

Internal models will still regulate some portfolios, governor predicts; output floors still a matter for “debate”

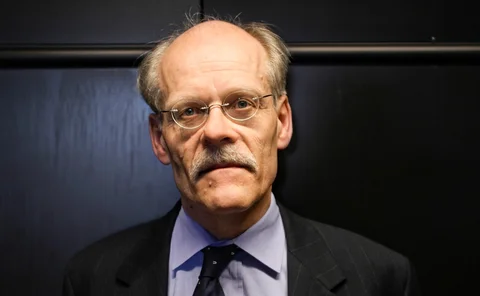

Ingves: internal modelling may create too much complexity

Basel Committee chair says complexity created by internal modelling has a range of adverse effects, though more research is needed

Deal on output floors and op risk approach likely – Ingves

Revised standardised approach to credit risk will be “capital neutral” and more compatible with IRB

Bundesbank board member takes hard line on Basel negotiations

German central bank “not prepared to reach an agreement at any price”; calls for no universal output floors and abandonment of advanced approach for op risk

Big data in central banking: 2016 survey

Results and analysis of a survey examining how central banks view big data and data governance in their institutions