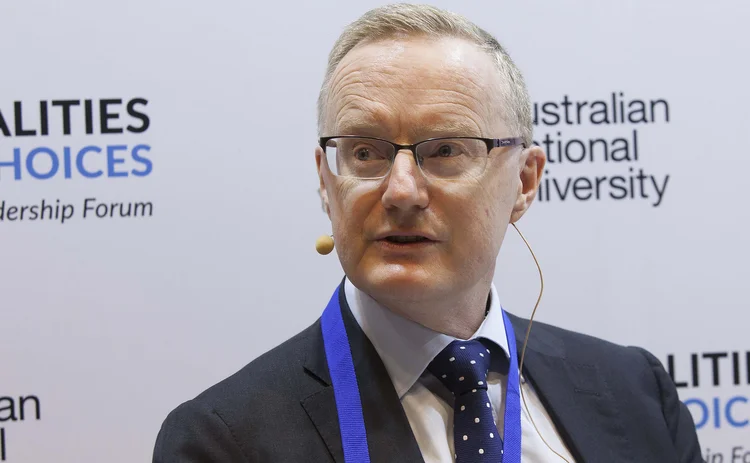

Too early to declare victory over inflation, says RBA’s Lowe

Outgoing governor warns sticky services inflation could shift Australians’ expectations

The Reserve Bank of Australia’s outgoing governor, Philip Lowe, said it has made progress in taming inflation but may have to tighten monetary policy further.

“We have made progress here and things are moving in the right direction, but it is too early to declare victory,” Lowe said at his last appearance in parliament as governor.

Lowe will be presiding over his last monetary policy meeting on September 5. He has been the RBA governor since September 2016. His successor, current deputy

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com test test test

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com test test test