Creating trust in money in a data economy

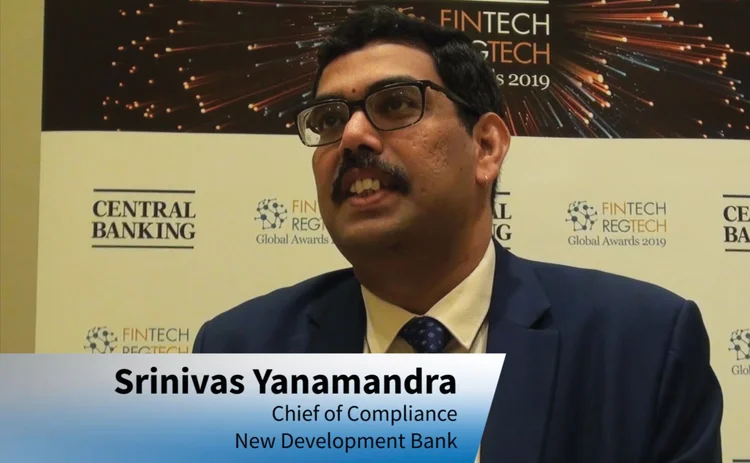

NDB’s compliance chief speaks about new approaches to regulation

Central banks and supervisors need to adopt new approaches to oversight to ensure the public’s future trust in money, as the monetary system transitions towards data and away from finance, says Srinivas Yanamandra, chief of compliance at China’s New Development Bank.

This involves establishing what Yanamandra terms “fintecgrity” in core data-economy areas such as digital currencies, distributed ledgers and deep-learning algorithms.

“Fintecgrity” involves regulators ensuring technology

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com