Shifting to globalisation 4.0

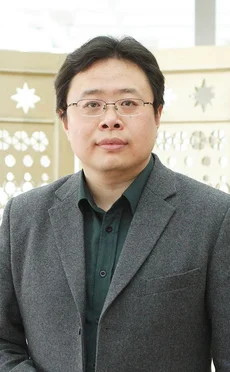

Each new wave of globalisation has been preceded by crisis and a belief that globalisation is foundering. The fourth wave, characterised by radical digital progress, is no different, writes Shao Yu, chief economist at Orient Securities

Last year marked the 10th anniversary of the subprime mortgage crisis in 2007 and the 20th anniversary of the Southeast Asian financial crisis. It would be useful to take stock and review the course of this decade of crisis, and the anti-crisis measures that were utilised in response.

Turmoil in the US subprime mortgage market spread crisis through major global financial markets – the US, the European Union and Japan – in August 2007, evolving into a global crisis by September 2008. Major economies mobilised all of their resources in large-scale expansionary policies to combat this. By the end of 2009, the crisis was deemed to be over, ushering in the post-crisis era. But, at this critical moment, the Greek sovereign debt crisis erupted. This crisis intensified and swelled immediately, drawing in other European countries and eventually evolved into the European debt crisis. In August 2011, while markets were still reeling, the US debt-ceiling crisis in Congress shocked the world, in part prompting Standard & Poor’s to downgrade the country’s AAA credit rating for the first time in US history.

In response to these consecutive crises, developed countries have repeatedly resorted to quantitative easing (QE) – since the financial crisis of 2007–2008, the US Federal Reserve Board has released three rounds of QE, with assets purchased amounting to around US$3.9 trillion. The European Central Bank conducted a series of long-term refinancing operations, introduced a direct monetary transaction plan and dramatically expanded its QE policy in March 2015; the Bank of England and the Bank of Japan have significantly augmented asset purchase plans. In turn, these stimuli have triggered turbulence in international financial markets.

These crises can be traced back to the period of unbalanced globalisation prior to 2007 – globalisation 3.0. Globalisation does not maintain continual growth and prosperity; it is punctuated by stagnation, dissipation and even collapse. In modern history, there have been three waves of growth in globalisation: globalisation 1.0, the era of exploration; globalisation 2.0, the era of the UK and sterling; and globalisation 3.0, the era of the US and the US dollar. Globalisation has also manifested three major trade and economic imbalances in the real and financial economies: between China and the UK, Europe and the US, and Asia and the US. Current imbalances have been prompted by the globalisation of the US and the US dollar.

Imbalances in the global real economy are both internal and external. Internal imbalances are visible in economies seriously affected by debt crises, such as the US and the Piigs nations – Portugal, Italy, Ireland, Greece and Spain; they fail to meet their needs in the cause of pursuing deficit spending. As a result, government revenue falls below its expenditure, and private savings below consumption. In contrast, other countries – many in Asia – are working actively to save money.

External imbalances include trade deficits, such as that between the US, which runs a long-term trade deficit that has led to capital outflow, and China, which runs a trade surplus to accumulate US dollars.

The world’s financial and economic imbalances are caused by problems in the international monetary and financial system, including global and regional ‘centre-periphery’ imbalances. The global centre-periphery imbalance allows the US to capitalise on its central position in the international monetary and financial system to obtain resources at a low cost, worldwide, to sustain and magnify the imbalance in the real economy while controlling the peripheral countries.

A converse example of the regional centre-periphery imbalance is the eurozone, where the central countries – Germany and France – are controlled by the peripheral countries. Sharing the same currency and benchmark interest rate as the periphery, Germany and France shoulder more responsibility in maintaining currency stability when crises occur. The eurozone has unified the currency, but not its finances; this mechanism leads to the containment of the centre by the periphery.

Imbalance leading to overconsumption

The US subprime mortgage and debt crises are the manifestation of the imbalance between the East and the West. Developing countries – such as China, in the East – feature export-oriented economies, whereas developed countries – such as the US, in the West – are characterised by overconsumption. The European debt crisis reflects the north-south imbalance in the eurozone – the south, as represented by Greece, Spain and Portugal, are premature consumers, while the north, including countries such as Germany, are more industrious. Their cost advantage in export has remained because of minimal wage increases over the past 10 years.

These East-West and north-south imbalances have rebalanced the books for nations, enterprises, individuals and central banks. Ten years after the outbreak of the subprime mortgage crisis, a re-examination of the state of affairs indicates that financial crises are continuing to spread.

The first of these were in the US, when overleverage led to the collapse of its real-estate balance sheet. The second emergence was in Europe with the sovereign debt crisis, meaning the collapse of the national balance sheets due to high fiscal leverage. Crises may now come to emerging markets that have borrowed large amounts in reserve currencies while taking out the corresponding local currency to provide support. Once the Federal Reserve raises interest rates, this capital will frantically flow out of emerging markets and possibly provoke a currency crisis. During this process, the balance sheets of expanding central banks will eventually be called to account.

Globalisation serves as an important driving force, unifying all nations. From a global perspective, pre-crisis globalisation was unbalanced, and came about because of the growing ties between the real economy and the financial sector, which to a certain extent triggered three separate crises – the global financial crisis and the eurozone and US debt crises.

Deglobalisation

Since the global financial crisis, deglobalisation has become an increasingly prominent strand of thought. Its spread can be attributed to financial and economic crises causing trade protectionism and economic populism in some countries, enhancing isolation and leading to deglobalisation.

Deglobalisation gained most prominence in 2016 with the election of Donald Trump as US President, but its trigger can be considered the subprime mortgage crisis, and it has escalated since through the eurozone and US debt crises. An emerging anti-globalisation phenomenon is evidenced by rising trade protectionism, the declining year-on-year global trade growth, the fragile and uneven global economic recovery, partial marginalisation of multilateral trading systems, and the recent series of ‘black swan’ events. Anti-globalisation has also resulted in a slowdown in trade and investment, disrupting world economic growth and, thus, recovery.

The world is crying out for globalisation 4.0, a more sustainable, reasonable and balanced version, led by innovation, inclusiveness, shared benefits and tolerance. Lessons from the pre-crisis unbalanced globalisation and post-crisis deglobalisation will be learned – globalisation 4.0 aims to enhance the voice, influence and rulemaking power of emerging and developing countries in the real economy and financial sector worldwide to reverse past imbalances. It also requires all nations to participate in a global division of labour and co-operate in a more open and inclusive manner, rather than pursuing deglobalisation driven by protectionism. China has drawn its lessons from the old order and repeatedly emphasised openness and inclusiveness in the economy from top to bottom. Rather than shaping a parallel hegemonic structure, globalisation 4.0 intends to correct the flaws inherent in globalisation 3.0 that allowed the dominance and wealth superiority of the great economic powers to hinder the optimisation and evolution of the global governance structure. Globalisation 4.0 should be inspired by China’s own reform that prioritises frontier and incremental stock.

Yet, as geopolitical frictions become more frequent, epitomised by the Trump administration’s protectionist policies and Brexit – Britain’s decision in 2016 to withdraw from the EU – there is a disturbing sense that the opportunities thrown up by the global financial crisis were almost certainly wasted. Apart from injecting more liquidity into the economy, progress has been otherwise limited. The world is currently experiencing three highs and three lows: high central-bank balance sheets, high debt or leverage in the real economy and a record high in risky asset prices, and low volatility, low inflation and low growth and trade levels.

The past decade has witnessed probably the most significant period of deception in currency history. Price inflation of core assets and the widening global wealth divide highlight this. The so-called macroprudential policy, or efforts to reduce the level of macro leverage, may seem progressive, but a closer look at the macro leverage of large economies reveals that few are actually under control.

Where are the modern theoretical innovators? Every previous major financial crisis has provoked intellectual breakthroughs by major figures such as Karl Marx, John Maynard Keynes and Milton Friedman. Now we see an ugly and noisy battle with nationalism and populism on the sidelines; liquidity may be abundant, but insight is clearly meagre – this is the sharpest contrast of the modern age.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com test test test

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com test test test