Managing the tides: the dynamic history and future challenges of Korea’s foreign reserve diversification

Min Soo Kwon

Executive summary

Trends in reserve management: 2024 survey results

RMB – internationalisation is not over

Managing the tides: the dynamic history and future challenges of Korea’s foreign reserve diversification

Interview: Jonas Stulz

Reserve management at the National Bank of Slovakia

The NBP’s gold purchases – a view from the risk management trenches

Appendix 1: Survey questionnaire

Appendix 2: Survey responses and comments

Appendix 3: Reserve statistics

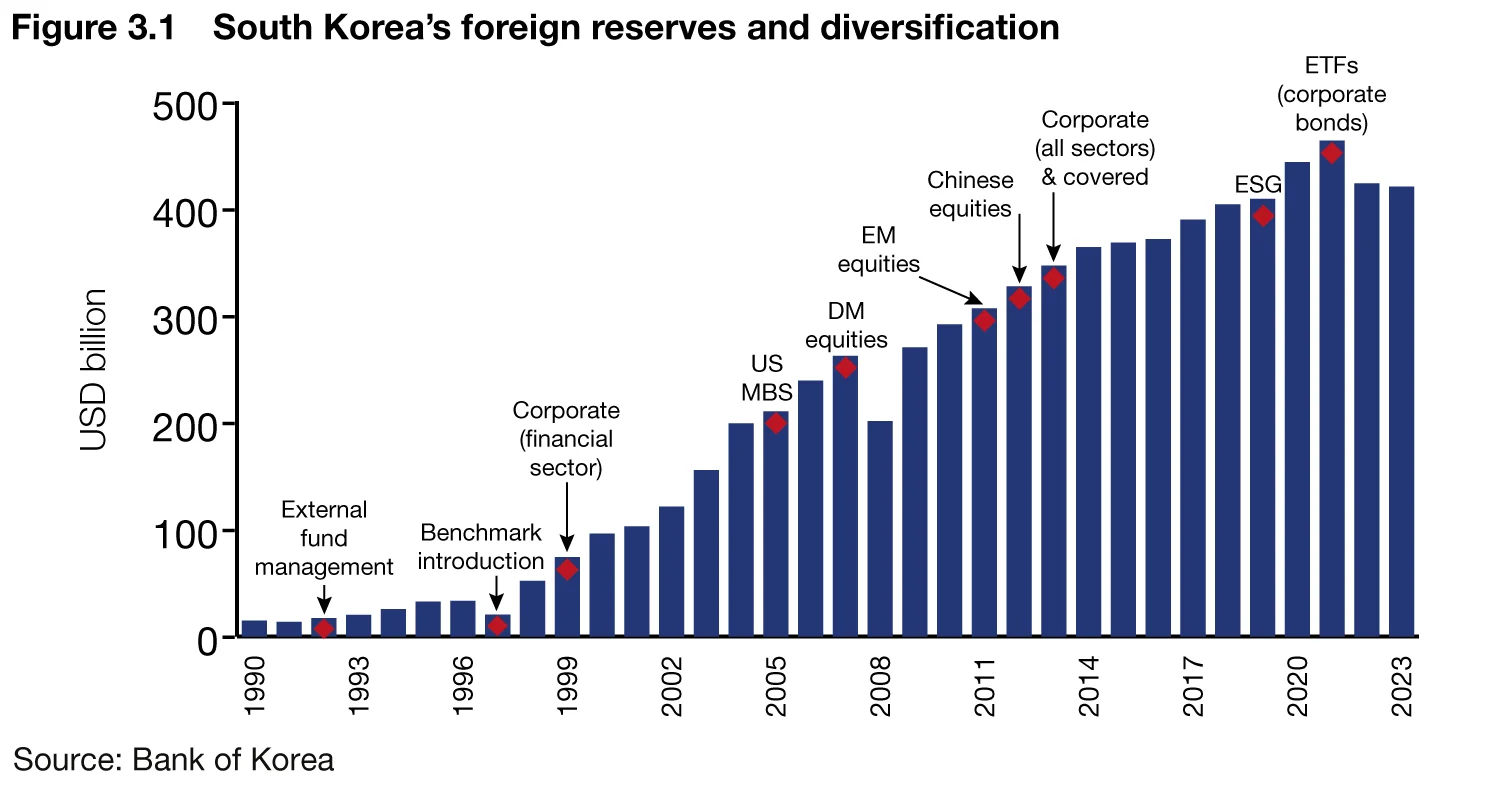

The Bank of Korea (BoK) manages the ninth-largest foreign reserves in the world. By the end of 2023, South Korea’s foreign reserves had surpassed $400 billion, a significant accomplishment credited to the rapid growth of the Korean economy. As our foreign reserves are a product of our foreign exchange policy aimed at stabilising the foreign exchange market, it is of utmost importance that their value be safely preserved and kept liquid at all times. This ensures that the nation can respond to external payment needs in a sufficient and timely manner under unstable market conditions. In addition, given that foreign reserves are a part of ‘sovereign wealth’, it is imperative to seek optimal investment strategies to increase their value. The BoK is confident that it has successfully achieved the three objectives of safety, liquidity and profitability over the past decades of foreign reserve management. The central bank attributes this success to its proactive and robust efforts at diversifying its foreign reserves, which are second to none among central banks.

In the following sections, I will explore the background behind the BoK’s diversification efforts, delve into the history of diversification in terms of products, currencies and strategies, and assess the effects of diversification from various perspectives. Finally, I will discuss future challenges that the BoK faces in designing a future blueprint for foreign reserve management.

Background and history of diversification: changes in recognition of foreign reserves

Prior to the 1997 Asian financial crisis, the BoK, like other emerging-market central banks, focused on the function of foreign reserves as ‘minimum emergency funds for crisis response’. Since that crisis, the importance of foreign reserves has been rediscovered, and maintaining sufficient foreign reserves has emerged as one of the major policy objectives for the Korean economy. The economy rebounded rapidly from the crisis with improved economic fundamentals and with a current account surplus, following International Monetary Fund structural reforms, and foreign reserves, which had fallen to $3.9 billion, reached $100 billion by September 2001. As the reserves reached a level that allowed the country to recover from the trauma of the crisis, the BoK naturally faced a new challenge: diversifying the investment of its reserves. The BoK thus began to take on a new role as an ‘asset manager’, rather than just as a ‘monetary authority’ that manages emergency funds for use in times of crisis. Since then, the BoK has continued to diversify its investments in various ways to adapt to the changing economic landscape, based on the fundamental principle of enhancing long-term profitability through diversification.

Evolution of investment diversification

The journey of the BoK’s investment diversification can be divided into three periods, the first of which was the period from the aftermath of the 1997 crisis to the mid-2000s (1998–2004). This period can be characterised as the ‘beginning of diversification based on fundamentals’. At that time, the twin deficits in the US raised concerns about the long-term sustainability of the US Treasury market. As the Federal Reserve lowered its interest rates, which led to a significant drop1 in market interest rates, global public investors started to reconsider their investment practices in dollar-denominated safe assets, and the BoK was no exception. On the domestic front, the current account surpluses that have been recorded every year since 1998 have reduced the burden of having to respond to emergency foreign exchange needs, providing the BoK with greater flexibility to invest its foreign reserves more efficiently. In response to these macroeconomic changes, the BoK began to gradually expand its investment portfolio by investing in new financial products and by diversifying into new currencies.

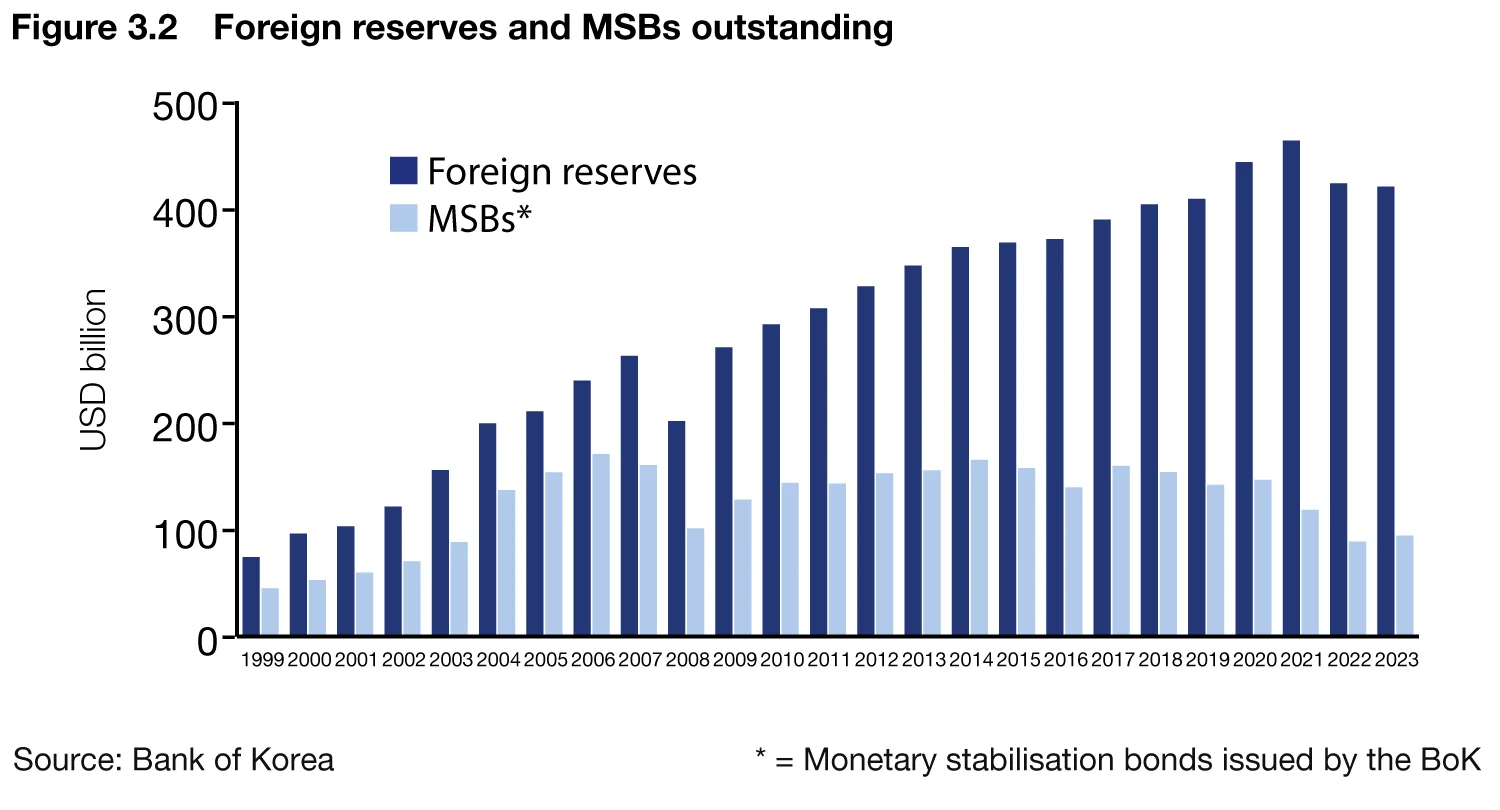

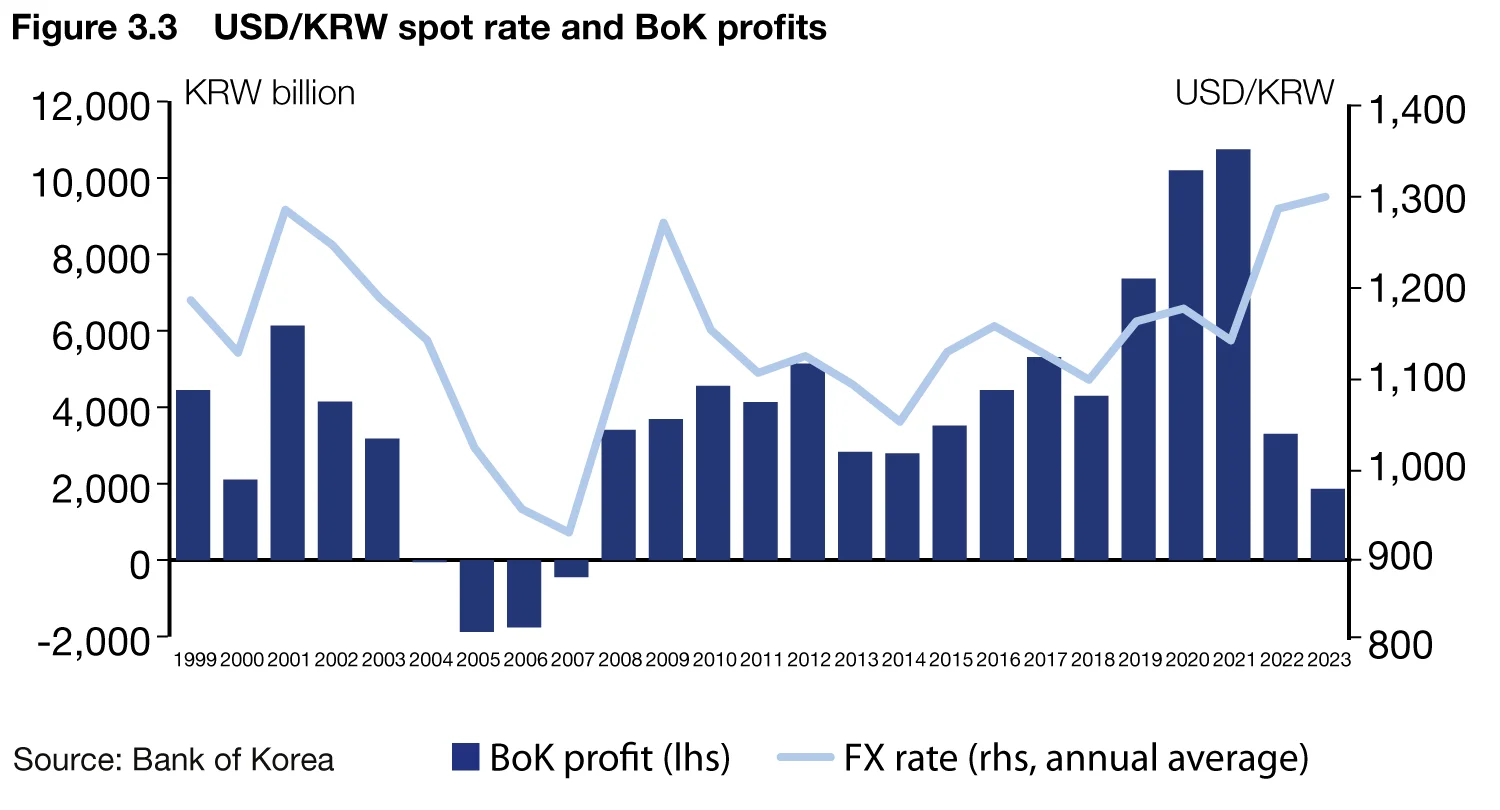

The second period was from the mid-2000s to the global financial crisis (2004–08). The central bank’s unusual deficit during the period underscored the challenges in balance sheet management, prompting a new perspective on investment diversification. The BoK posted accounting deficits for four consecutive years, from 2004 to 2007, resulting from a decline in investment gains, as the Korean won appreciated, and from a widening of the domestic and foreign interest rate differentials.2 The increase in foreign reserves led to a simultaneous increase in the central bank’s domestic liability through a sterilisation policy. However, Korea was facing a situation where the returns from the asset side’s US Treasury bonds were no longer sufficient to cover the cost of Korean won financing on the liability side. Thus, diversification during this period was implicitly driven by both asset and liability considerations, as opposed to the explicit asset-only considerations of the previous period.

The third phase of diversification spans the aftermath of the financial crisis to the present (2009–2024). During this period, Korea witnessed a surge in foreign reserves alongside the private sector’s accumulation of external assets. Foreign reserves, which were significantly depleted because of the crisis response in 2008, had declined to $200.5 billion by November. However, they rebounded, surpassing $300 billion in April 2011, driven by global liquidity expansion resulting from major countries’ quantitative easing measures. Moreover, since 2012, Korea has been running large current account surpluses,3 which significantly contributed to foreign reserves surpassing $400 billion in June 2018. This number has given the BoK confidence that its foreign reserves were sufficient for crisis response, while also providing a buffer for the BoK to pursue a more aggressive investment diversification strategy. In fact, the BoK was able to respond appropriately to the interest rate spike and the stock price decline in 2022 by maintaining sufficient liquidity while still expanding investment diversification. In addition, the absence of a severe financial crisis before Covid-19 and stronger macroeconomic fundamentals than before also contributed to the strengthening of the role of foreign reserves from a sovereign wealth perspective.

History of diversification across products, currencies and methodologies

In the 1990s, the BoK’s foreign reserve management was primarily focused on cashflow management. Accordingly, the majority of foreign assets were invested in US dollar-denominated term deposits and government bonds of major countries. However, even during this period, the BoK attempted a basic level of diversification into mainly US agency bonds and corporate bonds in the financial sector.

In the 2000s, the BoK began to diversify its product mix in earnest. In particular, as issues occurred such as downward pressure on the BoK’s accounting profits from 2004 to 2007, the BoK significantly increased the size and proportion of its mortgage-backed securities (internally invested in 2005) and corporate bonds, to secure profitability. In addition, in 2007, the BoK began investing in equities, which was not common among central banks at that time.

In the 2010s, as the diversification of the product mix matured, opportunities for new investment products were limited, leading to the search for new investment opportunities within existing asset classes. In 2013, in addition to the financial sector, the BoK started investing in non-financial corporate bonds and in European covered bonds. Recently, corporate bond exchange-traded funds have been added to facilitate agile tactical positioning.

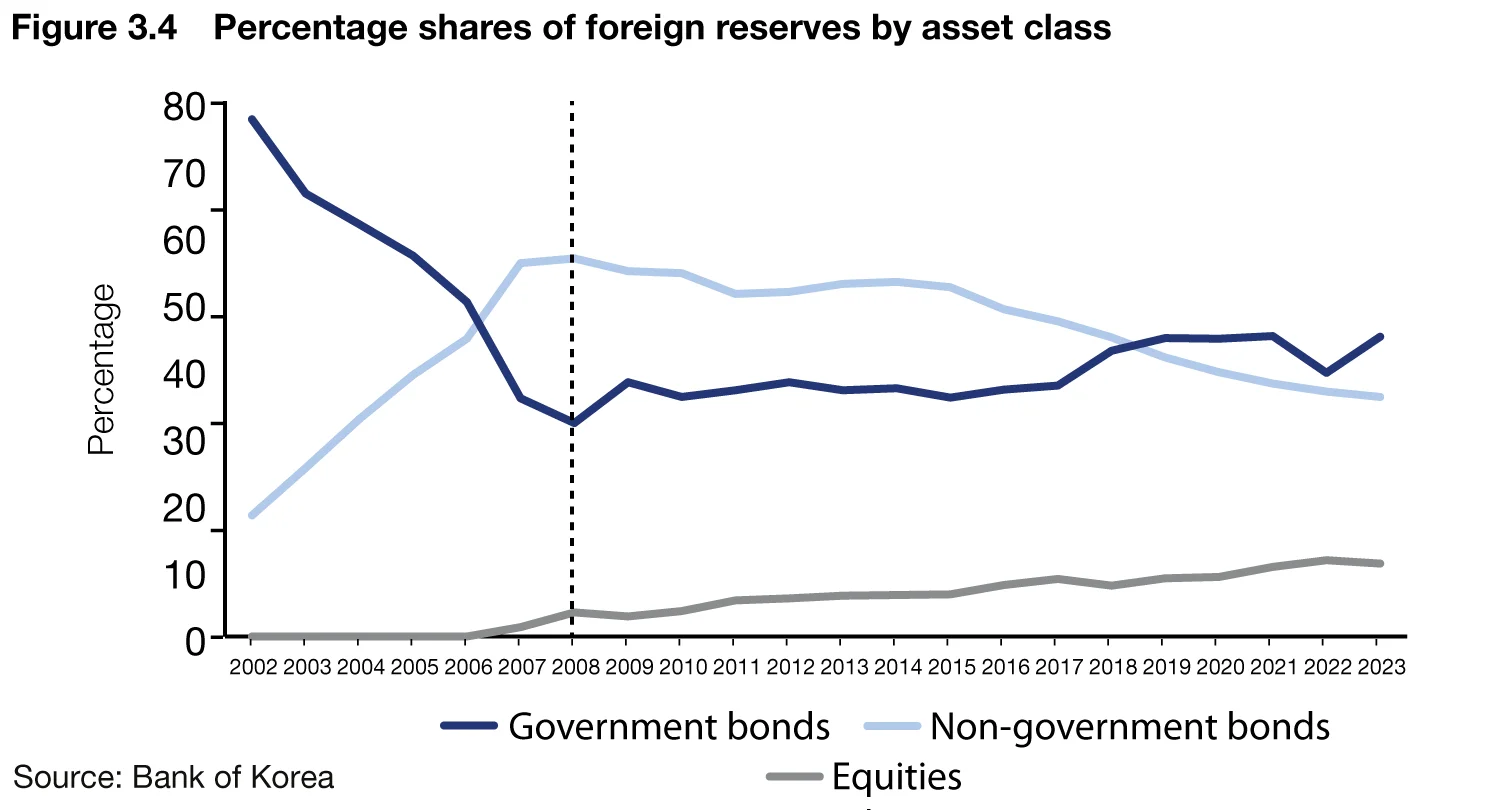

Examining the change in product composition from a longer-term perspective, prior to the global financial crisis in 2008, the proportion of government bonds had decreased, while the proportion of corporate bonds and asset-backed securities had increased. As a result, the proportion of government bonds decreased from nearly 80% in the early 2000s to the low 30% range in 2008, while the proportion of non-government bonds tripled to about 60% during this period. However, after the global financial crisis, as the BoK strengthened its risk management, the BoK gradually increased the proportion of government bonds once again, leading to a decrease in the proportion of risky assets. At the same time, within risky assets, the BoK has increased its allocation to equities, to ensure that this rebalancing does not reduce overall returns. Consequently, the allocation to government bonds has recently been maintained at around 40%, while the allocation to equities has steadily increased to the low 10% range.

Diversification of currencies

The degree of diversification in currencies is limited compared with that of the products, reflecting the usage of currencies in Korea’s external trade and finance as well as the status of major currencies in the international financial markets.

In the early stages of its investment diversification, the foreign reserves of the BoK primarily included eligible Group of Four currencies (the US dollar, the euro, the yen and sterling). Subsequently, in the mid-2000s, the BoK expanded its range of eligible currencies to encompass both Canadian and Australian dollars. This coincided with the BoK’s attempts to diversify its investments in order to enhance returns in response to the BoK’s accounting deficit at that time. In 2012, the BoK began investing in the yuan in light of China’s growth potential, high interest rates compared with developed economies, as well as its economic links with Korea.

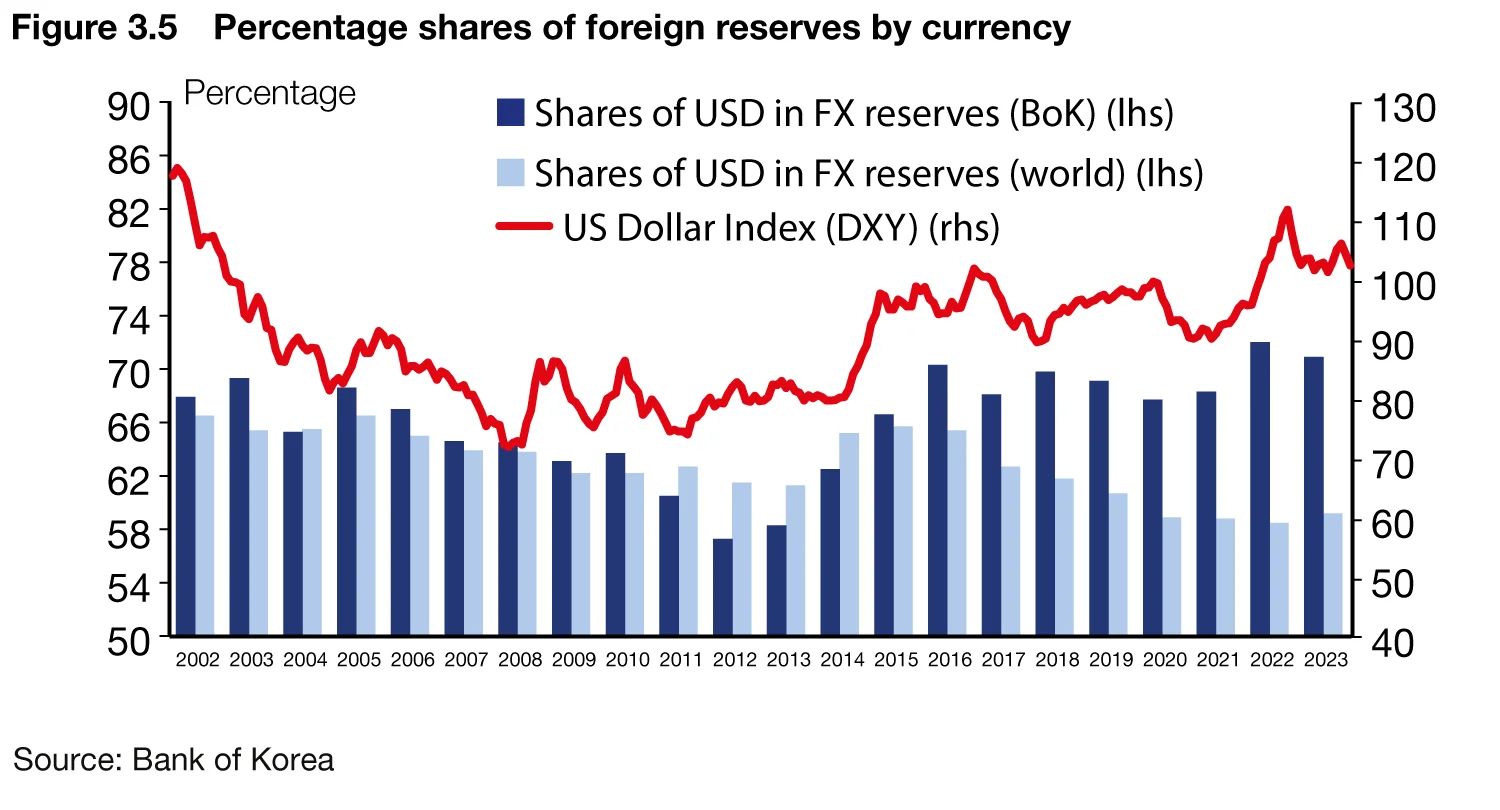

Looking at the long-term investment trend by currency, the proportion of US dollar investments declined significantly in the early 2000s due to concerns about the US economic slowdown. By 2012, the share of US dollar investments among the BoK’s foreign reserves had dropped to below 60% with the inclusion of yuan investments. Subsequently, from 2014 onwards, the BoK increased its US dollar allocation back to the 70% range, driven by the general strengthening of the dollar influenced by differentiated monetary policies, interest rates, economic growth among developed economies and other factors. In this manner, the BoK has adjusted its currency allocation, based on its own currency composition model and market forecasts, to minimise foreign exchange risk.

Diversification of strategies via external funds

The BoK has actively used external funds managers to pursue diversification. In 1992, the BoK began managing a portion of its foreign reserves through external funds managed by renowned global asset management firms. Since then, it has diversified its external funds from being mainly focused on government bonds to encompassing a broader range of countries and bonds, such as corporate bonds and asset-backed securities.

Equity investment, which began in 2007, as mentioned above, was outsourced to the Korea Investment Corporation (KIC), a sovereign wealth fund. In 2011, the BoK expanded the scope of its external funds management to include emerging-market equities, and the following year the BoK began to invest in equities in the Chinese market through that country’s Qualified Foreign Institutional Investor programme. However, the Korean central bank is currently focusing on investments in developed markets and China, given the instability of emerging markets and the high correlation between investment performance in emerging markets and the value of the Korean won.

In the 2010s, the BoK focused on diversifying the strategies of its external fund management. For fixed income funds, the BoK induced more aggressive investments by loosening credit rating criteria and by allowing external funds to bear a higher tracking error compared with internal investment assets. For equity funds, the funds under external management varied to passive and active funds to diversify risks. Meanwhile, the central bank introduced various types of style index funds that take advantage of market conditions. In recent years, the BoK has also been exploring various other strategies to improve the investment efficiency of external funds.

The Korean central bank seeks a variety of benefits from its external fund management. The BoK uses the investment capabilities of global asset managers4 as an initial entry strategy into areas where the central bank may lack sufficient experience to invest internally. Despite having accumulated some investment capabilities, the BoK has redefined its objectives to enhance profitability, and has maintained the use of external funds. Additionally, external funds have significantly contributed to improving the efficiency of the BoK’s foreign asset management by providing market intelligence and various investment techniques through global asset managers. Furthermore, they have facilitated a system for comparison and competition with the internal fixed income investment organisation.

Effects of diversification: improving the efficiency frontier

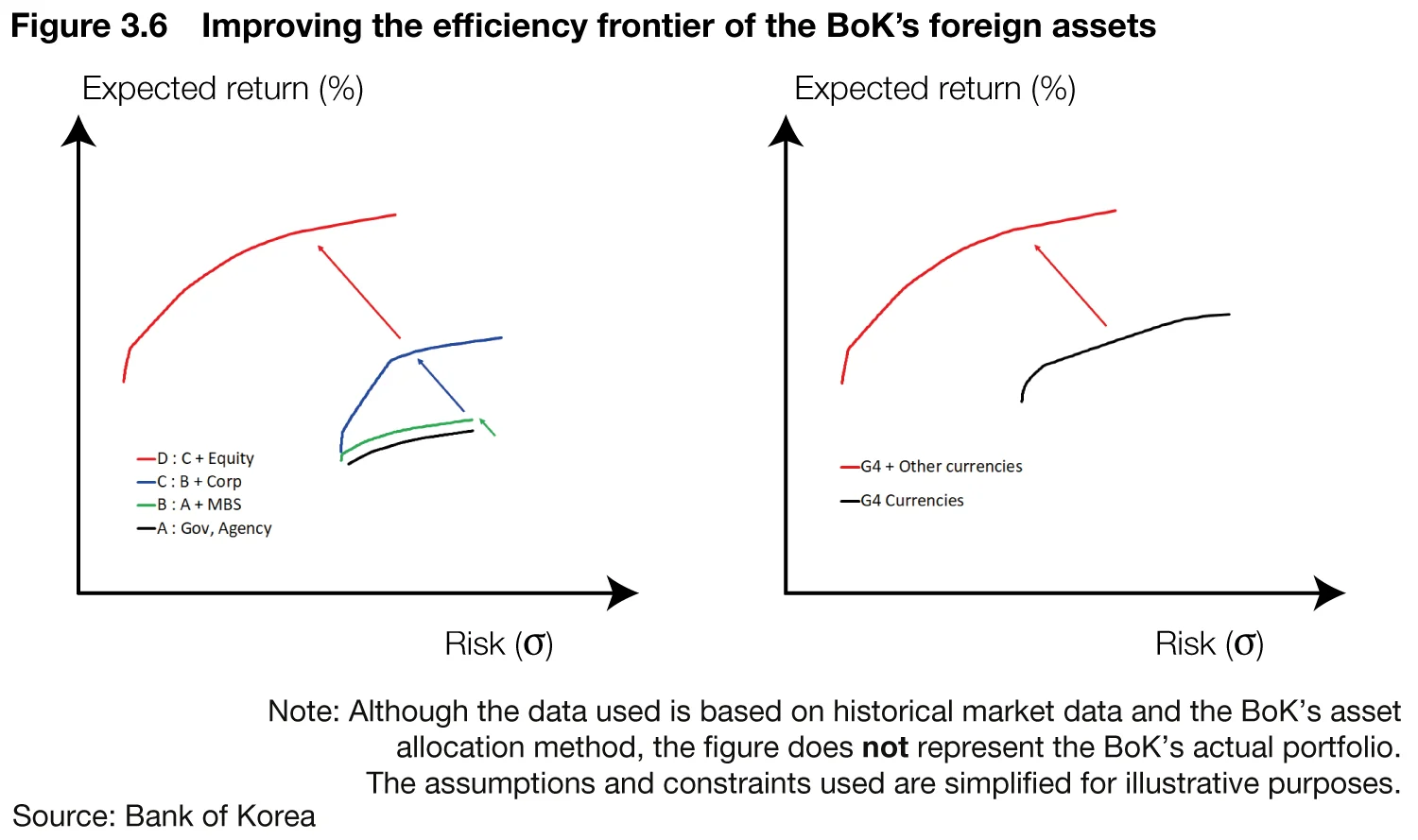

As a result of continued diversification efforts, the BoK has experienced a substantial improvement in the efficiency frontier of its foreign assets. That is, the expected return has been improved as the weights in risky assets have increased, while the risk has increased only to a limited extent, thanks to the diversification effect across different asset classes. Figure 3.6 shows the efficiency frontier of the BoK’s foreign assets as estimated using historical market data from the last decade, and projections for future markets. The efficiency frontier shifts to the upper left, reflecting the positive impact of diversifying asset classes and currencies.

Looking at the details, the figure shows an enhancement in the risk-adjusted return of the investment portfolio. The risk-adjusted return of the portfolio is improved as the investment universe, which initially consisted of government and agency bonds, expanded to include mortgage asset-backed securities, corporate bonds and equities (left side of figure 3.6). The most pronounced diversification effect is observed in equities, followed by corporate bonds.

Currency diversification has a similar effect, with the efficiency of asset allocation improving when introducing currencies outside the G4 (right side of figure 3.6). The effect of diversification is estimated to be relatively substantial in high-interest currencies, such as the Australian dollar and the yuan.

Enhancing investment returns

The effects of diversification on the portfolio’s returns can be indirectly estimated by comparing the historical return5 on the BoK’s foreign assets with the simulated returns that would have been realised had the BoK maintained a specific asset mix at a given point in time.6

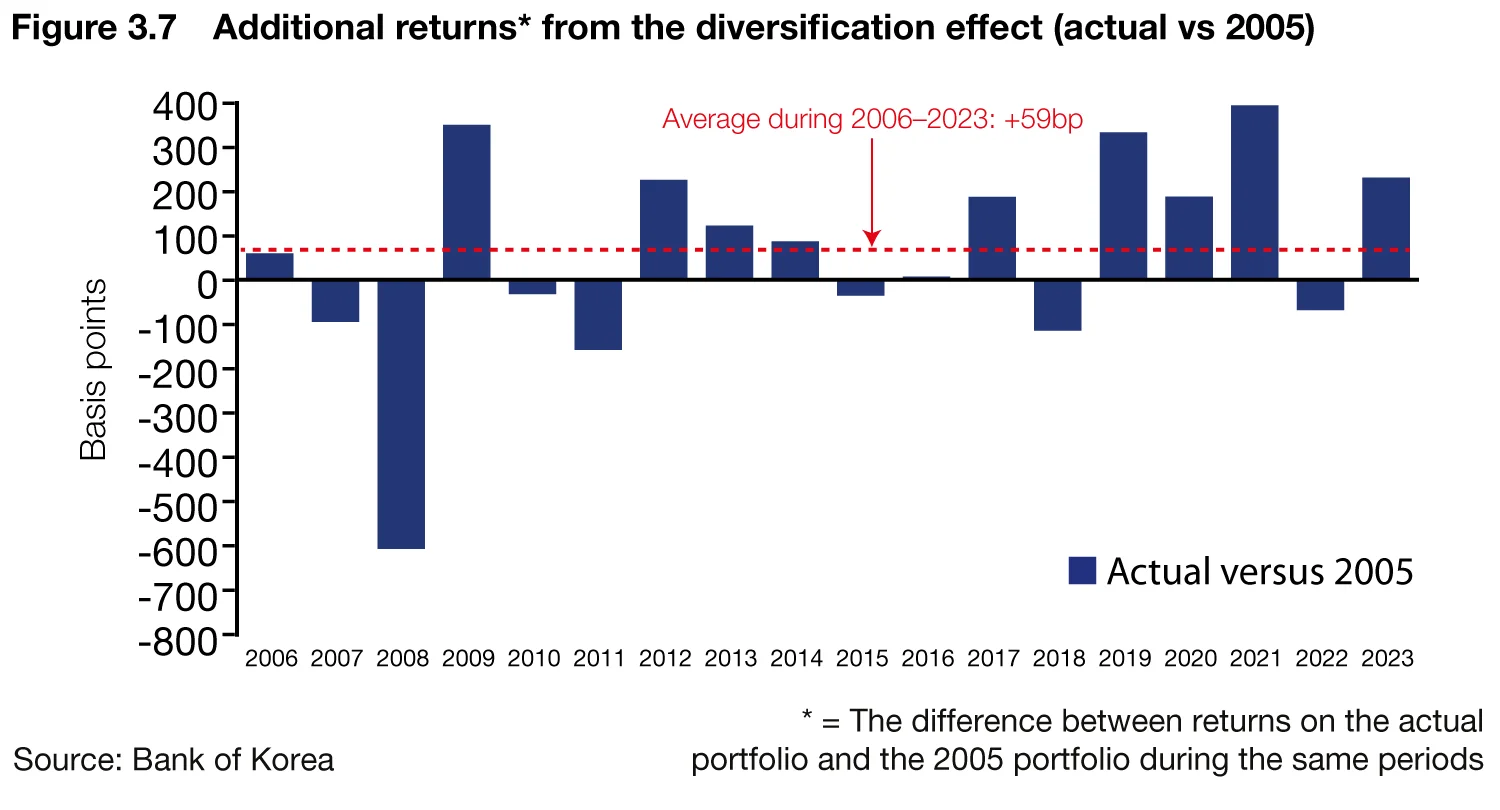

Figure 3.7 illustrates the difference between the historical returns on the BoK’s foreign assets and the simulated returns derived using the asset weights of 2005. This simulation serves as a proxy for the additional returns that the BoK gained by diversifying its investments since 2006. Consequently, the BoK is estimated to have garnered an average of around 60 basis points per annum during the 2006–2023 period through its diversification efforts.7

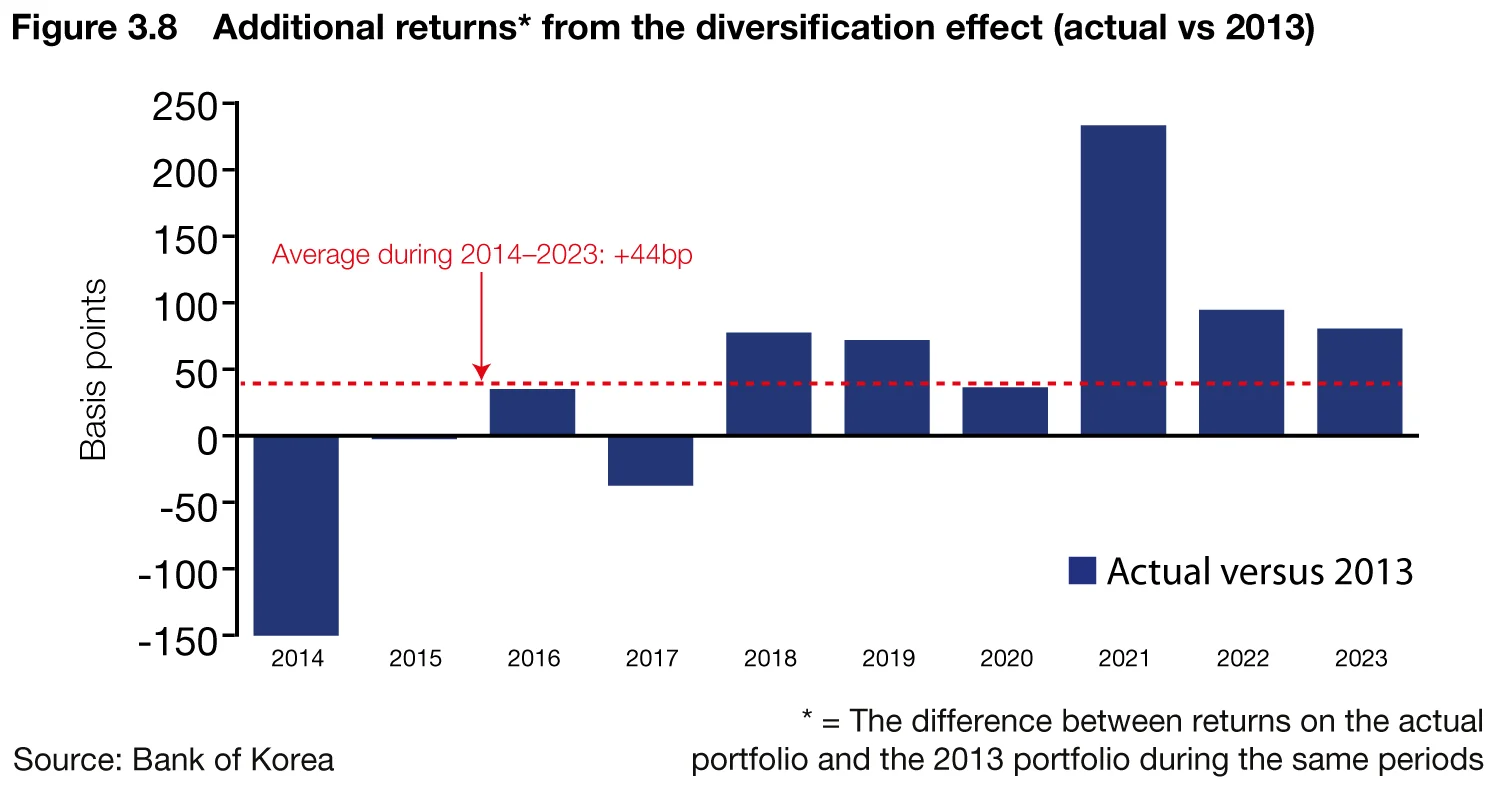

It is worth noting that even when calculated using the asset mix of 2013, when diversification into riskier assets had already been significantly achieved, returns improved by an average of around 40bp per annum (figure 3.8). These additional returns can be attributed to the more sophisticated mid- to long-term market forecasting models used after 2013, which enabled the BoK to further optimise its portfolio in terms of risk-return. Additionally, the gradual expansion of equity investments that began in 2007, which significantly improved the risk-return profile of the investment portfolio, also contributed to the higher returns.

Rising tides of challenges: pursuing more active and agile diversification

In recent years, reserve managers around the world, including at the BoK, have faced substantial challenges due to the increasing volatilities in global financial markets in the wake of active policy responses implemented by governments during the pandemic. In particular, high and persistent inflation has made it more difficult to preserve the real value of foreign reserves. Additionally, around 2022, the correlation between stocks and bonds began to exhibit behaviour different from the past, diminishing the diversification effects and adding more complexity to decision-making related to foreign asset management.

However, the recent market volatility is part of the economic and financial cycles, and can be viewed as an outlier from a long-term portfolio investment perspective. With decades of experience in investing in foreign assets, which includes multiple financial crises, the BoK has learned that diversification is a realistic and effective strategy to secure stable returns over the long term.

The BoK aims to leverage the recent situations as an opportunity to reassess the effectiveness of its current investment strategy and to construct more agile and proactive diversification strategies within its strategic asset allocation framework. In addition, in order to enable more prompt and active responses to short-term market fluctuations, the BoK will persist in using its tactical asset allocation framework and conduct in-depth and extensive research on the economy and financial markets.

Given the growing necessity to enhance profitability and to maximise the diversification effect of foreign assets, which is anticipated to rise along with the size of foreign reserves, there may exist a need to explore new investment areas with distinct risk-return profiles compared with the current investment universe. For example, the alternative investment market has been growing faster than the traditional asset market in recent years due to the interest of investors seeking high returns during the low interest rate period. As a result, its influence on the overall financial market is gradually increasing, making it an important market that is difficult to ignore for reserve managers. The BoK is also actively monitoring the trends in the alternative investment market in order to adapt to market changes and to further enhance its performance.

ESG investing: balancing social responsibility and profitability

Environmental, social and governance (ESG) investing is becoming an irresistible trend around the world. The BoK has been continuously increasing the size of its ESG investments since 2019, holding $19.6 billion in ESG assets as of 2023. In addition, the central bank has recently supplemented its foreign asset management objectives to incorporate ESG components, laying the groundwork for systematic investments in the ESG space.

Currently, the BoK is experimenting with the introduction of an ESG-integrated strategy, extending beyond the ESG negative screening strategy it is currently implementing. As preparatory work for this, the BoK has begun to evaluate the ESG risk management of its foreign assets through the measurement of various ESG risk indicators. Nevertheless, challenges persist, including the selection of suitable indicators among various climate-related risk metrics (eg, climate value-at-risk, carbon emissions and ESG scores), and in ensuring the reliability of ESG-related data, which is crucial to establishing an integrated ESG strategy. Going forwards, the BoK will sustain its efforts to incorporate ESG components into the overall process of its foreign asset management, including asset allocation, risk and performance management.

The central bank also plans to explore ways to address the challenge of finding a balance between social responsibility and profitability. In the past, there were concerns that ESG investments could potentially compromise profitability, due to a weakened diversification effect resulting from a reduction in the investment universe. More recently, however, more studies8 have suggested the contrary. This debate is likely to intensify as more long-term ESG data is accumulated. Considering that profitability is an essential objective for reserve managers, ESG investments will become truly sustainable only when they are able to harmonise with the existing objectives of reserve management. The BoK aims to find optimal solutions to the new challenges regarding ESG investing through careful analysis of ESG investment performance and active knowledge-sharing with peer groups.

Conclusion

In this article, I have summarised the BoK’s foreign reserve management history from the perspective of investment diversification, and discussed the challenges ahead. The BoK’s reserve management group has learned lessons from both successes and failures, spanning from daily performance to multi-year investment outcomes. A common thread running through many of these lessons is that foreign reserve management is a dynamic process that must constantly evolve in response to changing circumstances. The BoK will continue to pursue proactive initiatives, constantly communicating and sharing the experiences with our peer group along the way.

Notes

1. In the early 2000s, the collapse of the IT bubble caused the Fed to drastically cut the benchmark interest rate (6.50% in December 2000 to 1.00% in June 2003), and the two-year US Treasury bond rate fell from 6.91% on May 18, 2000, to 1.08% on June 13, 2003.

2. The Korean won appreciated by 11.8% in 2005 and by 7.2% in 2006 because of the weakening of the dollar due to the US current account deficit, and the Korean-US interest rate differential (two-year government bonds, daily average) widened from a low of 0.02 percentage points in 2006 to 0.98 percentage points in 2007, and then to 3.48 percentage points in 2008 due to the US Federal Reserve’s interest rate cut (5.25% in August 2007 to 0.25% in December 2008) in response to the subprime mortgage crisis in September 2007.

3. The current account surplus as a percentage of GDP surged from around 1.5% in 2000–2011 to about the 5% level in 2012–2021.

4. The BoK began to use global asset managers for its initial entry investments, with corporate bonds in 1996, mortgage-backed securities in 2004 and equities in 2007.

5. ∑ actual returns on each asset class × actual portfolio weight of each asset class.

6. ∑ actual returns on each asset class × specific portfolio weight of each asset class.

7. During the same period, risk-adjusted returns, calculated as the return divided by the standard deviation, demonstrated a similar improvement (+59 basis points). This can be attributed to the fact that, despite the improvement in returns, volatility was constrained to approximately the same level as the asset mix in 2005.

8. According to a meta-analysis of over 1,000 papers published between 2015 and 2020, 58% of studies suggest that ESG investing has had a positive impact on financial performance in the long run, while only 8% found a negative impact (Whelan et al, 2021).

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com