Custody in 2025: a primer for reserve managers

John van Verre and Jane Karczewski

Trends in reserve management: 2018 survey results

Denmark’s move to a holistic and dynamic risk budget

Custody in 2025: a primer for reserve managers

Assessing sources of excess return: style analysis for active investing

The role of reserves in Iceland’s post-crisis recovery

Interview: Solomon Kavuma

It is often said that custody has changed little since the turn of the millennium. As a result, it is widely viewed as a commoditised service with limited scope for innovation. We take a different perspective – that custody has seen significant change in recent years, and we expect this to accelerate in the future. This chapter will look forward to 2025 and beyond, and set out some predictions for far-reaching developments in the industry and their impact on central banks. Naturally, some of these developments may not come to pass and, indeed, the future may look completely different, but nonetheless we offer this as a possible vision of the future based on what we know in 2018.

An historical perspective...

To refresh the reader’s mind, let’s go back to the beginning of the millennium. A typical request for proposal in the market broadly, say, a $10 billion custody mandate, would have been around 20 pages long, with the majority of questions focused on very basic services such as safekeeping, settlements, corporate actions, tax services and securities lending. To a large extent, the ability to execute these basic capabilities was the main criterion for awarding such a mandate. Fast-forward to 2018, and these activities have come to be seen as “hygiene factors”. It is taken for granted that a service provider can carry out these tasks. In that sense, there is some truth in the view that custody has become commoditised.

At the same time, however, new factors have gained much greater importance. Clients have placed significant focus on ancillary services. These include pure banking activities at the core of a central bank’s mandate, such as foreign exchange and cash management, but also additional analytical services such as performance measurement and investment compliance monitoring, and yield enhancing products, such as collateral optimisation and securities lending. More emphasis has also been placed on the revenues generated by asset managers, and their comparable performances, so central banks are more interested in the cost and quality of services provided. As more emphasis has come to be placed on the performance of central banks’ third-party managers, these managers are being forced to assess costs linked to their own services such as middle office and fund administration.

However, what will not change is the need for a custodian. Safekeeping of assets is a regulated activity, and it seems unlikely that any new entrant, say a technology firm or specialised provider will voluntarily become a fully fledged custody bank. The cost, capital and complexity to develop, implement and maintain an infrastructure to meet client asset protection rules, and carry the associated liability, are also significant barriers to entry for non-bank entities. In addition, new entrants would struggle to provide the required intraday liquidity, market knowledge and globally consistent client experience that custodian banks can provide. Such intraday liquidity and foreign exchange management is critical in the reserve management of central banks.

...and a vision for the future

We believe that custody will therefore continue to evolve. The industry’s focus will shift away from traditional functions and current value-added activities towards new areas – including client service, knowledge provision, data management, liquidity management and risk management. Liquidity and risk management are, in particular, at the top of the agenda for central banks. Here, liquidity meaning cash liquidity, but also market liquidity for the credit and high-yield assets that central banks hold as a result of diversification. A custodian has valuable data that can assist in defining the depth of market in certain illiquid securities and the network reach to facilitate market entry. These changes will reshape the whole investment value chain. They will also have a significant impact on individual custodians’ technology, client management and business models, see Box 3.1 below.

Box 3.1 The future of custody: a checklist

Considering the drivers for change, we would not be surprised to see the following developments by 2025.

-

-

Custody responsibilities will be segregated into processing and servicing. Processing will be commoditised and low margin. It will not be limited to custodians, and could instead be handled by specialist providers or industry utilities.

-

-

-

Operational process in the end-to-end investment chain will have changed. Rather than every party maintaining their own static data, it will be held in a central repository. This could even go beyond static data.

-

-

-

The arguably artificial split between global and direct custody will no longer exist. Custody will be provided on the basis of “one book of records”.

-

-

-

Query handling will be largely automated, using digital tools such as application programming interfaces (APIs) and robotics. Clients will have direct access to teams on the ground for local support beyond automated query handling.

-

-

-

Custodians will act as the consolidated data source for all asset classes, and even for crypto currencies, digital keys and digital identities.

-

-

-

Custodians will be data consolidators, taking information feeds from different sources. This information will go beyond traditional transaction and holding data requirements.

-

-

-

Digital integration will give clients live access to their data at any time, in a manner that allows for integration with their internal core processes.

-

-

-

Custodians will continue to play a key role in protecting clients from cyber threats. Asset safety will no longer just be about safekeeping, but will also include data protection against cybercrime.

-

-

-

Custodians will be knowledge providers to their clients, leveraging local insight and their connections with market infrastructures, industry organisations and regulators. Data will be a chargeable asset in its own right.

-

-

-

Pricing will be based on activities and services provided, including charging for data, and be closely aligned with the associated risks and liabilities. ■

-

In the following sections, we explore a few of these potential developments in greater detail, beginning with the shift to custody as a service. Section two discusses the development of a single book of records, and section three new models for client service. A fourth section looks at developments in data management and a fifth at custodians as knowledge providers. Section six considers the development of yield-enhancing products and the following section turns to pricing of services. A final section offers some conclusions.

Custody as a service

In 2018, there is much debate about custodians being disintermediated by technology, with new entrants acting as disruptors. We have already seen new initiatives from non-traditional providers entering the post-trade arena. There is also a widespread expectation that established technology providers will enter this space, as has been the case with related sectors such as mobile payments and other digital methods of exchange. With this advance, traditional processing has become commoditised: there is no competitive advantage in processing a settlement or corporate action. These activities, subject to regulatory acceptance, could be performed by specialist providers, technology firms or utilities owned by the industry. If they can perform these activities more efficiently than custodians, it makes perfect sense for other providers to take them over. This is no different from what has already become an accepted model for other activities in the value chain, including proxy voting and class actions. The speed to market and the type of non-traditional provider, be it FinTech or central industry utility, will be driven by regulation. Many are not regulated hence the partnership with a custodian is necessary.

However, where does this leave the custodian? We think custodians will increasingly become service providers rather than processors. The future of custody will involve gathering information from different sources, aggregating it, and then integrating it with a client’s internal core processes. Custodians will not need to process instructions to create value for clients. Value will be derived from the analytics and performance management tools that can be extracted from the significant amount of data held within the custodian’s platform. This is no different to initiatives in other industries, where the service provider does not simply produce or own the underlying processes itself. AirBnB and Uber are good examples, see box below..

From the central bank perspective, as reserve managers move to add additional investment risk to their portfolios for yield generation, they will need to do so under strict risk parameters and with intelligent sources of market data create demand for more custody service. The depth of a central bank’s relationship with its custodian will be key to leveraging what a partner can provide. This will ensure that the insights provided are relevant to, and in compliance with, the investment portfolio. This in turn will drive the return on assets invested. As yield can often come from exposure to emerging markets, it is important to work with global custodians who have far-reaching networks, highly automated scalable processing and who can support the infrastructure to access those markets. The use of a custodian with a mature operating model will be central to eliminating operation risk. Errors can be costly, and more importantly, can have direct market impact and reputation risk.

Box 3.2 The role of the custodian

Being a custodian implies certain regulatory obligations, including liability for loss of assets. Safekeeping new asset types like digital keys and crypto currencies will present new challenges. Defining the responsibilities of a custodian will require a lot of thought and debate between stakeholders, including regulators, and some interesting non-technological questions will need to be addressed.

-

-

What does it mean to hold a digital asset?

-

-

-

If a custodian safekeeps a digital key giving access to a distributed ledger, is it responsible for the information held in that ledger and therefore liable for the corresponding assets?

-

-

-

Does the existing regulatory framework support the safekeeping of these asset types?

-

-

-

What is the view of regulators on “one book of records”?

-

-

-

What happens if something goes wrong – who is responsible for the content?

-

-

-

What sort of governance model will enable disputed issues to be resolved?

-

-

-

If intermediaries such as asset managers and insurers have direct access to a distributed ledger, what would this mean for client asset protection? ■

-

A single book of records

Having discussed the shift to a service model, we turn to the impact financial technology (fintech) will have on the book of records. Developments in distributed ledger technology (DLT) will allow for the creation of “one version of the truth” about securities master data, holdings, entitlements, standard settlement instructions and other data. This golden source will work across the entire value chain. Brokers, custodians, central securities depositories and clients will all have access to this single book of records. Depending on role, each participant in the value chain will have access to the relevant information on a real-time basis.

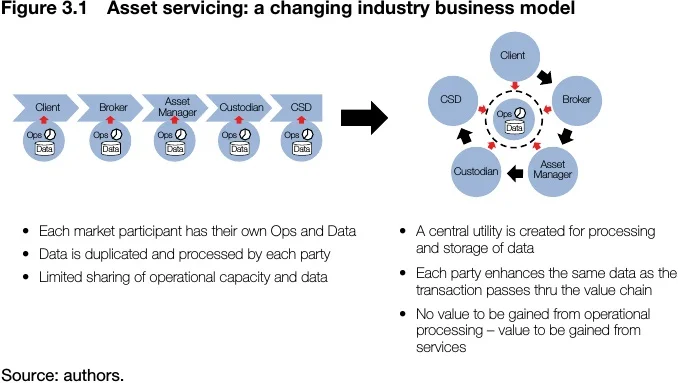

In 2018, these various activities within the end-to-end value chain are typically structured vertically. Each participant in the value chain maintains its own set of data. In the future, we contend that the model will be based on a central repository using one set of records. Figure 3.1 illustrates how this could look.

The benefits of a single book of records are obvious: shorter settlement cycles; cost reduction; full straight-through processing; the removal of reconciliation processes; and fewer settlement failures. This sounds attractive, but there is an even bigger potential upside. The entire matching process can take place within this closed community, turning settlements into an internal book transfer. This will support a shortening of the settlement cycle to T+1 or even T+0, which in turn would require a change in the funding of foreign currency if it is needed to buy a security. Further, this would also have an important impact on the risk profile and liquidity requirements of the custody business – something we discuss later in the chapter.

It is not just custodians who will have to adapt to a new world. Exchanges, central securities depositories and brokers are among the key players that will need to embrace the changing environment. These entities still largely operate separate platforms for different asset classes, often based on single currencies. Data centralisation could potentially result in some of these functions being absorbed by other parties in the value chain.

New client service models

We now turn to client servicing, where we believe the incumbent model is both outdated and inefficient. In theory, technology supports real-time information sharing, allowing quick response times for client queries. The reality is often very different, as illustrated by the following example:

A US-based client receives a report of previous day activities. The client has a query about a settlement in an Asian market. They contact their local client service manager, who contacts the local agent in Asia. Given the time difference, this person has already finished work. Someone in client service may still pick up the phone or read the email, but is unlikely to have the knowledge to answer the query immediately. The following day, the Asian agent takes action, but has to involve the service centre where processing took place. It takes the service centre a day to find the answer. In other words, the US client may need to wait until Wednesday or Thursday to answer a simple request about an event that took place on Monday.

In future, digital workflow tools combined with robotics and self-learning technology (artificial intelligence) will be the basis for client service. In 2018, approximately 60–70% of client queries have been simple information requests. Digital solutions will allow most of these requests to be handled instantly. Clients will be self-serving. For queries that cannot be handled automatically, clients will expect direct access to local staff with ready access to the required information. Workflow tools will be required to maintain a central record of client queries, and all internal teams will need real-time data access – regardless of location or platform.

Another key development will be to provide clients with a globally consistent experience. Today, clients investing in different markets are faced with diverse service models. This is largely driven by differences in local market infrastructure, legislation, regulation and practice. In future, custodians will be expected to “normalise” local differences and provide a truly consistent experience. A globally consistent experience will also help to facilitate digital integration with clients’ internal processes. At the same time, the importance of local presence and language capabilities should not be underestimated. Delivering globally consistent solutions requires detailed knowledge of local markets. Different markets will also deploy different technology solutions. Custodians will need deep knowledge and understanding of local markets to mask these differences for their clients.

Developments in data management

As an extension of the service, custodians will become “data integrators”, not only for information about assets they hold in custody but also for “noncustodiable” or “out of network” assets. This concept already exists as a master record-keeping function, and will be further developed to include data about physical assets such as art or metals. It will also include the safekeeping of digital keys and possibly digital identities. Physical assets will be “personalised” using distributed ledger technology to provide better legal protection for registered owners.

There will be data integration across the whole value chain, including end-clients. The current process is highly inefficient, with key stakeholders – brokers, managers, central banks, fund administrators, transfer agents, custodians, central securities depositories, central counterparties (CCPs) and exchanges – all setting their own standards. That leads to a situation in which every party is working to execute the same client order, but each with their own processes and standards. This is even more surprising given that the data elements required at each stage are largely the same, with all parties working towards the same regulatory principles. It is a dubious achievement that, as an industry, we have managed to create so much inefficiency.

New technology, from DLT to the need to reduce costs to harmonisation initiatives such as Target2-Securities (T2S), will all drive a new way of working. All relevant data will be held in a central utility, with each actor in the value chain having access to the data required to perform their role. Clients will also have access to this utility, and be able to extract data at any time in a manner that is useful to them. Traditional tools such as portals will be viewed as legacy technology, used only as a contingency solution.

It will be interesting to see whether distributed ledger technology will also result in end-clients (beneficial owners or their appointed managers) having their own record in the ledger, or if they will still use a custodian. Theoretically, the technology makes a direct account feasible. Having said that, many challenges could prove hard to overcome, for example:

-

-

different central securities depositories will have their own version of distributed ledger technology for their own market, and it will be difficult for clients to manage dozens of different distributed ledger technology relationships;

-

-

-

regulators will continue to insist on proper asset and client protection – therefore, safekeeping will remain a regulated activity, with clear and strict liability backed by capital;

-

-

-

clients will look for integrated data solutions, and will value service providers that can consolidate various data sources and normalise these to provide them with the relevant information and knowledge;

-

-

-

there will be technical obstacles to processing the transaction volumes required to support the industry in the absence of a regulated central trust.

-

In reality, the situation is unlikely to change very much. Some large clients already open accounts with local central securities depositories for certain investments. The introduction of distributed ledger technology will not change this. What may change is what custodians will actually be safekeeping. Instead of safekeeping a record of holdings and a very small portion of securities in physical form, custodians might safekeep the digital keys to a centrally maintained ledger.

In our discussion of a single book of records earlier in this chapter, we referred to the risk profile and liquidity requirements of the securities settlement business. In 2018, the picture can be characterised as follows: sub-custodians provide intraday liquidity to support local settlement. Global custodians provide contractual settlement to clients, meaning that client cash is credited or debited on the date determined by the settlement cycle for that market – in most cases, between zero and three days after the trade. Cash settlement therefore occurs regardless of whether the securities trade has actually settled. In providing this service, global custodians accept counterparty credit risk on the client in the event that a securities sale fails to settle. This risk is mitigated by granting the global custodian a lien over the assets, although the enforceability of such liens is increasingly subject to challenge. By shortening settlement cycles, new technology such as distributed ledger technology could reduce the credit risk that custodians currently assume.

Even so, we still expect custodians will need to provide intraday liquidity in the future, regardless of how asset data is managed. A move to real-time settlement (similar to real-time gross settlements (RTGS) for payments) is theoretically possible, but would require a fundamental change to business models in trading and brokerage. This seems unlikely in the foreseeable future. Therefore, although the need for intraday liquidity may fall, it will not disappear. This is another reason why custodians will resist disintermediation and continue to play a valued – if altered – role in the value chain.

Acting as knowledge providers

Global shifts in asset allocation will encourage custodians to become knowledge providers. Investing in emerging and frontier markets presents significant challenges for investors. Deep understanding of local and cross-border regulations, law, tax and other relevant matters will be critical to helping clients achieve their strategic objectives. Connections with local regulators and industry bodies will be essential, meaning that having a local presence will become even more important than it is today.

In addition, the integration of various data sources beyond pure transaction and holding information will allow custodians to translate data into highly relevant information for clients. After all, custody banks typically have extraordinary access to information. They know which markets are efficient, how money is flowing, the value of their clients’ holdings and what form they take.

That information is slowly becoming a valuable product in itself. This will involve data collection, consolidation, normalisation, integration and analysis. In future, custodians will also be able to combine all sorts of other data – for example, from social media. The rise of big data analytics plays to a global custodians strengths. Understanding investment patterns, foreign exchange fluctuations and liquidity based on an aggregated data set across a broad set of market participants is valuable to investment making decisions for central banks. That will allow custodians to help asset managers mine correlations and spot investment trends, moving them further up the value chain and involving them more closely in clients’ decision-making processes.

Development of yield-enhancing products

Of particular relevance to reserve managers will be custodians’ ability to generate increased returns. As central banks continue their search for yield and revenue protection, they are moving: (i) to increase their investments in corporate bonds; and (ii) to increase their use of derivative hedging as they protect the value of their assets against geopolitical events affecting inflation, currency and interest rate movements. Effective use of their assets for collateral (cash or securities) for cleared and non-cleared derivatives, and the financing of high-quality liquid assets via securities lending or repo is key to increasing returns. Here, collateral management, Treasury and securities lending can be interlinked to ensure best use of assets, fluid settlement and limited risk exposure.

In 2018, central banks are increasingly entering the market to earn revenues on their high-quality liquid assets. Here, for example, it is important that these assets are not unnecessarily used for collateral when they could be earning solid revenues. Providing central banks with analytics allowing them to have a real-time view of their cash, over-the-counter counterpart exposure, lent or repoed assets, pledged assets and counterpart risk should enable them to optimise. This is the role of the custodian. Only the custodian will have the visibility, liquidity and balance-sheet provisions to support the full value chain. Additional yield analytics, as well as core products provided by collateral management areas within the custodian, will allow for better investment-making decisions and potential re-balancing of portfolios and derivative hedges. As a result, custodians will start to add significant value to the investment process.

Smarter pricing structures

Having discussed the services and activities, we turn, finally, to pricing. Interestingly – perhaps strangely – custodians charge for what they don’t do – the simple service (ie safekeeping and processing) and ironically not for all the other things they now “do” (value-added services such as provision of information and liquidity). Of course, this is not quite true as there is still a small cost for the safekeeping of assets, but the point still holds. This is based on historic practice (and associated high costs), when securities were predominantly held in physical form and needed physical safekeeping. Following the dematerialisation of securities, safekeeping now consists almost entirely of maintaining an electronic record in a ledger. Costs have gone down enormously, and this has been reflected in a steep decline in ad valorem fees. The second main chargeable component is settlements, but the advance of technology means that the cost of these activities has also fallen, and is set to decrease further.

In contrast, custodians charge little or nothing for other services that they already provide – and will provide more of in future. These include covering the risks of asset loss, providing liquidity and credit for contractual settlement, and providing information, including the extended data services described earlier in this chapter.

In the future, we expect pricing to be based on a combination of factors. These will include: activity-based services such as settlements, corporate actions and tax services; fixed cost elements such as account services; and fees for risk and data provisioning. The risk premium will still be based on underlying value, and the other chargeable services will be based on volumes. The current “cover all” ad valorem fee model will disappear.

Conclusion

The custody industry is going through a period of transformational change. This evolution has to progress with clients in mind. The drivers include stronger investor protection, the need for more transparency, new technology, and client demands for more and better data and greater risk awareness.

Custody has been ever-evolving and changing, but to date these changes have not fundamentally altered the shape of the value chain or custodians’ business models. In contrast, the changes we are now starting to see are much more fundamental and will change the role custodians play in the overall value chain.

Having said that, custodians will not be disintermediated. They will have a vital role to play for the foreseeable future. The activities a custodian will perform may change, but the need for investor protection, core banking services and risk mitigation will remain the same. Custodians will also develop new capabilities, making themselves more valuable to investors and their advisors. As the industry continues to understand and adapt for the future, the power of central banks will play an important part in influencing the direction of travel.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com test test test

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com test test test