Michal Piechocki, a founder and chair of the supervisory board at BR-AG, and Anastasia Rudynska, marketing specialist, review the global use of supervisory technology – known as suptech – among central banks for enhanced digital supervision

Suptech adoption is accelerating, as evidenced by numerous reports over the past years. Supervisory authorities are now placing a greater strategic focus on developing clear suptech strategies and building internal capacity to modernise operations. This includes aligning technology with long-term statutory and supervisory goals.

As more central banks embrace ‘use case-driven approaches’, they are building skilled teams, fostering cross-departmental collaboration and upgrading digital infrastructures to enable more automated and data-driven supervision.

Suptech adoption worldwide: 47 of 50 supervisors on board

In a survey of 50 supervisory authorities conducted by the Financial Stability Institute (FSI) and the Bank for International Settlements (BIS) Innovation Hub in 2023, only three reported not having ongoing suptech projects. The Cambridge Suptech Lab’s 2023 report found that 81% of financial authorities are involved in suptech initiatives. Of the 64 global respondents, 58% represented central banks.

As central banks’ roles expand beyond traditional monetary policy and financial stability – covering more areas to supervise and greater volumes of data to collect and process – supervisory authorities are pushing the boundaries of their competences. To meet these demands, they are increasingly adopting innovative suptech. Such technologies can automate supervisory authorities’ data collection, data analytics and governance processes, making them more efficient and effective.

In recent years, there has been a notable increase in interest in suptech, evidenced by active market dialogues, numerous requests for proposals (RFPs) and the establishment of suptech labs by central banks and financial supervisors worldwide. In the past 12 months alone, at least 10 requests for information and RFPs have been published by supervisors from Europe, the Middle East and Africa (Emea) and Asia-Pacific (Apac) for comprehensive suptech platforms, highlighting a growing recognition of the need for technological solutions to enhance supervisory capabilities.

Among these, 70% came from Emea, where financial authorities are replacing outdated systems with cloud-based or integrated platforms. These solutions aim to improve data collection capabilities, efficiency and compliance, including handling European and national reporting obligations, particularly the ISO 5116 Data Point Model and eXtensible Business Reporting Language (XBRL) for data reporting. Additionally, there is a clear push towards implementing scalable and flexible supervisory technology systems that can adapt to changing regulatory demands and increasing data volumes.

In Apac, supervisory authorities are mainly focusing on implementing comprehensive solutions that cover the complete lifecycle management of core suptech systems, starting with gaining knowledge about best suptech practices and feasibility for potential system acquisition.

Suptech benefits: from promise to practice

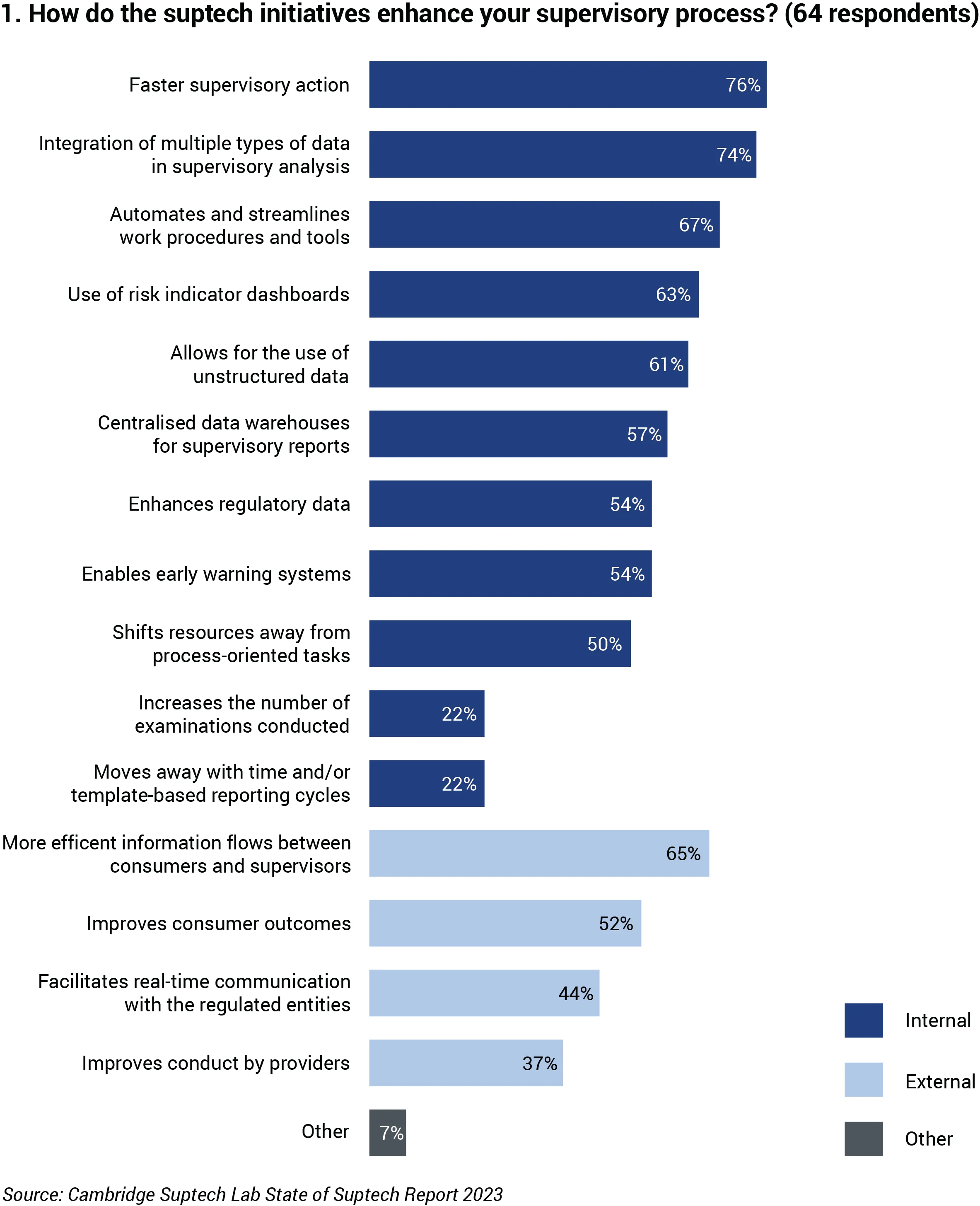

According to the Cambridge Suptech Lab’s report, financial authorities increasingly recognise the transformative impact of suptech on supervisory processes, which benefits internal operations and external interactions with consumers and financial institutions. A notable advantage is the acceleration of supervisory actions, with 76% of authorities reporting that suptech tools enable swift analysis and rapid responses to emerging risks. Furthermore, the integration of diverse data types, also cited by almost three-quarters of respondents, enhances supervisory analysis, providing a more comprehensive view of the financial landscape.

Additionally, the automation and streamlining of work procedures and tools, valued by 67% of authorities, lead to operational efficiencies by reducing manual efforts and expediting supervisory tasks. The adoption of risk indicator dashboards, which 63% of authorities find beneficial, fosters a timely and proactive approach to risk management, allowing financial regulators to stay ahead of potential threats. These findings highlight the critical role suptech plays in modernising supervision and improving the overall effectiveness of financial oversight.

How financial regulators are leveraging suptech for enhanced supervision

Financial authorities harness innovative technologies to enhance supervisory effectiveness, cut costs and improve capabilities. The 2024 FSI briefs reveal that most financial authorities have implemented solutions for data visualisation, regulatory reporting, financial risk assessment and supervisory automation. Suptech development efforts remain focused on these areas, with growing interest in cyber risk detection and monitoring, environmental, social and governance (ESG) reporting, governance assessment, regulatory reporting and crypto asset monitoring.

Supervisory automation can encompass a broad range of processes when it comes to practice: for instance, the European Central Bank’s (ECB’s) digital tools aimed at enhancing the supervision of European banks’ focus on improving data access, reducing reporting burdens and increasing efficiency in risk identification and decision-making. Its transformation strategy involves leveraging technologies, such as artificial intelligence (AI), machine learning and cloud computing. Athena is the ECB’s AI-supported textual analysis platform offering natural language processing capabilities to all supervisory areas. Heimdall is its machine reading tool used in the analysis of thousands of fit and proper applications. The ECB also continues to leverage data standards such as ISO 5116 (Data Point Modelling (DPM)), ISO 17369 (Statistical Data and Metadata Exchange), ISO 20022, ISO 17442 (Legal Entity Identifier) or XBRL to enable a broader data-centric approach across the entire organisation.

In total, at the time of writing, 14 suptech tools have been implemented by the ECB from a starting point of more than 100 ideas, prioritised using a structured innovation management framework and defined innovation strategy. In the process of ensuring supervisors can fully use the applications and data available to them – and that technology is seamlessly integrated into their day-to-day work – the ECB also emphasises the importance of digital culture.

“European Union regulators, including pan-European ones, are also focusing on the importance of getting metadata right – a prerequisite for more integrated, automated and digitised data flows in suptech systems, ensuring good data understanding,” says Michal Skopowski, head of customer success management and vice-president of the management board at BR-AG.

As part of the European System of Financial Supervision, the European Insurance and Occupational Pensions Authority (EIOPA) is using a collaborative metadata management and modelling platform to enable users to cross-check their understanding of data requirements, swift implementation of different reporting packages and their incorporation into the same taxonomy. As a result, supervised markets benefit from full consistency and use of the same data dictionary, which enhances regulatory clarity and efficiency.

Simultaneously, in Europe, numerous supervisory authorities have adopted, or are in the process of implementing, the XBRL open data format for supervisory reporting. These include the De Nederlandsche Bank, the Bank of Spain and the National Bank of Belgium.

The European Banking Authority and EIOPA have actively promoted the use of digital DPM data dictionaries, issuing taxonomies to ensure uniform XBRL format for reporting requirements, which enhances regulatory harmonisation and facilitates cross-border supervision within the EU.

Suptech also takes the form of a risk identification tool that helps identify irregularities at financial institutions by primarily using quantitative or structured data. Capital, credit and liquidity are some of the risk areas targeted. For instance, the Central Bank of Brazil created Adam, a machine learning tool designed to assess the entire credit portfolio of supervised entities and detect credit exposures with underestimated expected losses. Adam can process 3 million customers’ exposures within 24 hours, a task that would otherwise require 30 years for a team of 10 experienced inspectors to complete manually.

Another prominent example of suptech adoption comes from the Bank of Ghana. As the regulatory and supervisory authority for banks, and a range of other financial institutions, it has invested in various technological tools over the years to support its prudential, market conduct, and anti-money laundering/combatting the financing of terrorism supervisory functions.

Elsie Addo Awadzi, second deputy governor of the Bank of Ghana, positively assessed the results achieved after the bank’s suptech platform implementation: “It has enabled, for the first time, the collection of large volumes of granular-level data, including on a sex-disaggregated basis, age and other demographics, for classification of products and services, including deposit accounts and loan types.”

The central bank’s suptech solution has also improved data collection on digital financial services, such as internet banking and mobile money-based products like microloans, as well as fraud-related data, ESG compliance reporting and deposit insurance reporting. “This helps to better track access to the use of banking services and helps to design appropriate interventions to promote financial inclusion,” she said.

Suptech strategy: the foundation for long-term supervisory efficiency

Though 59% of financial authorities use one or more suptech applications, only 9% have formulated a comprehensive suptech strategy or road map.

In a recent address, Andrea Enria, chair of the ECB’s Supervisory Board, said: “Harnessing technology for supervision is not just about keeping pace with innovation, but ensuring the effectiveness and efficiency of our oversight. Without a clear strategy, we risk falling behind in a world where agility and adaptability are key to addressing evolving risks.”

Data gathered from the latest surveys among supervisors confirm that the mix of new technologies used by the market and peers, time sensitivity, tight budget controls and little room for trial and error are the primary factors driving central banks to prioritise suptech strategies.

Consequently, it is essential for central banks that suptech tools are not only implemented efficiently but also deliver long-term effectiveness, enabling them to enhance data management practices and supervisory processes. Designing a comprehensive strategy is becoming one of the top priorities for supervisors, ensuring suptech is manageable in addressing future challenges and positioning it as a source of strategic advantage.

The FSI and BIS surveys revealed that supervisory authorities with a defined suptech strategy are nearly twice as likely to successfully deploy critical suptech tools. In stark contrast, about 50% of authorities that lack a strategy faced significant challenges in implementing effective solutions, resulting in inefficiencies and wasted resources.

In addition, according to the Cambridge Suptech Lab report, only a small percentage (9%) of institutions have clear, detailed plans for suptech adoption, leaving many projects in the early stages.

This underscores the need for a forward-looking, strategic approach to effectively identify priority areas, craft road maps through diagnostic processes, and adopt and integrate supervisory technologies, seamlessly merging legacy systems and new infrastructures into suptech frameworks.

Supervisors embrace a use case-driven approach

A significant majority of financial authorities (66%) are adopting a use case-driven approach in their suptech initiatives. Prominent examples of financial authorities employing this approach include the central banks of England, Austria, Indonesia, Japan and Ghana, as well as European supervisory authorities.

An example illustrating collaboration and market dialogue is to be found in the UK, where the Bank of England (BoE), together with the Financial Conduct Authority, rolled out the Transforming Data Collection programme. This initiative defines several key use cases to test, such as the Review Prudential Data Collection one. A fundamental component of these transformed, automated data collection efforts is structured, consistent and digital regulatory reporting.

At the 2023 Eurofiling conference on the future of regulatory reporting, leaders from the BoE emphasised the role of technologies such as XBRL in streamlining data collection processes, while keeping the process cost-effective for financial institutions.

The BoE’s suptech strategy also emphasises using machine learning and AI to improve data collection and rely on international standards such as ISO 5116 and XBRL to enhance supervisory data quality in accordance with the Basel Committee on Banking Supervision’s BCBS 239 standard for effective risk data aggregation and reporting.

In this context, the design of the suptech strategies extends far beyond the implementation of new technologies: they serve as comprehensive frameworks that integrate policy, data management and capacity-building efforts to meet the evolving demands of financial supervision. These strategies are closely aligned with broader institutional initiatives, which aim to modernise supervisory processes and improve data management capabilities.

As Bartosz Ochocki, head of product management at BR-AG, notes: “Suptech development or implementation projects are rarely isolated, standalone projects. They are usually either part of, or at least aligned with, the authority’s guiding programmes, such as digital transformation and data strategies. One of the technological considerations we see as cross-cutting these strategies is the shift to cloud versus the more traditional approach of keeping tech and data on-premise.”

This shift to cloud-based infrastructure is a key element in suptech’s modernisation efforts, offering greater flexibility, scalability and security compared to traditional on-premise solutions. It reflects the growing need for financial authorities to adopt more agile and future-proof technologies that facilitate secure data sharing and integration with expanding data sources and the creation of automated data hubs.

This transformation, however, requires careful consideration of long-term goals and data security, balancing immediate needs with the future objectives of supervisors.

Building internal capacity for supervisory innovation growth

Effective suptech strategies also greatly rely on well-co-ordinated project teams, often composed of members from various departments. There is a range of organisational approaches to taking forward suptech initiatives.

As the May 2024 FSI Briefs report, financial authorities were asked about internal resources dedicated to building supervisory technology tools. Many respondents indicated that suptech efforts were spread across different departments, such as data management, innovation, IT and supervision. However, without further details on the allocation of staff or their time, it is unclear how ‘dedicated’ these resources truly are.

Additionally, fostering an organisational culture that embraces agile methodologies and design thinking is critical but often difficult, with more than half of authorities citing this as a barrier, according to the Cambridge Suptech Lab report.

The lack of internal skills in product design further complicates the process, with 52% of financial authorities turning to external expertise to fill these gaps. Limited knowledge sharing between departments, as highlighted by 44% of respondents, can also slow the pace of suptech integration and reduce the overall effectiveness of these initiatives.

Despite the growth of suptech and the availability of established vendors, a recent BIS survey shows that many financial authorities still rely heavily on internal teams and resources to build their suptech solutions. The decision to develop in-house or buy from the market applies not only to suptech systems – it extends to broader capacity-building programmes, impacting how quickly suptech solutions deliver tangible benefits for automated, data-driven supervision.

By equipping teams with the necessary knowledge and skills, supervisors are nurturing internal talent that plays a crucial role in developing and adapting suptech strategies to meet emerging global and data challenges.

Comprehensive capacity building, when coupled with strategic planning, requires collaboration across multiple stakeholders, including vendors, other authorities and the broader professional community. This process starts with aligning suptech initiatives to organisational priorities, and continues with building effective teams, establishing governance structures and developing road maps.

Feasibility studies, proofs of concept, cost-benefit analyses and peer experiences all inform these road maps, which ultimately lead to market engagement through dialogues and procurement processes. This collaborative approach enables international scaling of solutions, maximising value for money and speeding up knowledge exchange.

In some cases, organisations establish dedicated suptech labs, hackathons and sandboxes to drive the development and implementation of these solutions. Open communication between stakeholders – internal teams and external partners, including reporting entities and IT providers – is crucial to ensure smooth integration and alignment with institutional goals.

Digital culture and training staff

“Establishing a digital culture and training staff in advanced technologies is crucial to fostering our digital transformation. Digital culture encourages innovation and facilitates the process of adopting new technologies,” said Elizabeth McCaul, a member of the ECB’s supervisory board, at the Supervision Innovators Conference in 2022. “Managers and staff need to develop the right skills and mindsets to enable them to embrace the opportunities offered by new technologies.”

At Central Banking’s 2024 Summer Meetings, digital innovation and the fostering of an innovative supervisory culture were presented not as a choice for supervisors but as a necessity to meet new challenges.

Training staff and building a digital culture do not happen overnight. It is a gradual process that requires the systematic acquisition of specific knowledge and skills. Just as suptech implementation should be approached incrementally and focused on specific supervisory areas, training should be tailored to meet the unique needs, and cover knowledge gaps, of supervisory teams. This strategy not only sharpens focus on key priorities and projects but also optimises costs by investing in customised training programmes.

For example, recent efforts by officials and supervisors at the Central Bank of the Republic of Uzbekistan involved collaborating with experts to enhance their teams’ knowledge of data-modelling approaches. This initiative was aimed at improving data collection systems, developing new data management models and systems, and advancing automated reporting systems.

Through this collaboration, they created a learning environment for supervisory teams. Supported by industry experts, these teams could explore different suptech approaches and test various data models within their data management platform, and determine what works best for them, considering their unique objectives, regulatory environments and the jurisdictional contexts in which the central bank operates.

Ultimately, the success of suptech strategies depends on strong leadership, effective cross-departmental collaboration and a flexible data infrastructure that can adapt to the complexities of modern financial ecosystems. By overcoming technological and organisational challenges, financial authorities can create more responsive, data-driven supervisory systems that are better equipped to meet the demands of today’s dynamic financial markets.

Conclusions

The global momentum behind suptech is undeniable, with financial authorities increasingly recognising its potential to enhance supervisory and regulatory practices. As revealed by recent reports and surveys, the majority of financial authorities have implemented solutions for data visualisation, regulatory reporting, financial risk assessment and supervisory automation.

These efforts aim to address common supervisory challenges, such as the lack of timely or quality data, inefficient use of already available data and limited staff resources. Additionally, the growing focus on cyber-, climate- and crypto-related tools reflects the rising complexity of these emerging risks.

However, to harness the full benefits of suptech, supervisors are defining comprehensive suptech strategies that help them align suptech capabilities with their specific needs and objectives.

As Kathy Bostjancic, chief US financial economist at Oxford Economics, puts it: “Regulators are like parents trying to keep up with their kids’ social media habits – always a step behind and trying to figure out the latest trends.”

While the analogy may sound harsh, it conveys a simple yet important message: supervisors already occupied with complex daily tasks may find it difficult to keep up with the rapid pace of technological advancements, let alone identify which ones will truly enhance their oversight capabilities and fully harness these innovations.

A well-designed approach provides the road map, but it is the skilled and adaptable teams that turn this plan into lasting results, ready to tackle the challenges of tomorrow. Equipped with the necessary knowledge and skills, supervisory teams serve as the driving force behind effective suptech implementation and its ongoing management. Authorities aim to achieve this through internal training programmes or by partnering with external experts who bring practical experience and specialised technology expertise.

Technology is, of course, an essential component of an ambitious transformative vision of digital supervision. However, a truly effective suptech strategy is not just about hardware and software; it is important that supervisors set themselves – along with their wider teams, key stakeholders and the markets they supervise – up for success.

Learn more

Connect with us to discuss your suptech challenges.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com