This article was paid for by a contributing third party.

DLT and financial markets governance – Mutual dependency and the role of supervisors

Maciej Piechocki, Moritz Plenk and Aaron Janowski of BearingPoint examine the need for regulatory authorities to develop a clear strategy on how to become part of distributed ledger technology platforms, take advantage of the resulting enhanced data streams and set fundamental frameworks.

Many financial institutions are willing to use distributed ledger technology (DLT) – often referred to as blockchain – to simplify trading for certain financial products and save processing costs. However, defining governance structures between counterparties that ensure benefits are evenly spread remains a challenge. Thus, the need for supervisory commitment for emerging technologies such as DLT increases. So far, few DLT networks exist in which regulatory bodies are actively involved, but use cases in regtech illustrate the promising prospects of DLT in market supervision.

Transaction reporting for derivatives – The point of departure for DLT use cases in regtech

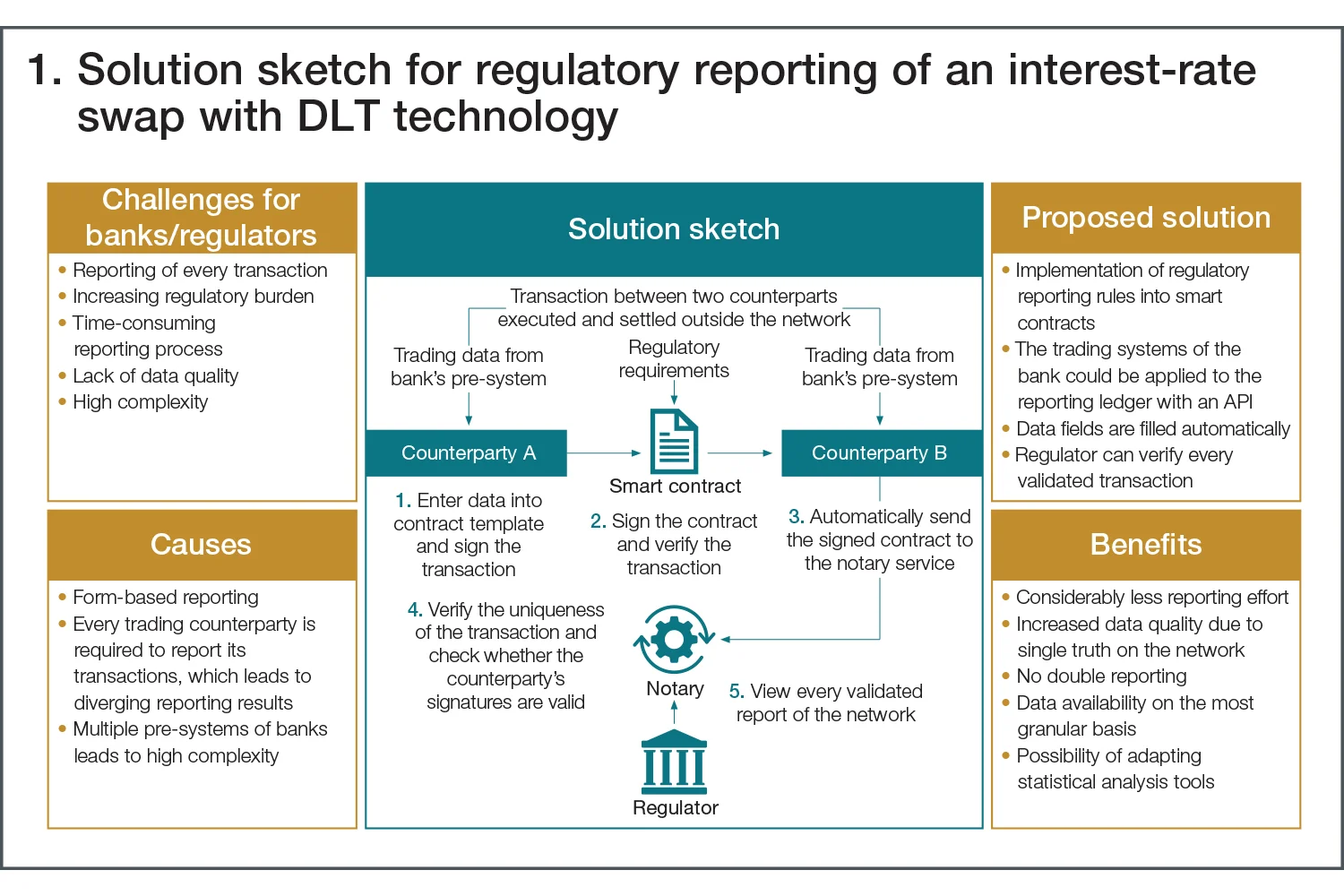

Regulatory reporting requirements are extensive, and the implementation of the Securities Financing Transaction Regulation, the European Market Infrastructure Regulation or European transaction reporting frameworks are complex, costly and time-consuming. They even require manual processing of regulatory data and data reconciliation. Because of data quality issues, the process is also insufficient from a regulatory perspective. DLT can overcome these problems by allowing a reduction of reporting effort and the real-time update of regulatory data without the need for trading counterparties to manually intervene. It can also provide real-time access to relevant reporting data for the regulator. BearingPoint’s DLT team has shown that a use case of derivative reporting – that fulfils transaction-based reporting requirements – is not only feasible but can be extended to other post-trade settlement obligations.

By using the technical possibilities of programmable smart contracts, regulatory requirements can be programmed as preconditions for post-trade processing. Combined with the immutability and the transparency of shared facts between trading counterparties, DLT offers the advantages of minimised data reconciliation and less manual intervention.

To exploit the illustrated benefits, supervisors need to reflect on their purpose as an organisation to define a coherent strategy.

Supervisor roles follow purpose and determine governance measures

Regardless of their geographic and constitutional backgrounds, central banks and supervisors share a common interest in financial market stability, preservation of the value of money and prosperous economies. Central banks and supervisors, as public actors, aim to provide a specific public good.

Compared with other types of goods, public goods are unique for two reasons: it is difficult to exclude users from consumption of public goods; and consumption does not lead to exhaustion of the public good.1 Private market actors are not able to claim remuneration for the production costs of the goods and, therefore, choose not to deliver them. Because of the widespread benefits public goods offer, political communities establish a variety of public actors, each acting as a stand-in to provide a specific public good. If these organisations fail to deliver, they typically lose first their legitimacy and political support, then their organisational resources, before finally diminishing into insignificance.

In practice, public actors provide public goods by establishing a system of rules to be followed by private actors. In this context, governance models provide a label for a specific type of rule set.2

Table A presents the classic types of public goods and relates them to a supervisory context. The role a public actor occupies is not a coincidence but a consequence of its organisational purpose. Each role comes with a set of expedient policy instruments.

The DLT relevance of public goods can be twofold, establishing a mutual dependency between DLT and public goods.

The DLT relevance may refer to DLT’s own exceptional contribution to meet the governance purpose of providing a public good (A); and a public good’s provision may be a precondition for the supply of the DLT instrument itself (B).

As table A highlights, the prospects of DLT to serve as a core instrument in financial market supervision are immense. For example, even before a trade is signed between two parties, DLT consensus algorithms could recognise emerging cluster risks and prohibit the exchange of these financial instruments.

Ultimately, this could prevent bank failures. Thus, DLT might avoid depriving investors or depositors that provide bail-in debt, which is usually consumed during the resolution of banks. The pressure experienced by external parties – for example, taxpayers – to spend money to reduce public losses could be averted.

A broad variety of governance schemes is available

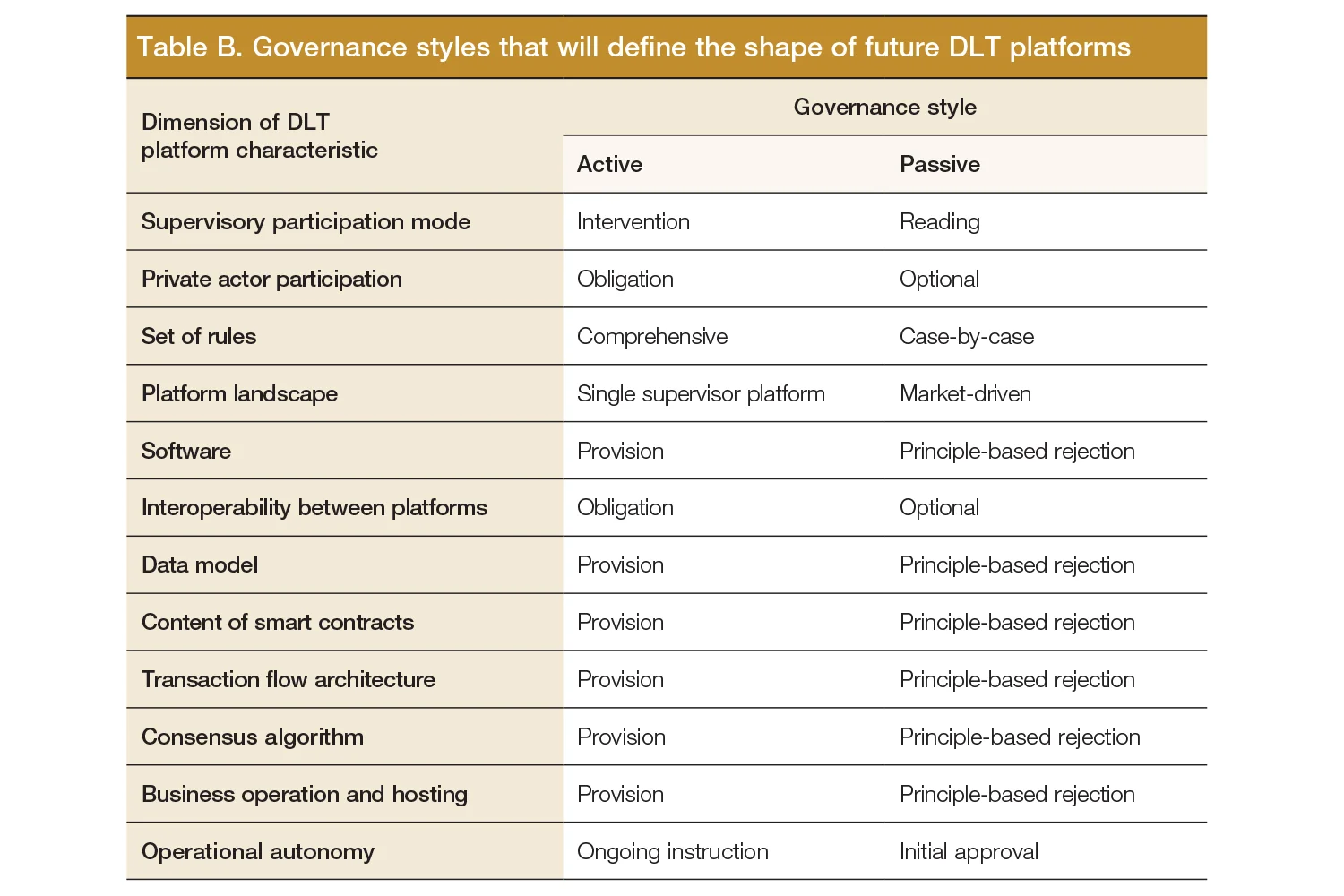

Central bankers and supervisors will not only have to realise the roles they must pursue as organisations, but also decide how to perform them, whether actively or passively. Depending on the assumed governance style, table B compares the shape of DLT architecture with regard to the dimension of possible DLT platform characteristics. For each dimension, manifestation of the two governance styles represents only the most extreme one in a continuous space, leaving room for variants.

Since the governance style can be chosen for each dimension separately, many combinations are possible. Consequently, supervisors may choose from a broad range of governance schemes.

For example, a scheme may be envisaged in which all consortia are allowed to launch distinct DLT platforms that meet certain minimum criteria. Among those could be, for example, the assurance of interoperability across private user platforms or the release of obligatory interfaces to a regulator-provided meta-platform that grants a consolidated view across all underlying platforms. Such a meta-platform could then be used for supervisory purposes, assuring full integrity of the covered market, not tied to a specific DLT solution. This framework may also be extended to cover aspects of proactive monitoring. Underlying platforms may have to provide standardised intrusion points, enabling the regulator to install automated macroprudential backstop rules. For example, these could immediately fire and prohibit trades in a certain market environment or when indirect dependencies within a chain of actors are detected.

This set-up would combine features of a fully supervisor-supplied DLT marketplace and market-driven solutions. In contrast, passive regulators may only demand to approve private platforms based on the adherence to some minimum requirements regarding transaction flows.

Conscientious supervisors recognise their role early

A variety of options determines choice. Thus, the first successful DLT applications today will determine investments in the future. Once investments are made, their initiators will defend them and forces of inertia will evolve. These forces are difficult to overcome at a later point. Without setting early landmarks, supervisors risk private initiatives to determine the shapes of future markets, and supervisors may miss the momentum to guide the market effectively towards the preferred path. To counteract this, a first inevitable measure is to define the supervisor’s role and find a governance style suitable to the local importance of the industry and its supervision.

Many private market actors demand regulators move away from a ‘wait-and-see’ approach and explicitly state their position towards DLT platforms with regard to aspects of financial market regulations and antitrust considerations. Additionally, platform-developing consortia face problems when defining internal decision rules and co-ordinating their actions towards efficient industry standards.

Such coalition building and industry co-ordination problems may ultimately result in DLT becoming a bubble of wasted investments, prompting investors to shy away from supplying software innovation that meets regulators’ expectations. Regulators that formulate standards providing guidance can prevent these co-ordination problems.

Nonetheless, much more is at stake than simply solving these problems. Real practice in accounting depends on manual processes and centralised databases run by the supervised entities themselves – leaving room for conflicts of interest to find their way through, from out-and-out fraud to practical errors. Unfortunately, today’s auditing practices are mostly manual and depend on fallible personal knowledge and private interests. This renders the truthfulness of published accounting numbers much more expensive and therefore more undersupplied than necessary. Accurate balance sheets are at the core of ensuring fair exchange of property in financial markets because accounting figures are the origin of any decision to invest or lend money. Not demanding immutability and integrity of the relevant underlying data points puts property rights in danger. In addition, bankbooks are a source of defining money stock and affect the actual and perceived value of money.

All these current phenomena can be addressed by regulators stepping out of the shadows and actively providing DLT frameworks to the markets they guide. Only then will central bankers and supervisors be able to live up to their promise.

Regulators want to define technology-agnostic rules rather than dictate the use of a specific software. The principles behind DLT serve as a neutral basis from which to start. Automated and infallible consensus algorithms during both set-up and execution of transactions and contracts must guarantee the integrity of data points from inception and across organisational borders. Once a data point is created, its immutability is assured. Thereby a shared but anonymised reality is established, driving fair exchange on markets.

Notes

1. For a first concise public goods definition see R Musgrave and P Musgrave, 1973, Public finance in theory and practice, New York: McGraw Hill, first edition.

2. Our preferred use of the term governance follows O Williamson, 1996, The mechanisms of governance, p.12, New York: Oxford University Press, “…governance is the means by which order is accomplished in a relation in which potential conflict threatens to undo or upset opportunities to realise mutual gains.”

Read the full Central Banking FinTech & RegTech Global Awards 2019 Winners In Focus report

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com