Central Banking Awards 2020

The winners of the 2020 Central Banking Awards

The Central Banking Awards 2020 recognise excellence in a community facing difficult monetary policy and financial stability challenges that will need to be tackled and effectively communicated, while prudently embracing technological change in reserves, financial services, payments, currency management and data.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com

The Central Banking Awards 2020 virtual ceremony

View the trophy presentations and acceptance comments from all the winners recognised in the seventh annual Central Banking Awards

Central Banking Awards 2020: the winners

All the winners in the 2020 Central Banking Awards

Governor of the year: Mark Carney

Carney has played a vital role in managing Brexit risks while driving efforts towards climate, payments and dollar funding reform

Central bank of the year: Bank of Ghana

The African central bank has carried out extensive reform of Ghana’s banking sector

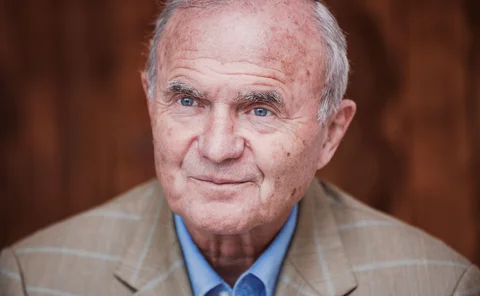

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Reserve manager of the year: Swiss National Bank

New trading capabilities have helped the pioneer of reserves diversification and risk management to better manage liquidity as its portfolio has risen to $825 billion

Currency manager: Bank of Mexico

Central bank invested in new printing plant to address capacity and concentration risks

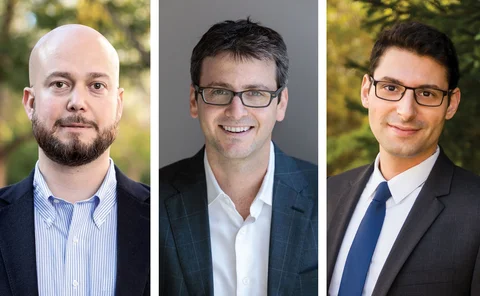

Economics in central banking: Matteo Maggiori, Brent Neiman and Jesse Schreger

The Global Capital Allocation Project has helped pick apart the tangled network of cross-border capital flows. The work may prove essential to those looking to shore up the international monetary system

Risk manager: Central Bank of Brazil

The G20 central bank has made important breakthroughs in applying ERM

Transparency: Reserve Bank of New Zealand

Publication of new MPC handbook and minutes increases RBNZ’s openness

Green initiative: Network for Greening the Financial System

The voluntary body is driving efforts to tackle climate-related risks

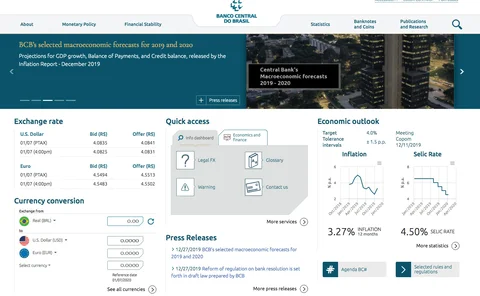

Website of the year: Central Bank of Brazil

The new bilingual site offers enhanced communications to the full range of stakeholders

Payments and market infrastructure development: European Central Bank

The ECB has created a framework to help payments and market infrastructure firms bolster cyber defence that is being disseminated on a global scale

Initiative of the year: Bank of Thailand

The Thai central bank has used two-way communications to support the delivery of major initiatives, including an instant payment system

Communications initiative: Bank of Jamaica

The Bank of Jamaica broke the mould with its reggae-inspired communications strategy, but observers suggest it has done more than just lift the economic literacy of its society

Asset manager of the year: Amundi Asset Management

The French asset manager helped reserve managers meet ESG criteria while also boosting central bank assets under management

Innovation in reserve management: BlackRock

The US asset manager has made great strides in its technology, research and advisory capabilities, allowing clients to implement ESG while preserving financial returns

Global markets award: HSBC

The UK-headquartered bank is a leader in green finance and helped its clients navigate the low-rate environment over the past year

Custody initiative: Euroclear

The securities depository has debuted instant dollar settlement in central bank money outside the US – a service that has virtually eliminated settlement risk

Treasury systems initiative: Calypso Technology

The tech company secured important breakthroughs including with its Maps treasury operations system

Collateral management services: National Bank of Georgia/Montran

The duo developed Georgia’s fully automated new collateral framework

Specialised lending initiative: BNP Paribas

A new ‘global’ setup helped secure US dollar-denominated assets from a Eurosystem central bank

Financial market infrastructure services: Bloomberg

The US company has helped central banks improve monetary operations and deepen forex markets by scaling up technical infrastructure and database monitoring capabilities

Payment services: Swift

The organisation has responded strongly to threats from cyber crime and the decline of correspondent banking

Currency services: Note Printing Australia

Improved IT and data provision helped the Reserve Bank of Australia

Advisory services: Deloitte

The consultancy has shown its strength in a wide range of technological and governance advisory roles in the past year

Data services: Swift

Better data is making global payment chains safer and more efficient