Website of the year: Central Bank of Kenya

Responsive design caters for increasingly mobile public

Kenya is often viewed as a world leader in mobile innovation: 21 million people hold bank accounts with M-Pesa, one of the world's largest mobile money-transfer providers; the majority of its largest commercial banks offer mobile financial services; and many people have mobile medical wallets.

Now these users can access an array of information on the Central Bank of Kenya's website, following a major overhaul of its architecture during the past year to make it responsive. The team comprised five individuals from the central bank: Peter Emanikor; Onesmus Kirimi; Habil Mutende; Grace Okara; and Loice Wafula.

"As the number of mobile users increased, there was an ever more pressing need for us to update our website as one of the glaring gaps in our old site's design was its unsuitability for mobile devices," says Wafula, head of organisation development at the Central Bank of Kenya. "It was crucial for us to address this issue, and what better way to celebrate the bank's birthday than by giving its image a facelift?"

The revamped site went live on September 11, 2016, just in time for the central bank's fiftieth anniversary celebrations. The eventual solution combined elements of the old portal with several additions, including a new grid format, which is viewed as international best practice in responsive web design.

"The new website has been developed to allow for a creative and functional user experience, drawing from feedback on user/stakeholder expectations," Wafula adds.

Bank staff at the new website’s launch

Bank staff at the new website’s launch

Before embarking on a redesign, the central bank asked public users and other stakeholders about weaknesses in its existing website. The surveys revealed that despite being functional, the site lagged behind several regional peers due to its cluttered homepage, which many found unappealing.

In May 2016, a decision was taken to overhaul the site. The central bank's in-house design team worked with an external consultant to solve the weaknesses revealed during the stakeholder engagement exercises. The team then submitted three designs to the central bank's top management, with a final one chosen in July and given to the IT department for implementation.

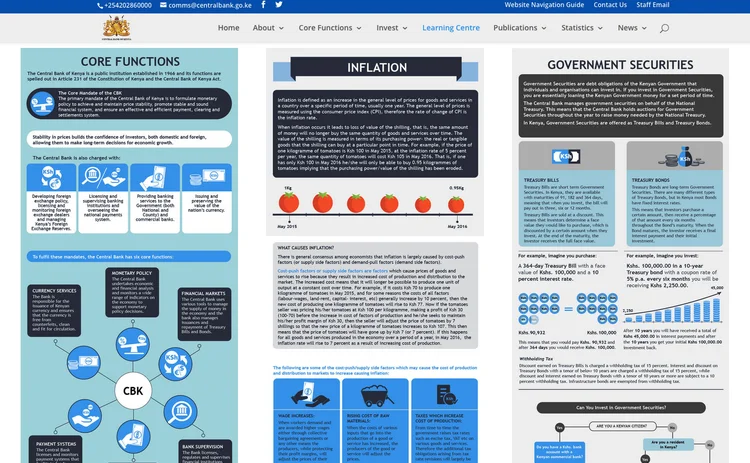

The redesign looks modern and clean, and it is easy to scan, while remaining attractive. The layout of the homepage aims to fast-track access to the most frequently sought-after information and leads to subpages located in a right-hand navigation panel. Hosted by Safricom Telecommunications, the new website is fully responsive and can be used on all devices, including mobile phones and tablets.

"We hope mobile devices will particularly benefit from the new design, thanks to the extensive use of images, which are both visually appealing and linked to various parts of the site map," says Wafula.

The bank decided in May 2016 to overhaul the site

The bank decided in May 2016 to overhaul the site

The design was based on the feedback from stakeholders, whose behaviour dictated which sections of the site were given priority. Convenient new tools, such as key rate tables, have been included on the side navigation panel, while spotlight and news sections direct users quickly to recent information – all have been given prominence on the homepage.

"Although we did not engage with other central banks directly, we did examine the websites of those we felt were internationally recognised," said Wafula. These included the sites of the Bank of Canada, Bank of England, Reserve Bank of New Zealand, Sveriges Riksbank and the South African Reserve Bank.

Public engagement

One recommendation from the stakeholder survey was for the Central Bank of Kenya to engage more with the general public, who were having difficulty understanding its mandate and how this affected their lives.

"We saw how other central bank sites had adapted economic data into simplified rhetoric and wanted to recreate that," Wafula explains.

The redesign also adopts infographics, which form a major part of the Reserve Bank of New Zealand's website. "The infographics help translate the mandate of the bank to a younger audience. We thought this was a very innovative design element and wanted to recreate it."

Stakeholder feedback also indicated that members of the public repeatedly search for information on investment opportunities. As a result, the redesigned website now has an 'Invest' section, linking users to investment opportunities in government securities and to the Kenyan Investment Authority, where additional details can be obtained. Information on government securities has also been given more prominence on the homepage.

We hope mobile devices will particularly benefit from the new design, thanks to the extensive use of images, which are both visually appealing and linked to various parts of the site map

Loice Wafula, Central Bank of Kenya

The relaunch was a bank-wide event, with each department responsible for making sure the content in each relevant section was accurate, liaising with the IT team if there was an issue.

L to R: Peninah Kwamuma, Diana Kiget and Godfrey Putunoi

L to R: Peninah Kwamuma, Diana Kiget and Godfrey Putunoi

"We were guinea pigs," says Wafula. During beta testing, certain members of the bank were given access to the redesign, allowing it to be tested across all devices. Once the revamp gained the green light from all departments, the IT department received the go-ahead to make the switch.

"The transition was a quick one. There was no downtime during the swap over – as soon as we were given the green light, it took less than a minute for us to switch the systems over," says Habil Mutende, head of the bank's IT department. Since the relaunch the central bank has seen the number of page views increase by more than 180% from 370,000 per week to over 1 million.

The Central Bank of Kenya has also noted a change in the feedback it has received. "While a few users had challenges finding information due to the rearrangement of content, previous queries that inundated the bank's inboxes – for example, how to calculate interest on government securities – have diminished," says Wafula.

A prominent guide at the top of the homepage has since eliminated any navigation concerns.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com