Geopolitical risks to reserve adequacy: 2024 survey

Geopolitics are heightened going into 2025. Twenty-four reserve managers reveal their strategies.

A survey of 24 institutions, conducted by Central Banking, delved into global geopolitical risks and their significance for central bank balance sheets and foreign exchange reserves. Reserve managers identified the US elections as critical. US foreign policy will shape the trajectory of conflicts, with consequences for oil prices, supply chains and global inflation.

Officials from emerging markets said capital flight towards safe-haven markets may put pressure on reserves. Some central banks have already positioned themselves for this eventuality and expect their investments to increase in value.

Geopolitical shocks raise the possibility of higher commodity prices. An increase in inflation may lead to rate hikes, higher yields and a longer restrictive monetary policy stance. On the asset side, “higher yields might contribute to negative mark-to-market valuations for fixed-income instruments”. On the liability side, “higher domestic interest rates might become a burden”.

Reduced business confidence and investment can also negatively impact a central bank’s marked-to-market fixed-income portfolio if yields continue to rise, though this risk can also be marginally mitigated by carry. Risk aversion can compromise equity and credit holdings while supporting gold holdings.

Due to possible liquidity issues and currency depreciation triggered by geopolitical risks, central bank balance sheets and reserves may also be affected through the “deployment of reserves through purchasing programmes or interventions” and expansion of the balance sheet.

Key findings

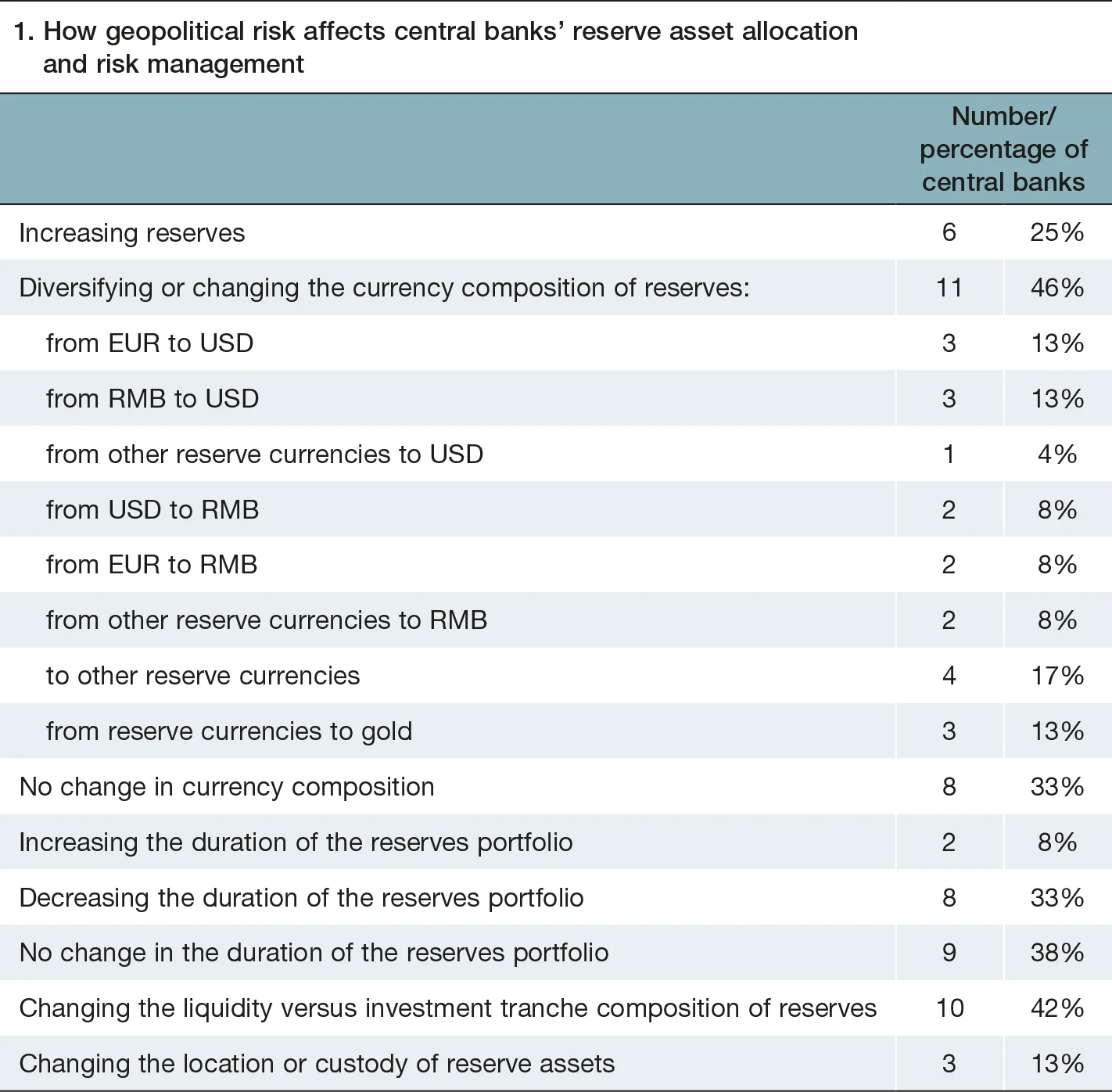

- One-quarter of respondents (six central banks, 25%) said they are increasing reserves in response to geopolitical risks.

- Almost half of respondents (11 central banks, 46%) said they are diversifying or changing the currency composition of their reserves.

- 42% of respondents (10 central banks) said they are changing the liquidity versus investment tranche composition of reserves.

- A similar proportion of reserve managers said they are cautiously decreasing the duration of their reserves portfolio (nine central banks, 38%).

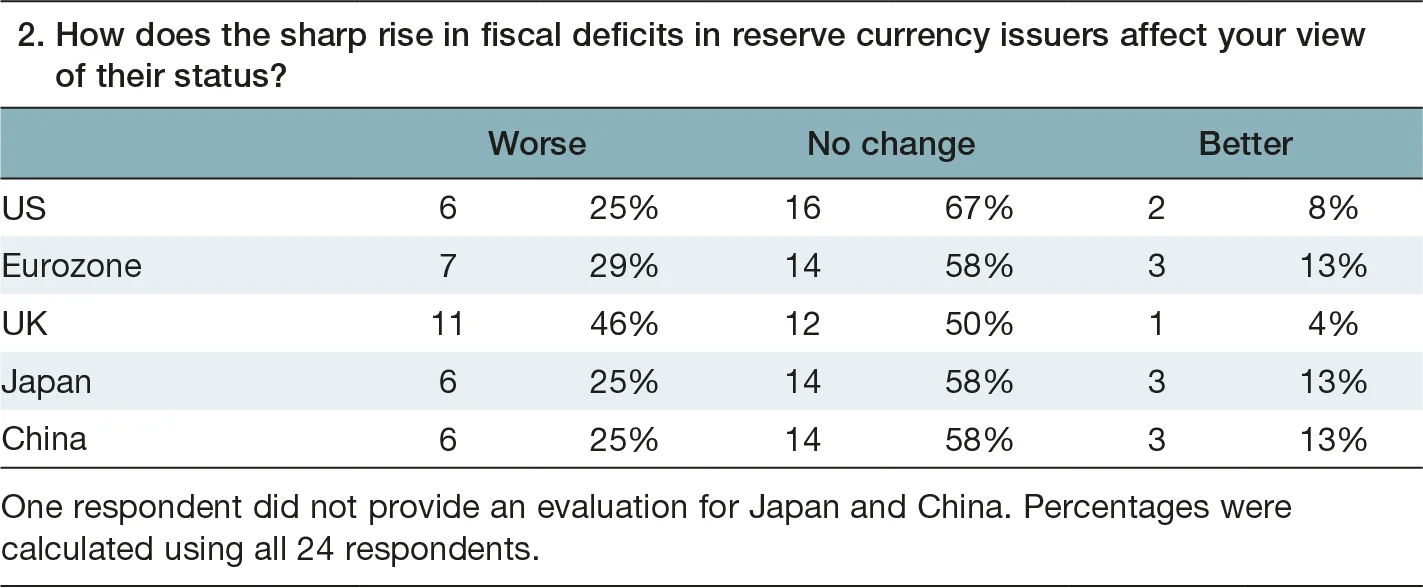

- Most respondents do not see any change in the status of the US as a result of the sharp rise in its fiscal deficit.

- 17% of respondents said they are diversifying or changing the currency composition of reserves to currencies other than the US dollar or renminbi.

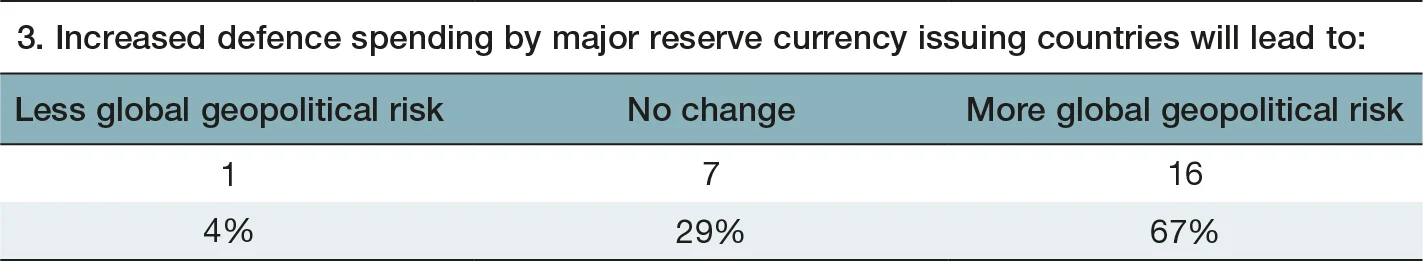

- A clear majority of respondents – two-thirds – said they expect increased military spending by major reserve-issuing currencies to increase geopolitical risks.

- Highlighting the cyclical nature of escalation, “global geopolitical risk will lead to increased defence spending”, a reserve manager in the Middle East said.

Data and methodology

Central Banking conducted the Geopolitical risks survey in May and early June 2024. Twenty-four central banks participated. There were four respondents each from Africa, the Americas and Asia-Pacific, six in the eurozone and three from non-eurozone European countries, as well as three respondents from the Middle East. Eight respondents are from high-income jurisdictions, nine from upper-middle, seven lower-middle and none from low-income countries, as classified by the World Bank. Of these, 17 (71%) are classed as emerging and developing economies by the International Monetary Fund, and the other seven (29%) are advanced economies. Respondents shared data on condition of anonymity.

How regularly does your central bank review its strategic asset allocation (SAA)?

Most central banks review their SAA annually (19 central banks, 79%). Four central banks review every 2–5 years. Just one said it reviews every six years or more.

Geopolitical risks and their impact on balance sheets and reserves

Geopolitics affects economic performance directly and indirectly through different channels: financial, trade and commodities prices.

The Central Banking survey requested written responses about the most important economic scenarios reserve managers are preparing for that might materialise as a result of geopolitical risks, and how these may impact their central bank’s balance sheets and reserves.

US elections risk, US dollar strength and US-China relations

“The most important economic scenario we are preparing for is political risk,” a reserve manager in the eurozone told Central Banking.

In terms of dollar strength, a weak US dollar “can have a negative impact on our investments”, a Europe-based official said. Because of this risk, the central bank diversifies its portfolio “by investing in other currencies”.

However, an Americas-based reserve manager explained how a strong dollar can be a double-edged sword. On one hand, a strong dollar “will increase the value of our reserves measured in local currency, improving our balance sheet”. On the other, the dollar-return of the reserves would be lower “due to other currencies’ depreciation”. Officials also pointed to FX volatility as a risk, as well as financial investment volatility.

In terms of economic foreign policy, officials from across the Americas, Europe and Africa pointed to the risk of US-China strategic competition compromising supply chain integrity and triggering macroeconomic shocks. Consequent FX fluctuations may cause “difficulties in operations with currencies and bonds”, a reserve manager at a central bank in the Americas said.

On the US-China trade war, a Europe-based official expects the US “protectionist economic policy against China” – imposing additional tariffs and barriers on imported inputs and goods – will be more severe under Donald Trump.

A reserve manager in the eurozone pointed out that “the war in Ukraine and conflicts in the Middle East are also related to the future US presidential election results because the US plays a key role in geopolitical risk management”.

War, energy prices, supply chains and inflation

Geopolitical conflicts affecting energy supply routes and sources can lead to energy shortages or price spikes. Reserve managers in the Middle East, which produces around one-third of the world’s oil, commented on risks around oil prices: “flight to quality” can have a positive effect on reserves for those already holding safe-haven assets, but a downside shock in oil prices “may have internal monetary policy consequences”, an official said.

Central bankers in other regions also raised concerns about the impact of higher oil prices and energy security.

“Being a developing, import-driven nation, we would be negatively affected by any adverse rises in oil prices and other related imports,” a reserve manager at a central bank in Asia-Pacific (Apac) said. Disruptions to supply chains and the growth of trading partner countries could lower export demand. In terms of reserve management, because the central bank assists local banks in meeting their foreign currency positions, “sustained outflows, or a decrease in inflows, will put downward pressure on reserves”.

To deal with “fluctuations in the prices of oil, natural gas and minerals because of geopolitical tensions” such as “sanctions, trade wars or conflicts in key producing regions”, an Africa-based reserve manager said it was building “strategic reserves”. Another reserve manager said it was also prepared to use reserves in anticipation of “tight liquidity” that “may spark from geopolitical risks”.

If regional war breaks out, “higher inflation and, consequently, higher rates will produce a negative impact on our balance and lower reserve levels,” a Europe-based official said. If the escalation of war is accompanied by lower growth and higher inflation, the impact on the balance sheet and reserves “is more complicated to evaluate”, and will depend on the monetary policy decisions of other central banks.

How does geopolitical risk affect your reserve asset allocation and risk management?

One-quarter of respondents (six central banks, 25%) said they were increasing reserves in response to geopolitical risks. Almost half of respondents (11 central banks, 46%) said they were diversifying or changing the currency composition of reserves as a result of geopolitical risks.

Globally, the most common shift was to currencies other than the US dollar or renminbi (four central banks, 17%).

Another striking result was that two in five respondents (10 central banks, 42%) said they were changing the liquidity versus investment tranche composition of reserves. A similar proportion of reserve managers said they were cautiously decreasing the duration of their reserves portfolio (eight central banks, 34%).

A relatively small, but noteworthy, number of central banks in the sample have changed the location or custody of their reserve assets (three central banks, 13%).

How does the sharp rise in fiscal deficits in reserve-currency issuers affect your view of their status?

At the end of 2023, China’s GDP-to-debt ratio reached 289% and Japan’s was 252%, followed by the US at 123% and the UK at 101%. The eurozone average was 89%. Meanwhile, the US deficit in 2023 was $1.7 trillion, China’s hit $690 billion but Japan’s reached a staggering $9.2 trillion in March 2023 – around 43% of which is held by the Bank of Japan.

Nonetheless, most respondents (16 central banks, 67%) do not see any change in the status of the US as a result of the sharp rise in its fiscal deficit, which has already hit highs of $1.9 trillion at the time of writing in October 2024, nor indeed in any of the other reserve currencies. The outlook for the UK was most likely to be viewed in a negative light, with just under half of respondents (11 central banks, 46% ) reporting that their view of its status has worsened. However, a majority of respondents – 14 central banks, 58% – did not think deficits in the eurozone, Japan and China affect their status, and half did not change their view of the UK’s status.

Reserve managers presented a range of views, which change depending on future US growth. The sharp rise in the fiscal deficit contributes to the US’s “continued status as the world’s primary reserve currency”, due to strong economic fundamentals and global trust in US financial systems. However, inflationary pressures and increased borrowing costs risk “erosion of confidence in the US dollar” if US debt is perceived as unsustainable.

“While we recognise these countries’ deficits – especially for the US – may impact their long-term standing as a reserve currency, we do not plan to change allocations for the time being,” a reserve manager at a eurozone central bank said. “While fiscal discipline is important, these nations are large, important economies, so debt levels may not materially impact their status when compared with other nations,” an Apac-based reserve manager agreed.

The picture for the eurozone is more complicated. An Africa-based reserve manager said that, while some countries “may benefit from fiscal stimulus boosting economic growth”, there is a “mixed impact, as member states have varying levels of fiscal health” – “stronger economies might offset concerns about weaker ones”. Nonetheless, there is a “risk of increased debt levels leading to financial instability in certain member states, potentially affecting the euro’s stability”.

What could increased defence spending by major reserve currency-issuing countries lead to?

US military spending in 2024 leapt from $1.52 trillion to $2.1 trillion. “In 2024, European allies of the Nato military alliance will invest a combined total of $380 billion in defence. For the first time, this amounts to 2% of their combined GDP,” Nato secretary general Jens Stoltenberg said in February 2024. Chinese government figures put defence spending at just 1.67 trillion yuan ($231 billion), though unofficial estimates put it at twice that. Japan approved a record ¥8 trillion or $56 billion defence budget for fiscal year 2024. A majority – two-thirds – of respondents said they expected increased military spending by major reserve-issuing currencies to increase geopolitical risks.

Many reserve managers said increased defence spending by major powers could lead to an arms race and heightened global tensions. The “proliferation of arms can potentially increase the flow of weapons into unstable regions” and “shift global alliances and geopolitical strategies”, an Africa-based reserve manager said. Global shipping lanes and trade routes described as “crucial” for oil exports may be disrupted by military conflicts or heightened naval presence. “Disruption in trade can lead to economic instability and affect FX earnings, increasing economic vulnerability.”

“Increased defence spending will result in higher fiscal deficits, which represents a risk factor for the global economy in the medium term”, a reserve manager at a European central bank agreed.

An official in the Americas added that “in a deteriorating global security landscape”, increased defence spending may also lead to a more severe “action-reaction spiral in conflicts”. On the cyclical and reinforcing nature of geopolitical risk, “global geopolitical risk will lead to increased defence spending”, a reserve manager in the Middle East said.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com