RBA hits out at further delay to new clearing system

Blockchain-based system for Australian Stock Exchange won’t be operational until at least late 2024

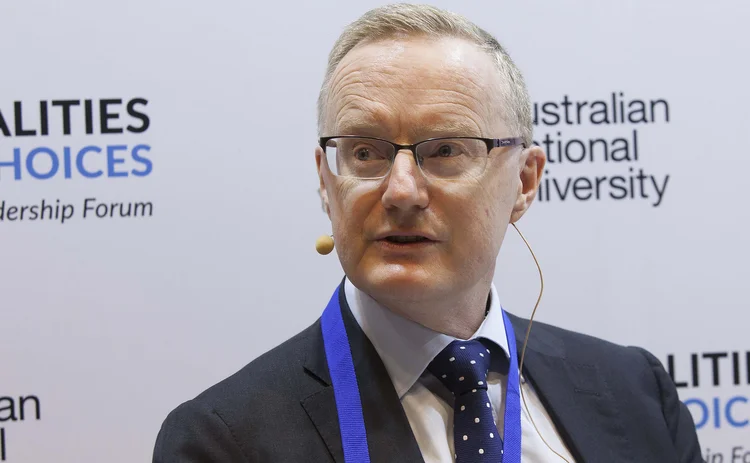

The Australian Stock Exchange has further pushed back the launch of its new clearing and settlement system till late 2024, prompting criticism from Australian financial regulators including central bank governor Philip Lowe.

Currently, ASX uses the Clearing House Electronic Subregister System, or Chess, to record shareholdings and manage equity transactions in Australia. The Chess system was introduced in 1990s.

ASX and its partner Digital Asset found that “more development” is need than was

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com test test test

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com test test test