‘Brace, brace’: quants say soft landing is unlikely

Investors should prepare for sticky inflation and volatile asset prices as central banks grapple with turning rates cycle

“A lot of investors are getting carried away by the hope that there will be a soft landing. We’re not buyers of that,” says Jan de Koning, portfolio manager of quantitative equities at $200 billion asset manager Robeco.

Nor are plenty of others in the quant investing community.

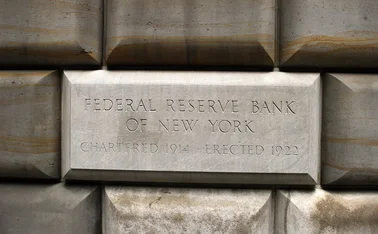

A soft landing, or a gradual slowdown in major economies, involves central banks raising interest rates just enough to tame inflation but not so much as to spark a damaging recession. Pull the lever too far in one

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com test test test

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com test test test