Eurozone

Forecaster surveys improve eurozone inflation modelling – ECB paper

Households’ and firms’ expectations do not provide useful data on inflation

Securities lending prevalent in European central banks

Monetary policy, market maturity and currency variation may limit adoption in other regions

SSM reduced large eurozone banks’ risk-taking – ECB paper

Reduced credit risk was driven by supranational authority’s greater efficiency, authors argue

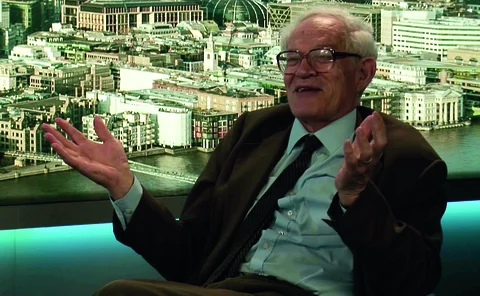

Goodhart, Gopinath and Lippi disagree on inflation

Central banks lack tools to deal with inflation, Goodhart warns, but IMF chief economist disagrees

ECB climate stress test reveals uneven risks across eurozone

First step in ‘climate roadmap’ assesses 1,600 banks and over four million firms

ECB’s stress capital buffer still a ‘black box’ – banks

National regulators retain wide latitude to set Pillar 2 Guidance under new rules

NPLs down in nearly 70% of jurisdictions, despite Covid-19

Lower income nations hit harder than most during past five years; Asia, Africa and Americas NPLs on different trajectory to Europe

People: ECB appoints director-general for international relations

Vansteenkiste replaces veteran Klöckers; head of IMF’s capacity development institute retires

Press conferences tend to be held for every monetary policy decision

The events can be a valuable tool for policy transparency and clarity

Lending rate rigidity weakens eurozone monetary policy – BdF paper

Asymmetric costs in changing bank lending reduce effects of looser policy

Asset purchase programmes prevalent among advanced economies

But just 17% of emerging market economies said they operate a purchase programme

ECB council divided on forward guidance, minutes show

Some senior officials argued new formulation risks inflation overshooting

An assessment of the ECB’s strategy review

A number of aspects of the new framework raise challenges for implementation and credibility, while the inclusion of climate change may politicise the institution, writes euro architect Otmar Issing

Three ways to bolster flawed AML/CFT in the EU

The EU needs to significantly improve the structure and resourcing of its AML/CFT oversight if it really wants to combat illicit money flows, write Panicos Demetriades and Radosveta Vassileva

Benoît Cœuré on CBDCs, stablecoins and central bank fintech co-operation

BIS Innovation Hub chief voices concerns about the timing of stablecoin and CBDC roll-outs, fintech risks for supervisors and monetary policy, and details development plans for eight innovation locations

Don’t dismiss inflation risks but don’t overreact, say central bankers

Sbordone, Smets and Vlieghe weigh up challenges for central banks in the “return towards normal”

Cash infrastructure as public good – implications for the cash cycle

Efforts are under way in the Eurosystem to safeguard cash infrastructure as a ‘public good’ even as transaction volumes have fallen significantly. How can policy-makers strike the right balance?

ECB paper measures economic uncertainty in eurozone

Researchers present method to monitor changes in uncertainty in eurozone and its trading partners

Zhang Tao on the IMF’s fintech agenda, CBDCs and big tech oversight

IMF deputy managing director speaks about the fund’s perspectives on CBDC operating frameworks, regulating big tech and macrofinancial oversight in a digital world

‘Giant of the field’ Robert Mundell dies

The Nobel laureate influenced a generation of economists via the Mundell-Fleming model

Mário Centeno on monetary-fiscal interaction in the eurozone

Bank of Portugal governor says ECB is not being overrun by former finance ministers, must improve the definition of its inflation target and has no need for yield curve control. Centeno believes NextGenerationEU fund could serve as template for a future…

Monetary unions might benefit from taxing external debt – DNB paper

Policy would reduce adverse effects of shocks to risk premia on sovereign debt, researchers find

Ulrich Bindseil on the launch of the digital euro

The ECB’s director-general for market infrastructure and payments speaks about the functionality, tiering approaches, privacy policies, ledger technology and ecosystem impact of the eurozone's planned CBDC

ESM to become backstop to Single Resolution Fund

Revised treaty enhances fund’s role in future adjustment programmes and crisis prevention