Communication

RBNZ’s Hannah: central bank is working to close trust gap

Survey in 2014 showed how poor public understanding of the central bank’s work went hand in hand with low trust

BoJ’s Iwata says expectations likely to shift as inflation returns

Deputy governor cites Milton Friedman in arguing that people will become more forward-looking when their wages are eroded by inflation

Bank of Canada prepares to open redesigned museum

Museum set to reopen in July after “complete reimagining”, including interactive exhibits on the central bank’s mandate, inflation-based games and a two-tonne “Yap stone”

Riksbank claims rate forecast success, despite inaccuracies

Study of 10 years of repo rate forecasting concludes it is a useful tool for setting and communicating policy, although forecasts “have not been particularly accurate”

Brainard turns cautious on inflation concerns

Lack of wage growth and lower than expected inflation data could slow further monetary easing, says Fed governor; interest rates are likely to rise “soon”

Tackling the ‘human agency’ problem

Central banks are readying their communication strategies to mitigate a populist backlash against their post-crisis policies

The BoJ’s risky yield curve control experiment

The Bank of Japan’s experiment with yield curve control could work if appropriate targets and communication strategies were applied. But its current policy objectives are muddled

Norges Bank board to meet more and publish minutes

Governor Øystein Olsen says the Norwegian central bank is looking to be more transparent around monetary policy; the executive board holds the key rate at 0.5%

Bank of Lithuania tailors new website to different audiences

Central bank launches redesigned website with the aim of making it easier to use; includes new sections designed for specific audiences while data presentation received overhaul

Bank of Canada’s Vardy and Harrison on the move to ‘peacetime’ communications

Central bank has reshaped its communications approach post-crisis, embedding it into the policy process and encouraging markets to think for themselves

No ‘taper tantrum’ this time around – Fischer

Fed vice-chair says US central bank has learned from mistakes made in 2013; markets unlikely to face same disruptions as Fed unwinds balance sheet, says Fischer

Volatile housing market puts RBA under pressure

Variations in housing growth and prices ramp up risk to financial stability, RBA minutes show; regulator to consider further measures “if needed”

BoE’s Vlieghe: good policy is more than accurate forecasting

MPC member says doctors cannot forecast heart attacks, but are still pretty useful before and after the event

Uncertainty matters for forward guidance success – BoE paper

Authors show that introducing uncertainty generates significantly different macroeconomic effects, with implications for policymaking

Haldane: central banks could ‘gamify’ communications

The game Monopoly could be the next tool in central bank’s communication toolbox, Haldane says, warning complex language breeds distrust

Bank of Israel revamps policy communications

New approach to communicating monetary policy decisions as committee moves to an eight-meeting cycle

Federal Reserve publishes its first fan chart

Fed unveils new communication method as Janet Yellen makes clearest statement yet that a March hike is on the table

Pace of Brazil's monetary easing could increase, minutes show

Copom says evolution of economic performance and the level of the structural interest rate will dictate pace of easing cycle; fiscal policy could reduce structural interest rate

Fed needs quarterly monetary policy report, Bullard says

St Louis president argues for better Fed communication when it comes to monetary policy decisions; a quarterly report would align the US with international best practice

Shafik calls for candidness on uncertainty in her final speech

Outgoing Bank of England deputy says central banks must do more than just increase transparency if they are to restore trust

Fed could raise rates ‘fairly soon’ – minutes

Minutes show committee members will be watching labour and inflation data very closely; raising rates would offer “flexibility” in responding to economic changes

Uncertainty about momentum in the labour market – RBA minutes

“Mixed” picture in Australian labour market shows unemployment increasing alongside full-time employment; spare capacity likely to persist “for some time”

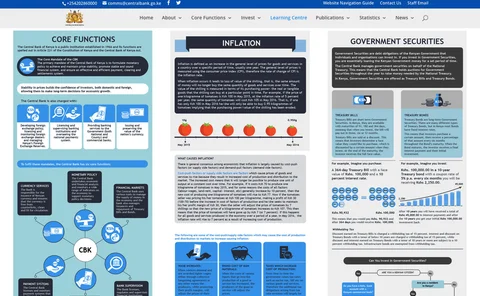

Website of the year: Central Bank of Kenya

The East African central bank has embraced responsive design to cater for an increasingly mobile audience, eclipsing the websites of many peers

Transparency: Bank of Canada

Communications embedded in the policy process, fresh thinking on shared content and an expanded senior team show the central bank’s commitment to staying at the leading edge of transparency