Interest rates

Yield curve inversion still tends to signal trouble ahead – Fed economists

The term spread has a “strikingly accurate record” for forecasting recessions, and this time looks to be no different, say researchers

Tunisia raises rates by 75bp to tackle inflation

First hike under new governor comes as prices rose year-on-year by 7.1% in February

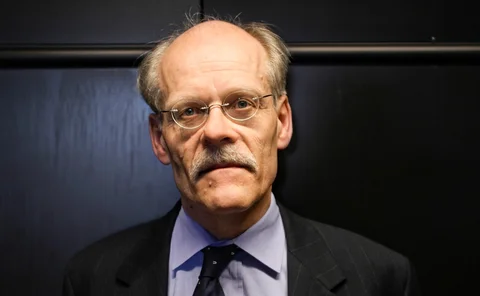

Low rates likely to persist in global economy, Riksbank’s Ingves says

Inflationary pressures remain weak, governor says; economic growth is a prerequisite for higher price pressures

Financial regulation powers pose new threats to central banks – Kganyago

Emerging markets are better equipped to deal with capital flows, Sarb governor says

NY Fed paper studies when government should issue safe assets

Model implies only under certain situations should the government issue new debt; changing inflation target might be superior

Norway lowers inflation target and changes policy mandate

The new mandate emphasises the need for high employment and financial stability

Indonesian deputy nominated for governor’s role

Perry Warjiyo needs confirmation by lawmakers

Fed’s Powell expects strong US growth

Robust labour market likely to support income and consumer spending rises, Fed chair says

Philippines advances with policy implementation revamp

The Central Bank of the Philippines is looking to cut its reliance on reserve requirements and move towards an interest rate corridor

Fed paper examines financial spillovers of US monetary policy

Authors find that conventional and unconventional policies create different spillover effects

Fed anticipates higher growth and tighter policy

Policymakers consider the latest economic data warrants the continuation of gradual policy normalisation

MAS aims to move OTC derivatives trading to ‘organised market’

As much as 80% of interest rate swaps in Singapore would have to be executed on exchanges or other centralised trading facilities

Italian consumer lending more risk-priced post-2008 – paper

Institutions tightened lending to consumers based on household factors

Philadelphia Fed’s Harker forecasts only two hikes in 2018

Despite stronger growth and lower unemployment, inflation remains too weak

Explicit wording sought to jolt market expectations, says Carney

Bank of England governor says committee was unusually explicit ahead of November hike to encourage markets to wake up to its signals

A changing of the guard

Risks emerge amid leadership changes at the US Federal Reserve Board and the People’s Bank of China

BIS paper uses ‘shadow rate’ to study market expectations

Fan Dora Xia and Jing Cynthia Wu find they can estimate expectations over a longer horizon by using a shadow rate term structure model

NY Fed paper measures global capital flow pressures

The authors’ method allows them to estimate how sensitive countries are to changes in global risk aversion, as well as overcoming problems with capital flow data

Canada effecting a cautious normalisation – deputy governor

Uncertainties related to trade, high debt levels and slower growth may delay new rate hikes

Higher inflation in the US pushes up yields

The headline consumer price index rose by 2.1% year on year

Implementing a holistic and dynamic risk budget

The National Bank of Denmark has implemented a dynamic risk budget that takes the bank’s unavoidable policy risks as the point of departure. The new approach has led to a reassessment of investment exposures and how they are rebalanced over time and…

Riksbank leaves rates unchanged as inflation remains contained

Deputy governor Henry Ohlsson dissented and advocated raising rates by 25 basis points

Mester advocates continuing 2017 rate path this year

Cleveland Fed president says the current policy balances inflation and growth risks

Powell faces balancing act as normalisation proceeds

New Fed chair likely to continue policy normalisation even as market volatility tests his resolve