Debt

Swaziland central bank needs macro-prudential powers – IMF

Fund urges authorities to fast-track reform to give central bank financial stability mandate; reliance on customs union leaves economy vulnerable

Housing reform ‘will stabilise’ market – Danish central bank

The new taxation system aims to reduce price volatility by 20% and stem rising house prices in cities

Australian first-home buyers have better finances, study finds

RBA research paper finds fewer people are transitioning from renting to owning houses, but those who do tend to be more financially stable

Riksbank: housing market is a ‘serious threat’ to stability

Swedish central bank welcomes amortisation proposals, but says further measures may be needed

Q&A: Asia’s caught in the Basel crossfire – Andrew Sheng

Veteran regulator says international standards may be the wrong medicine for emerging markets

PBoC offers reassurance on market liquidity after large-scale bond operation

Rollover of special government bonds will not have significant impact on liquidity, PBoC says; bonds were issued to finance China's sovereign wealth fund

BSP launches reforms to spur domestic debt market growth

The country aims to develop its domestic capital market to finance its massive infrastructure program; reforms will be undertaken over a period of 18 months

BoE’s Saunders says public is ready for rate hike

External MPC member denies hike would negatively impact household spending, noting inaction could leave the central bank behind the curve

Future Fund takes cautious stance despite strong returns

Australian sovereign wealth fund exceeds benchmark return but managers stress need for “discipline” amid reach for yield

Tougher action needed on China debts – research body

Asean research office says corporate debt needs close monitoring, even if immediate crisis is unlikely

Draghi’s ‘whatever it takes’ is not credible – Nobel laureate

Chris Sims says ECB cannot be sure it will be able to stop a run on the euro until it is backed by a central eurozone fiscal authority

Opaque money markets work well, Nobel laureate says

Bengt Holmström says policymakers should not try to make money markets more transparent

Archive – EMU: a sceptical US view

Allan Meltzer of the American Economic Association explains why he is worried about a union by the back door; first published in November 1997

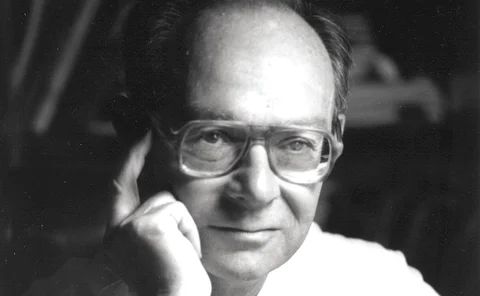

Archive – Interview: Allan Meltzer

Robert Pringle talks to Allan Meltzer, Carnegie Mellon professor and chair of the US Congress’s International Financial Institution Advisory Commission (the “Meltzer Commission”); first published in February 2003

China’s current credit trajectory is ‘dangerous’, IMF warns

Fund revises up China’s GDP growth forecast, but warns debt-fuelled growth is unsustainable

The changing composition of central bank balance sheets

Quantitative easing may have been necessary, but it has created worrying distortions and has probably discouraged structural change, while deflecting attention away from ever-greater levels of debt leverage

Serbia’s Tabaković deems NPL action plan a success

Proportion of NPLs has fallen by 6% since 2015, says governor

Banks’ funding plans need ‘careful monitoring’, EBA says

Planned increase in MREL issuances in 2018–09 may cause problems, report warns

IMF designs new instrument amid rise of regional financing

The “policy co-ordination instrument” is designed to allow the fund to offer technical support to countries looking to unlock funding from regional arrangements

Jaime Caruana defends pre-crisis record as Bank of Spain governor

Former governor says ultimate responsibility was on the “deficient” management of the regional savings banks, which relaxed their lending standards

Fiscal challenges a worry for Trinidad and Tobago – report

Central bank cites rising debt and failed fiscal consolidations as reasons for ratings downgrade that could make borrowing costs higher on international markets

RBNZ considers cutting contingent instruments from capital regime

Central bank casts sceptical eye over debt instruments with in-built conversion triggers, following recent problems in Europe

EBA study quantifies impact of IFRS 9

Report finds smaller banks are likely to see a heavier capital impact from new accounting rules; Basel Committee paper says a mix of forward- and backward-looking rules may work best

Yellen warns of debt impact on productivity

Fed chair states in “strongest possible terms” that the current spending by the US government is unsustainable and could harm productivity