Basel III

Basel action needed before ‘regulatory cycle’ turns

Failure to reach a deal raises the risk of more entrenched protectionist positions

RBNZ to rethink capital requirements

Review will reassess country’s approach to Basel III implementation, after Australia decides to bolster its banks’ capital to be “unquestionably strong”

Basel capital surcharges are too low – Fed paper

Authors argue current Basel standards are not enough to guard against the failure of a global bank, particularly those reliant on short-term funding

BoE acts to tackle disparity in capital requirements

PRA plans measures it believes will boost competition and address adverse incentives generated by the standardised approach to calculating risk weights

Basel III LCR affects RBI monetary operations – paper

Liquidity coverage ratio affects the central bank’s operational target via its impact on the unsecured overnight money market

Basel III has aided system stability, interbank models suggest

Model predicts future crashes will not be total wipeout

Only struggling banks cut lending to raise capital ratio – IMF paper

Study of Eastern Europe says banks' strategy matters when it comes to assessing the impact of Basel III; only banks with low profitability cut lending to meet requirements

RBNZ presses ahead with dashboard plan, despite bank concerns

Banks raise fears over the dashboard plan to publish disclosures on RBNZ website, but the central bank says it believes it can address all the concerns

Basel capital floors are necessary – Riksbank’s af Jochnick

Internal models have led to doubts over true capital adequacy, Riksbank deputy says, so floors have an important role to play

Regulations and QE impacting repo market – ECB’s Mersch

Executive board member says “confluence of factors” has boosted demand for collateral and impaired its supply, but the situation may improve

Completing reform agenda may not be enough – Caruana

BIS chief urges continuous effort to finish reforms, but says they need to be backed by policies that raise earning and debt-repayment capacities

Basel III completion date pushed back

Governors and heads of supervision to delay meeting that would have given final approval to Basel III, as disagreement continues on output floors

Lars Rohde on negative rates, pegs, productivity and resolution

The National Bank of Denmark governor speaks to Christopher Jeffery about the productivity paradox, defending currency pegs, unexpected limits for negative rates and addressing too-big-to-fail

Rohde criticises Italy's calls for BRRD special treatment

Danish governor believes the forceful implementation of Europe’s new bank resolution rules represents a “game-changer”; laments Basel’s shift from risk-based regulation

Kganyago warns of ‘importing structural instability’

Sarb governor highlights impact of global banking regulation on South African economy, as Barclays prepares to pull out of the continent

French governor sees outlines of possible Basel III deal

Internal models will still regulate some portfolios, governor predicts; output floors still a matter for “debate”

Basel III challenging to implement in Islamic countries – Kuwait’s Al-Hashel

Central bank governor says discretion for Islamic systems, “though well-intended”, could create divergence and opportunities for regulatory arbitrage

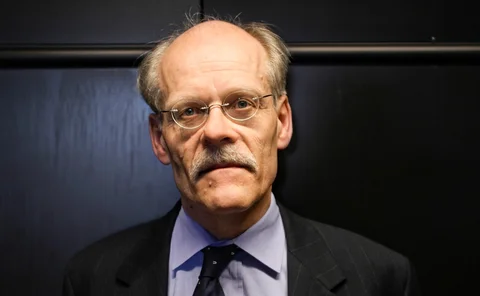

Ingves: internal modelling may create too much complexity

Basel Committee chair says complexity created by internal modelling has a range of adverse effects, though more research is needed

Should banks hold cocos or other kinds of buffers?

Richard Heckinger examines the merits of contingent convertible bonds vs other instruments for meeting regulatory requirements

Deal on output floors and op risk approach likely – Ingves

Revised standardised approach to credit risk will be “capital neutral” and more compatible with IRB

Bundesbank board member takes hard line on Basel negotiations

German central bank “not prepared to reach an agreement at any price”; calls for no universal output floors and abandonment of advanced approach for op risk

FSB’s agenda remains full going into 2017

Progress over past year includes loss absorbency, climate disclosure and shadow banking, though plenty of tasks remain for next year

Market forces drive deleveraging as well as regulation – Caruana

BIS chief says markets are forcing discipline on banks, although he concedes regulation is playing a role as well; discussion participants point to tensions in regulatory framework

Fischer: liquidity is mostly adequate but there are problem areas

Fed vice-chair recommends vigilance amid changing market structure, though he says problems are not widespread; SEC chief says she is “deeply concerned” on bond market liquidity