United States

Greater competition cut US banks’ ‘insider lending’ – BdF paper

Researchers quantify bank owners’ and executives’ loans to themselves and their interests

Fed asks watchdog to review controversial trading

Move follows resignation of Boston and Dallas heads, as Warren asks for SEC probe

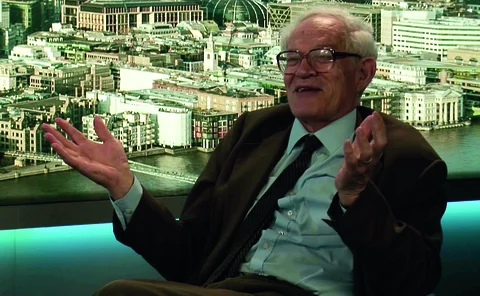

Larry Summers on stagflation risks, lessons from Delphi and never-ending ‘punch’

The former US Treasury secretary speaks about fiscal ‘overexpansion’, Fed/Treasury debt discord, the pitfalls of ‘unknown unknowns’ and central bankers ‘unable’ to remove the ‘punchbowl’

More regulatory action on big tech may be needed – FSI paper

Actions so far may not be enough to address growing risks, says Financial Stability Institute

US PCE inflation rises to 4.3%

Fed’s preferred rate reaches new high in August, but “trimmed” measure steady at 2%

People: Bank of Korea nominates board member

Bolivia’s former governor Pablo Ramos Sánchez dies; Trevor Braithwaite departs ECCB; and more

Goodhart, Gopinath and Lippi disagree on inflation

Central banks lack tools to deal with inflation, Goodhart warns, but IMF chief economist disagrees

Yellen warns of ‘catastrophic’ effects of not raising debt limit

Treasury secretary says failing to raise ceiling would be a “manufactured crisis”

Elizabeth Warren publicly rejects Powell reappointment

Senator calls Jerome Powell “a dangerous man to head up the Fed”

Brainard cites Delta in dovish speech

Fed governor warns “employment is still a bit short of the mark” for taper

Dallas Fed president resigns, following Boston’s Rosengren

Both faced criticism for equities trading and holdings, but are not unique among Fed leaders

Boston Fed president resigns, citing health

Rosengren had been accused of conflicts of interest due to real estate holdings

Biden nominates law professor for OCC

Saule Omarova favours more regulation and suggested the Fed take over deposits, alarming banks

FOMC doubles ceiling for reverse repo bids

Participating institutions can now borrow up to $160 billion per bid

Powell’s remarks show Fed set for November taper

Markets remain calm as analysts agree Fed is intent on cutting back asset purchases in November

Agustín Carstens on BIS strategic priorities, innovation and central bank policy

The BIS general manager speaks about policy trade-offs at critical time, tackling NBFIs and the dearth of ‘green’ assets, tech collaboration, and why he favours Biden’s $3.5trn infrastructure bill

BIS paper explores Fed’s ‘whatever it takes’ moment

Covid facility had most of its impact without the Fed actually buying any bonds, authors find

Podcast: Diversifying portfolios post-Covid

BNP’s Johanna Lasker talks about why central banks should consider equities and Tips

Book notes: Robert Triffin, by Ivo Maes with Ilaria Pasotti

Triffin’s story is well told by Maes, whose extensive personal and academic research shines through on page after page

Fed saved US from even larger pandemic downturn – ECB paper

Unemployment would have risen by 20% more without Fed’s bond buying, researchers find

Regional Fed presidents sell equities after media reports

Rosengren and Kaplan divest assets to avoid “even the appearance” of conflict of interest

OCC issues $250 million penalty against Wells Fargo

US regulator says bank has failed to meet commitments on loss mitigation

Demand shocks can have permanent impact on US economy – Fed paper

Authors find hysteresis is an important driver of longer-term growth trend in US

Pandemic Treasuries market calmed quickly – research

Dallas Fed analysis finds “headwinds” early on, but not lasting pandemic disruptions