International

Regulators must enforce stronger payment data protection – CPMI

Payment oversight needs to be updated to accommodate fintech firms and protect consumers

FSB co-ordinating Covid-19 response – Quarles

Board is focused on protecting financial stability both during and after the pandemic, chair says

Financial resilience may be tested further by Covid-19 – IMF

“Sudden stop” in credit markets could feed back to real economy, and requires a “forceful response”

IMF takes new steps to support weaker countries

Fund approves immediate debt relief for 25 countries; offers Ghana $1 billion to fight Covid-19

IMF projects deepest recession since Great Depression

Global growth could contract by between -3% and -6% this year, a combined loss of output of $9 trillion for 2020 and 2021

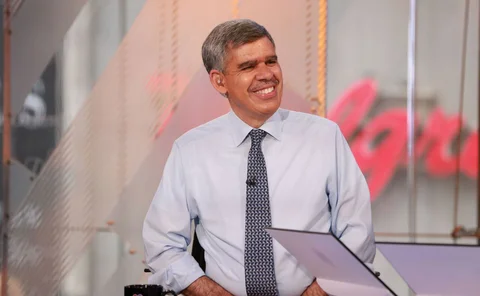

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

FSB outlines 10-point plan for tackling global stablecoin risks

Some powers already exist but stablecoins may cut across regulatory boundaries, report says

The IFF China Report 2020: China’s opening-up

Extending from east to west, China’s Belt and Road Initiative now encompasses as much as 65% of the world’s countries and a significant portion of global GDP. When first announced, investment was primarily targeted at transport infrastructure – but this…

Transfer season

Trade frictions with the US have caused a mass industrial transfer to China’s neighbours. Zhou Chengjun, IFF Academic Committee member and inspector of the Macro‑prudential Policy Bureau of the People’s Bank of China, says that shouldn’t stop China…

Crises enliven ‘totalitarian temptations’

The coronavirus pandemic will embolden governments and bodies such as the International Monetary Fund to grasp for more power, writes Steve Hanke

IMF doubles emergency lending capacity

Fund considering other options including SDR issuance, says Kristalina Georgieva

BIS paper finds little evidence of ‘liquidity trap’

Monetary policy remains effective even very close to the lower bound, economists find

Central banks may have to become ‘dealers of last resort’ – BIS economists

EMEs have not overcome “original sin” by deepening local currency bond markets, authors warn

Covid-19 could accelerate CBDC development – BIS economists

Fear could promote use of CBDCs but data is yet to point to whether cash demand has changed

The IFF China Report 2020: Financial stability

When US President Donald Trump introduced tariffs on Chinese exports in 2018 it upset the world order and dampened economic growth. China responded in force, asking its firms to find alternative sellers for US exports. As a result, it has bought…

The long march to global growth

Liang Tao, vice-chairman of the China Banking and Insurance Regulatory Commission, says that China’s growth is fuelling innovation and modernisation, but financial regulation and governance needs to be tightened up for China to take its place at the top…

Official institutions shed US Treasuries in record amounts

Fed holdings of Treasury securities for foreign official institutions dropped by $127 billion in March

Accounting for losses during a pandemic

US banks get green light from senators to use loan loss accounting methods widely criticised following 2008 crisis

Amplifying the soundwaves: the evolution of social media communications

Central banks’ social media usage is on the rise, but their choice of platform is shifting more and more towards the visual

Fed opens dollar funding to majority of central banks

New repo facility aims to ease strains caused by global flight to the safety of dollars

‘Ostrich approach’ to financial stability is a mistake

Denmark’s top supervisor, Jesper Berg, says scaling back IFRS 9 would be a costly error, despite the economic challenges raised by Covid-19

Covid-19 macro effects could last 40 years – research

Research from University of California says natural rate could take decades to return to normal

Concentrated firepower: central banks must expand their arsenal

Philip Turner argues central banks should be prepared to go further to avoid economic and financial collapse

Basel III reforms pushed back to buy time for coronavirus response

Basel Committee chief says banks and supervisors need operational capacity to cope with the virus shock