International

Central banks must mobilise their FX reserves

The pandemic and climate crises call for bold action, write Gary Smith and John Nugée

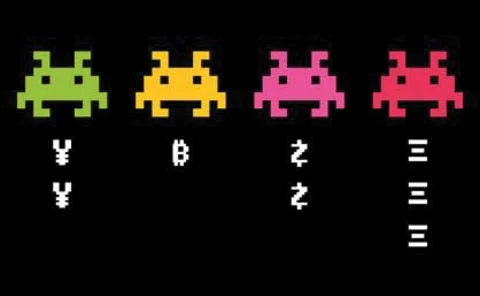

Book notes: The currency cold war, by David Birch

Pleasant and interesting read on whether digital money will jeopardise the US dollar’s dominant role in global trade and finance

Promoting fintech might reduce inequality – BIS’s Pereira da Silva

Inequality harms policy transmission, but technology may help, deputy general manager says

Economics Benchmarks 2020 report – executive summary

Shedding light on economics governance, salaries, forecasting, research, publications and more

BIS research tracks changing consumption patterns

Pandemic has led to “catching-up” process in e-commerce, bulletin article says

US Fed facility bought Libor bonds with ‘weak’ fallbacks

Industry figures express surprise over purchases linked to doomed benchmark

The changing data landscape: Part 1

Central Banking speaks to Eyal Rozen, Ramūnas Baravykas and Wanpracha Chaovalitwongse about whether there is a need to change underlying infrastructure to bolster data-driven policy-making

Hernández de Cos on ECB policy, crises responses and Basel reform

Spanish governor and Basel Committee chair Pablo Hernández de Cos favours a form of average inflation targeting, says ECB is willing to boost stimulus and Basel reforms not diminished by Covid-19 exceptions; stresses the need for structural reform and…

Central bank social media usage continues to evolve

User growth among central banks has started to level off, but those that use social media platforms are seeing growing subscriber bases and an increase in engagement

2020: The year in review

The past 12 months have been marked by crisis-fighting and losses, but also innovation

Rebuilding policy buffers is key challenge of coming decade – Borio

BIS economist says central banks are not out of options but the trade-offs are increasingly difficult

Economics Benchmarks 2020 – presentation

Central Banking’s economics subject matter specialist Daniel Hinge speaks with Christopher Jeffery about how central bank economists fared in a year where the Covid-19 pandemic upended the usual business of forecasting, analysis and research

Netherlands Bank backs IFRS plans for global sustainability standards

Governor Knot stresses global standard will be of less use if development continues to lag

Size matters for central bank research publishing

Staff numbers have strongest association with central banks’ research output

Administrative data is most popular alternative data source

Central banks make use of a wide range of non-traditional data sources

Central banks use alt data mainly for research

Almost all respondents make use of alternative data in at least one application

Non-banks continue to eat into banks’ market share

FSB monitoring finds patterns of links between banks and non-banks are changing

A ‘love-hate’ relationship with ESG screens

ESG screens seen as a first step in adopting sustainable investment practices, so why do so few central banks use them?

Carstens reveals details of ‘Rio’ high-speed data project

BIS chief unveils push for central bankers to innovate and rethink the way they collaborate

IMF’s Adrian weighs balance between stimulus and stability

Central banks need to incorporate macro-financial stability in decision-making processes, he says

Whither the age of ‘magic money’?

EME central banks are more exposed to changes in geopolitics, climate, demography, technology and inflation at a time when monetary theory is running well behind central bank practice

Few central banks forecast policy rates

Economics Benchmarks 2020 highlights wide variation in variables forecast by central banks

New Isda ‘fallbacks’ critical to making Libor transition a ‘non-event’

New protocol and supplement offer a transition away from Libor rates in 2021, despite CFTC saying 2,400 companies still exposed and Fed extending some US libor contracts until mid-2023

Monetary unions in the making in Africa

EAC, Ecowas and SADC can adopt practical steps learned from EMU to prepare for their own currency unions