Bank for International Settlements (BIS)

Central banks may have to become ‘dealers of last resort’ – BIS economists

EMEs have not overcome “original sin” by deepening local currency bond markets, authors warn

Covid-19 could accelerate CBDC development – BIS economists

Fear could promote use of CBDCs but data is yet to point to whether cash demand has changed

Basel III reforms pushed back to buy time for coronavirus response

Basel Committee chief says banks and supervisors need operational capacity to cope with the virus shock

US dollar has become ‘risk barometer’ – BIS economists

Role of dollar has changed since 2008 due to major changes in global financial sector, authors say

Banks rush to tap new dollar liquidity facilities

IIF warns of major capital flight from emerging markets as demand for Fed-backed repos surges

Central banks activate contingency plans amid Covid-19 pandemic

Rotating and remote team working aims to reduce contagion risk

Financial crises harm innovation – BIS paper

Loss of access to bank credit can harm research spending for more than 10 years, study finds

Riksbank seeks act amendment to host BIS innovation hub

Swedish central bank requests five-year permission for payments of up to $3.2 million a year

BIS research finds 20% drop in active correspondent banks

Retreat from correspondent banking could drive people into “unregulated channels”, authors warn

Major central banks ready to respond to coronavirus

Fed, ECB and Bank of Japan say they are willing to act; central bank events disrupted

BIS paper lays out ‘crucial’ design choices for CBDC

Challenge is to design a currency that balances credibility and convenience, says Hyun Song Shin

Fintech creating data gaps, BIS survey finds

New players do not always fit neatly into current statistical frameworks

BIS appoints heads of Switzerland and Singapore tech hubs

Cœuré says BIS’s Hong Kong hub will have head “in due course”

Global property investors may undermine macro-pru – CGFS

House prices are rising and increasingly synchronised, BIS committee says

Interview: Luiz Awazu Pereira da Silva

BIS deputy general manager talks about the obstacles central banks face with regard to climate change and why the status quo needs to evolve

BIS’s Pereira says green QE could distort market

Central banks should focus on financial stability mandate not green QE, says deputy general manager

BIS paper investigates distributive impact of fintech

Big data likely to reduce “negative prejudice” but could undermine regulation, says Thomas Philippon

Basel III implementation creating fragmentation, warns FSI paper

Authors say some variation is good, but more could be done to cut fragmentation

Central Banking Awards 2020: final winners announced

Awards include lifetime achievement, transparency, communications and website

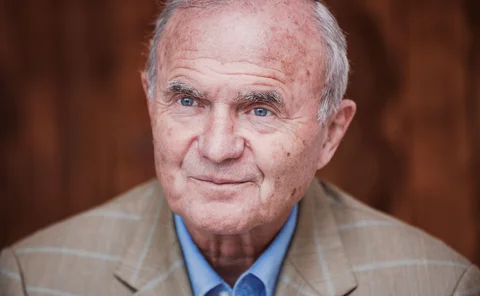

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Global markets award: HSBC

The UK-headquartered bank is a leader in green finance and helped its clients navigate the low-rate environment over the past year

BIS economist explores uneven adoption of fintech

Several factors can explain why some countries have been quicker to adopt fintech than others

BIS calls for wider adoption of FX Global Code

Some industry participants question the benefits of voluntary principles

Podcast: fintech predictions for 2020

Will cloud technology become mainstream? Is artificial intelligence the future of regulation? Rachael King and Adam Csabay make their fintech predictions for 2020 in the second episode of Tech Talk