FSB outlines 10-point plan for tackling global stablecoin risks

Some powers already exist but stablecoins may cut across regulatory boundaries, report says

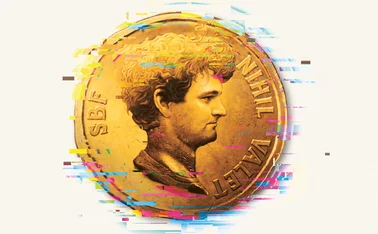

The Financial Stability Board is consulting on 10 recommendations for regulating and overseeing global stablecoins of the sort envisaged by Facebook’s libra project.

A document published today (April 14) sets out the findings of an FSB “stocktake” and gives guidance on how jurisdictions should tackle possible financial stability risks emanating from the new platforms.

Stablecoins have some features of fiat currencies, some of payment systems and some of banks. They are designed to allow users

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Most read

- Trends in reserve management 2024: survey results

- People: RBI appoints senior officials

- China to start selling ultra-long term sovereign bonds