South Africa reappoints Kganyago and top executives

Mampho Modise to replace Kuben Naidoo as central bank’s deputy governor

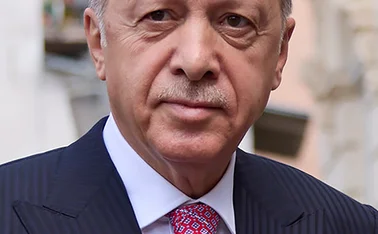

South Africa’s president Cyril Ramaphosa on March 15 reappointed the central bank’s senior leadership, including governor Lesetja Kganyago, and named a new deputy governor.

Kganyago, who has led the South African Reserve Bank (Sarb) for a decade, will remain in post for another five years from November. Nomfundo Tshazibana and Rashad Cassim will also serve additional five-year terms as deputy governors.

Ramaphosa appointed a new deputy governor, Mampho Modise, to take over from Kuben Naidoo, who resigned in November. Modise has been deputy director-general of public finance at the National Treasury since 2017. The Sarb noted her appointment means it now has a “full complement of executives”.

Kganyago’s decade as governor has been marked by crisis management. Like other central banks, the Sarb has had to respond to fallout from the Covid-19 pandemic, including surging inflation. Headline inflation peaked at 7.8% in July 2022, but has remained persistent, and rose to 5.6% last month. The Sarb has kept its policy rate on hold at 8.25% since May 2023.

As well as dealing with global shocks, the central bank has faced a difficult domestic backdrop, as the economy struggles under “load-shedding”, or rolling power blackouts due to inadequate electricity supplies. At the same time, close to a third of the workforce is unemployed and the Sarb has warned that large government deficits are driving up South Africa’s country risk premium and interest rates.

Kganyago was appointed deputy governor in 2011 and became governor in 2014. From 2004 to 2011 he was director-general of the National Treasury.

He won Central Banking’s Governor of the year award in 2018, in large part due to his efforts in defending the Sarb’s mandate from changes that could have undermined the bank’s independence.

In an interview with Central Banking that year, he said it was important for central bankers to “come down from their ivory towers” and explain their role to the public.

“When central banks come under attack, it is not just going to be central banks that will say ‘but the law says we are independent’, but that the entire society will come out and say: ‘This is our institution. Hands off our institutions’,” he said.

During his governorship, Kganyago previously chaired the International Monetary Fund’s International Monetary and Financial Committee and the Financial Stability Board’s Standing Committee on Standards Implementation. He also chairs the committee of central bank governors in the Southern African Development Community.

Deputy governor portfolios

Tshazibana remains chief executive of the Prudential Authority. She also serves as vice-chair of the Network for Greening the Financial System.

Cassim oversees the Sarb’s markets and international departments, as well as the payment system department. He represents the Sarb at the G20 and on the markets committee at the Bank for International Settlements.

Modise takes on responsibility for the financial stability, economic statistics, risk management and fintech departments.

She and the other deputy governors, as well as Kganyago, sit on all three of the Sarb’s main committees: monetary policy, financial stability and prudential regulation.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: http://subscriptions.centralbanking.com/subscribe

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@centralbanking.com

Most read

- ECB says iPhone is currently incompatible with digital euro

- Supervisors grapple with the smaller bank dilemma

- ‘Do I die, or do I survive?’ Officials reflect on Basel III complexity